Bitcoin’s Epic Showdown: Breaking Through Key Resistance Toward New ATH Glory

Bitcoin bulls lock horns with critical resistance—what comes next could define the next cycle.

The Ultimate Resistance Test

BTC isn't just knocking at resistance—it's kicking the door down. Every failed breakout attempt from earlier this year now looks like mere rehearsal. This isn't about incremental gains; it's about territory.

Market Mechanics in Play

Liquidity pools above current levels scream opportunity. Shorts get nervous every time BTC even breathes near these levels. Meanwhile, traditional finance still can't decide whether to adopt or panic—classic Wall Street indecision while real wealth gets created elsewhere.

The ATH Horizon

New all-time highs aren't just possible—they're becoming inevitable. Each consolidation phase builds stronger foundations. The market's memory grows shorter, but Bitcoin's resilience keeps writing new rules.

Remember: banks will still charge you for wire transfers while Bitcoin settles in minutes. Some things never change—fortunately, Bitcoin isn't one of them.

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, Bitcoin has broken out of its rising channel but is now struggling to reclaim higher levels. The asset is hovering around $114K, just below the 100-day moving average, which is acting as resistance. The RSI sits around 50, reflecting a neutral momentum state, neither oversold nor overbought.

If bulls can close above the moving average, the next target will be the $124K all-time high zone. However, repeated failures here could drag the market lower, with the $104K fair value gap serving as the key demand area supported by the 200-day moving average around $101K. This zone WOULD be the last line of defense before a deeper correction.

The 4-Hour Chart

The 4-hour chart shows price consolidating inside a tightening ascending triangle, with higher lows forming around $110K and the key resistance capped at $114K. The RSI at 55 also suggests momentum is slightly in favor of buyers, but the breakout is not yet confirmed.

If buyers manage to push above $114K with volume, a rally toward $118K–$120K could unfold quickly. On the downside, losing the ascending trendline and or the $110K support zone would weaken the bullish structure and open the way back to $104K. For now, the short-term bias depends on how the price reacts at the $114K ceiling.

Onchain Analysis

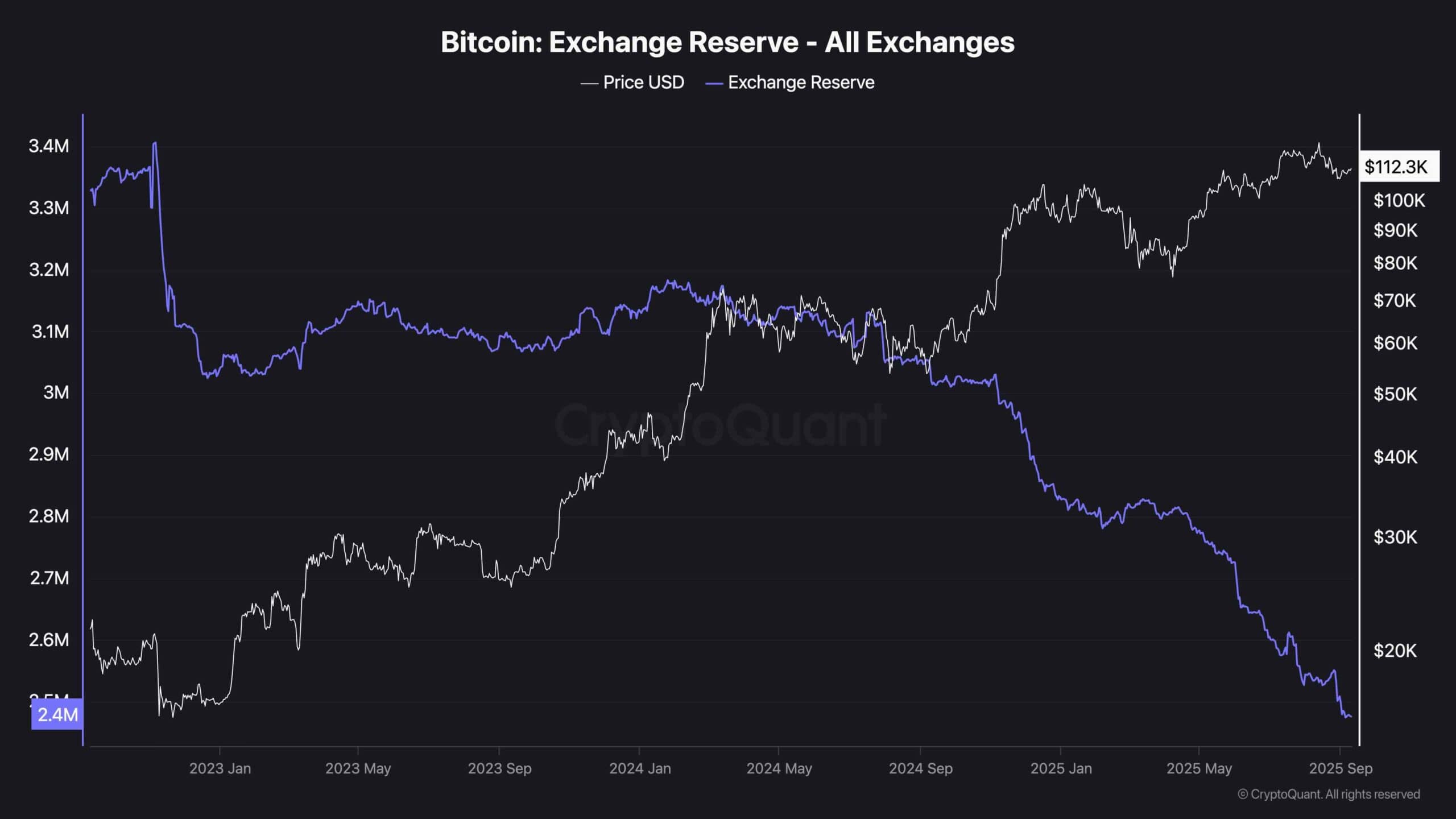

Exchange Reserve

Exchange reserves continue to decline sharply, falling to multi-year lows. This persistent outflow, which is quite odd for BTC being at all-time highs, indicates that investors are moving coins into long-term storage, reducing the liquid supply available for trading. Such a supply contraction often supports price stability and sets the stage for bullish moves when demand increases.

However, in the short term, declining reserves also mean thinner liquidity on exchanges. This can amplify volatility around key levels, making breakouts and breakdowns sharper. Overall, the reserve trend reinforces the long-term bullish case but doesn’t eliminate the near-term risk of corrections if buyers fail to reclaim resistance.