Bitcoin’s Next ATH: These Critical Support Levels Will Make or Break the Rally

Bitcoin teeters on the edge of glory—or another gut-wrenching correction.

Support or Suffer

Market watchers pinpoint precise price zones that must hold to maintain bullish momentum. Break below these levels, and the much-hyped run toward new all-time highs evaporates faster than a crypto influencer's credibility during a bear market.

The entire ecosystem holds its breath as BTC tests key thresholds. Traders scramble while institutional players watch with detached amusement—another day in the volatile digital casino masquerading as finance.

Next moves will define the short-term trajectory. Either Bitcoin catapults into uncharted territory or gets rejected hard. No middle ground.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, BTC recently staged a strong rebound from the highlighted order block (demand zone), underscoring that buyers remain firmly in control at this critical level. The bounce was further validated by a clean breakout above the 100-day moving average, which had previously acted as dynamic resistance.

This development signals a return of bullish momentum, though a short-term pullback into the broken MA near $112K cannot be ruled out. If this retest holds, the broader structure WOULD remain supportive of continuation toward the all-time high resistance zone.

The 4-Hour Chart

On the 4-hour chart, a clear Change of Character (CHOCH) has occurred, confirming a decisive shift from bearish to bullish structure. After breaking above prior swing highs, Bitcoin is now consolidating just beneath the $117K resistance region.

The green decision point zone at $112K remains a key level to monitor. A retracement into this order block would not undermine the bullish outlook; instead, it could provide a healthy correction before the next leg upward. Sustaining above this base keeps the path open toward ATH retests.

On-chain Analysis

By Shayan

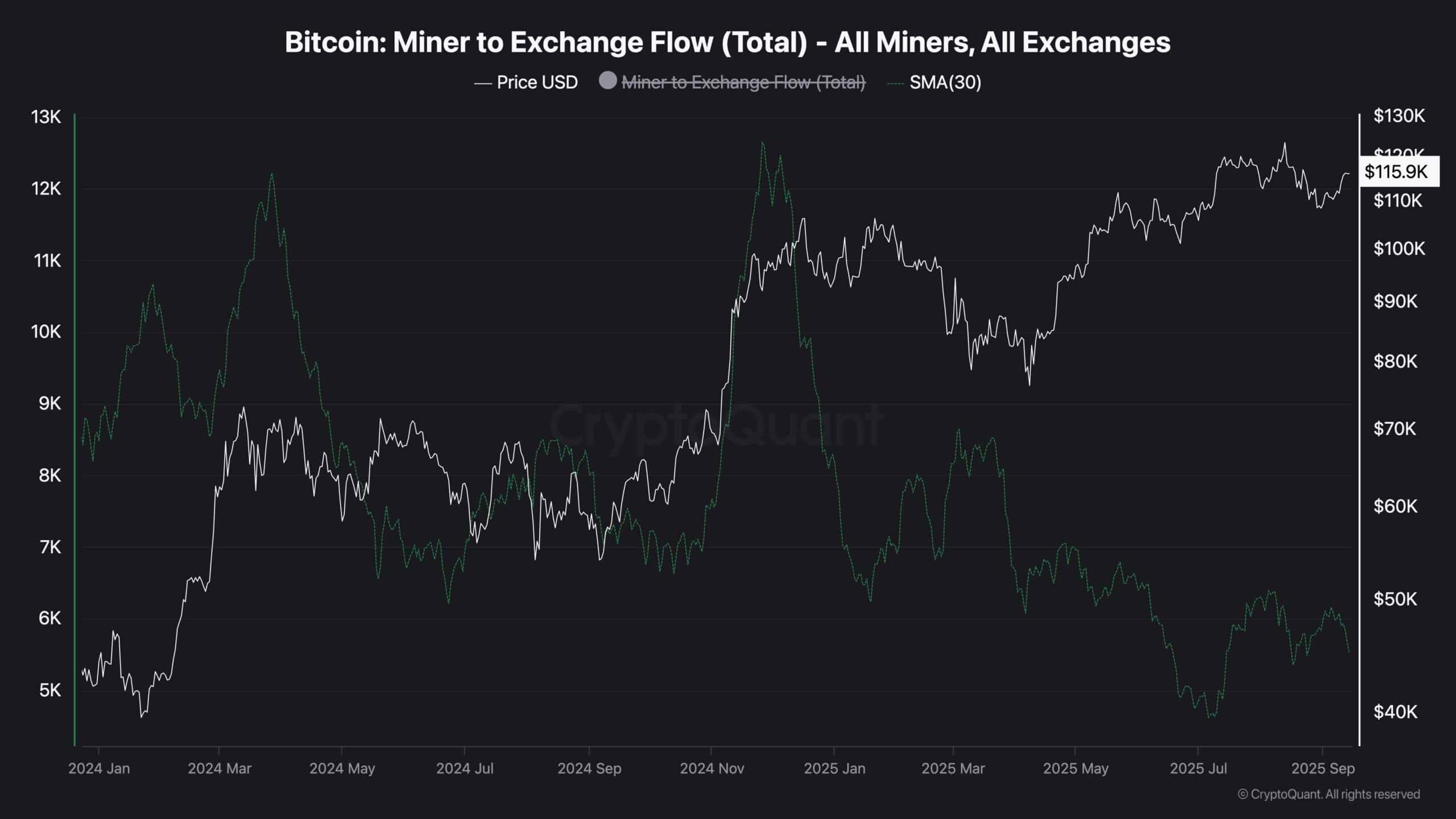

The transfer of BTC from miner wallets to exchanges has historically acted as a barometer of supply-side pressure. Peaks in miner-to-exchange flows have often coincided with market tops, as increased distribution added selling pressure.

Currently, the 30-day moving average of Miner-to-Exchange Flow has declined to its lowest levels in the short term. This drop suggests that miners are reducing distribution, and possibly accumulating bitcoin instead. Interestingly, this trend aligns with Bitcoin’s latest surge above $115K, reinforcing a signal of bullish sentiment from miners.

In short, the combination of a technical structure shift and miner accumulation provides a constructive outlook. As long as $112K holds, Bitcoin appears well-positioned to sustain momentum and mount another challenge toward its all-time highs.