Ethereum Price Analysis: Has ETH’s Rally to $5K Hit a Dead End?

Ethereum's $5K dream stalls—traders left wondering if the party's over.

Technical Resistance Mounts

ETH faces stiff resistance at key levels, testing bulls' conviction. The $5K psychological barrier proves tougher than expected, leaving momentum traders scrambling for exits.

Market Sentiment Shifts

Whale activity slows while retail FOMO fades—classic signs of exhaustion after a monster run. Even the most optimistic chartists acknowledge the need for consolidation.

Institutional Eyes Remain

Big money hasn't abandoned ship yet. Ethereum's fundamentals stay strong despite short-term price action. The merge, staking yields, and ecosystem growth keep institutions nibbling on dips.

Bottom Line: Temporary pause or trend reversal? Only time will tell if this is another 'correction' in crypto's endless cycle of hype and disappointment.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ethereum remains inside an ascending wedge pattern, a formation that often signals trend exhaustion. The asset has edged above the midline of its ascending channel, highlighting that bulls still retain control.

However, the RSI has developed a bearish divergence, with higher highs in price failing to match momentum, a warning sign that a pullback could be near. If Ethereum fails to close decisively above the $4,700–$4,800 resistance band, selling pressure may intensify, potentially dragging it back toward the channel’s mid or lower boundaries.

The 4-Hour Chart

On the 4-hour chart, Ethereum recently confirmed a Break of Structure (BOS), suggesting an early shift in trend dynamics. It then retraced into a demand zone, where buyers responded aggressively, reaffirming it as a strong decision point.

Since then, ETH has been consolidating between the major swing high NEAR $4,800 and the recent swing low at demand, with order flow tilting toward buyers. If resistance at $4,800 is cleared, a new bullish leg could take shape, but failure to hold demand risks another downside sweep.

Onchain Analysis

By Shayan

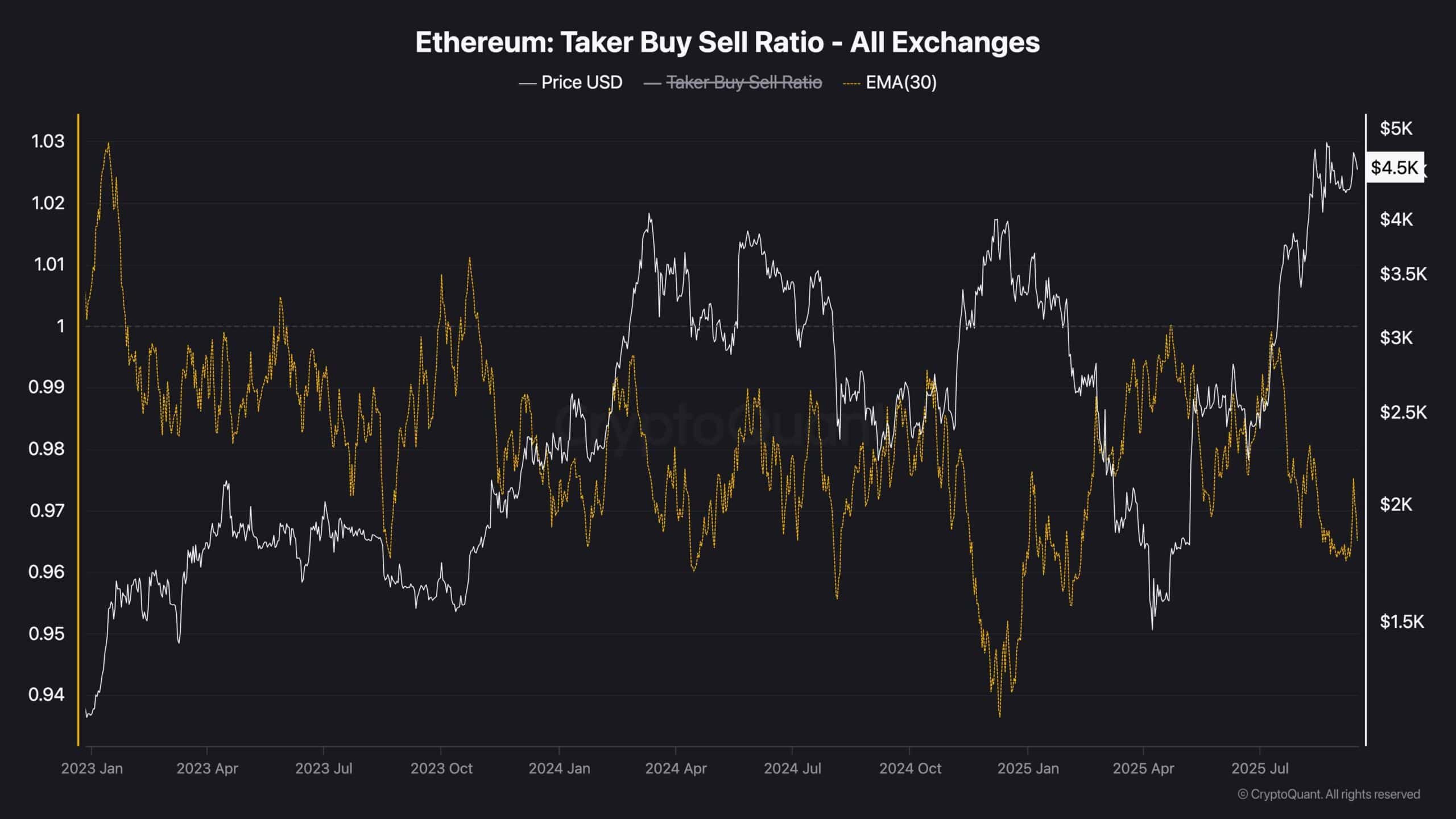

Ethereum is consolidating just below its all-time high near $5K, leaving participants uncertain about whether a breakout or a deeper retracement lies ahead. One key metric is the Taker Buy-Sell Ratio, which measures the balance of aggressive market orders.

The 30-day moving average of this ratio has been trending lower, signalling an increase in aggressive selling pressure. This suggests profit-taking and distribution are weighing on Ethereum as it struggles at resistance. Sustained weakness in this metric could pave the way for a deeper correction, with $4K emerging as a critical support level.

However, if the selling is primarily from short-term traders or weak hands, it could represent nothing more than a healthy consolidation phase, ultimately preparing the market for a renewed push higher.

In short, Ethereum’s next decisive MOVE depends on whether bearish pressure escalates from here or if underlying demand absorbs the supply, setting the stage for a breakout beyond ATH.