Bitcoin Nears $114K Milestone as Liquidation Map Signals Massive Short Squeeze Ahead

Bitcoin's relentless surge continues defying gravity—and trader expectations—as it charges toward the $114,000 threshold.

The Liquidation Heatmap Reveals All

Market data shows massive short positions clustered just above current price levels. When those positions get liquidated? They'll fuel the very rally they tried to bet against. Classic market irony.

Short Sellers Face Brutal Reality

Traders betting against this rally now face their own version of financial natural selection. The market's about to teach another expensive lesson in why fighting Bitcoin's momentum is a fool's game—but hey, someone's got to fund the next leg up.

This isn't just price action—it's a financial reckoning. The charts suggest we're witnessing one of those rare moments where the market decides to redistribute wealth from the skeptical to the convicted.

Short Liquidation Cluster Builds Above Current Price

Bitcoin is trading around $113,500 at press time, after gaining over a grand in the past hour or so. A recent liquidation map shared by TheKingfisher shows a heavy concentration of short positions just above the current price. The largest cluster appears near $112,630, indicating an upcoming short squeeze since the cryptocurrency has moved past that level.

$BTC: This liquidation map shows a clear setup. Most of the action is above current price, meaning *short liquidations* are stacked.

Look at 112,631.54. That’s a huge cluster for shorts to get flushed. We’re looking at an optical opti timeframe here, so this plays out over a… pic.twitter.com/CpuEUacDF0

— TheKingfisher (@kingfisher_btc) September 10, 2025

Notably, this type of setup can lead to a fast move upward, as short positions may get closed automatically once the price hits those levels. According to TheKingfisher, “smart money will be watching this level,” referring to traders who track liquidity zones for entry and exit opportunities. If this short cluster is triggered, the momentum could push Bitcoin above the current range.

The map is based on short-term price behavior and may play out within the next few trading sessions.

Resistance Near $113K Holds Firm

Bitcoin has tested the $113,000 level three times (including now) in the last seven days but failed to break through. This price area has seen intense selling pressure, with traders either taking profit or opening fresh short positions. The rejection confirms that $113K–$113.5K is a key barrier for now.

Analyst Michaël van de Poppe commented,

Is today the day that we’re finally going to be cracking the resistance on $BTC? pic.twitter.com/JHMSAyWXlk

— Michaël van de Poppe (@CryptoMichNL) September 10, 2025

The market continues to hover just below this level, awaiting a clear breakout or breakdown.

If the asset fails again, attention may shift to the area below $110,000. That zone has previously acted as support and holds stop-loss orders, which could be targeted if sellers take control.

Long-Term Structure Supports Uptrend

Merlijn The Trader posted a weekly bitcoin chart showing an inverse head and shoulders pattern. The larger structure includes a left shoulder from 2021, a head near $15,500 in late 2022, and a developing right shoulder through 2024. A smaller pattern has also formed inside the right shoulder.

Bitcoin broke the neckline around $71,000 and has since formed higher lows. If the structure is maintained, the target area lies between $130,000 and $150,000. Merlijn called it the “supercycle ignition” as it could be the start of a long-term rally if the price continues climbing.

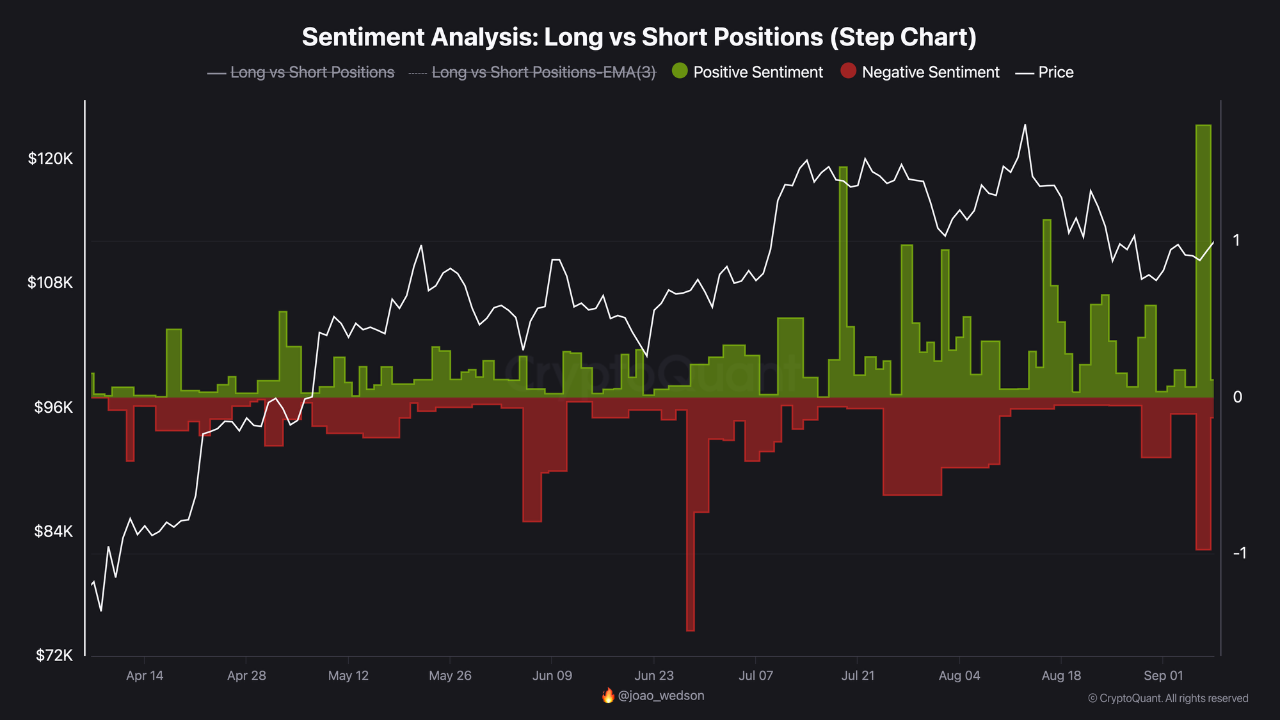

Sentiment Shift on Binance Ahead of $115K Zone

Analyst BorisD noted rising positive sentiment on Binance since September 6. During this period, more long positions have been opened. While the current tone is bullish, there’s caution around the $115,000 level. BorisD explained that a “free trading zone” exists up to that point, but warned that once cleared, the price could snap back quickly.

They added that if buying momentum fades while sentiment remains positive, it could expose the market to a correction. Binance remains a key exchange due to its high trading volume and a mix of retail and large participants.