LINK Supply Nosedive: The Bullish Catalyst That Could Propel It to $100

Chainlink's token supply just hit a critical inflection point—and it's flashing green for bulls.

Supply Shock Unleashed

LINK's circulating supply isn't just dipping—it's in freefall. That scarcity dynamic could ignite a fierce rally, pushing prices toward levels skeptics thought impossible.

The $100 Question

With reduced sell pressure and tightening availability, triple-digit valuations suddenly look less like fantasy and more like market mechanics at work. Traders are positioning for a supply squeeze that could bypass traditional resistance levels.

Of course, in crypto, even the most bullish setups can evaporate faster than a hedge fund's ethics—but this time, the numbers don't lie.

Exchange Supply Hits Lowest Level on Record

Chainlink’s native token, LINK, has seen a steady decline in its exchange-held supply, according to on-chain data shared by crypto analyst Wimar.X. Throughout August, data shows a steady decline, with a sharp fall recorded between August 10 and 11. The shift suggests more holders are moving tokens off exchanges, reducing the available supply for trading.

BREAKING:$LINK SUPPLY ON EXCHANGES HITS A NEW ALL-TIME LOW

CHAINLINK WILL BE THE SECOND BIG ALT AFTER ETHEREUM

BULLISH pic.twitter.com/MrEYWBuSIl

— Wimar.X (@DefiWimar) August 25, 2025

A lower exchange balance often means less selling pressure. LINK moved from around $16 to over $25 during the same period. This price pump came alongside heavy outflows, which often reflect a shift toward long-term holding or use in staking.

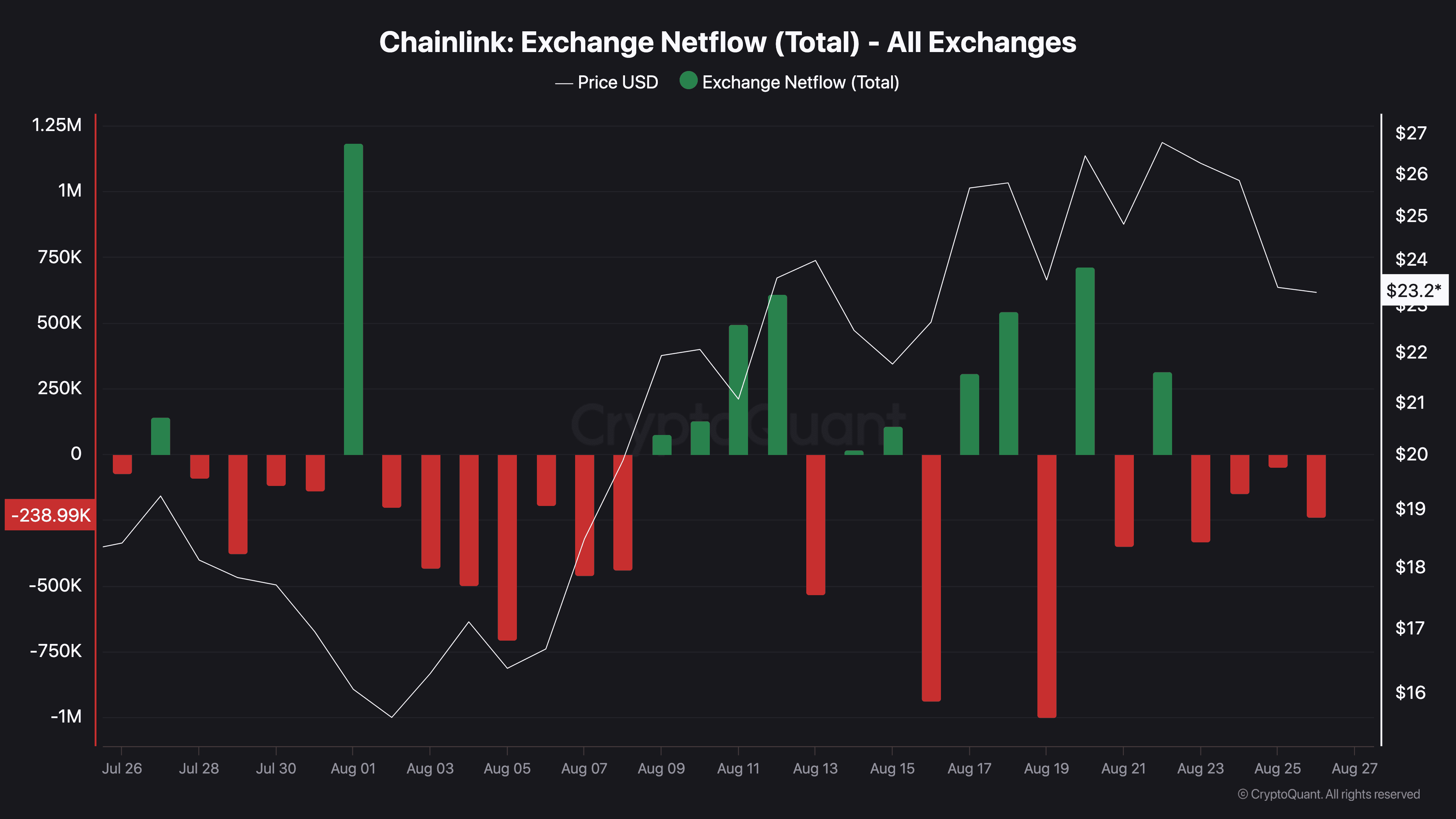

In addition, CryptoQuant data shows the latest netflow at approximately -239K LINK. This figure means more LINK left exchanges than entered. That kind of activity often reflects accumulation.

Between August 1 and 7, LINK saw strong outflows, including a single-day withdrawal of over one million tokens. From August 10 to 21, this trend reversed with inflows returning, likely from profit-taking as the price reached $26. In the final week, the direction flipped again. The outflows suggest LINK is once again being moved off exchanges.

Short-Term Price Pullback in Focus

LINK was trading around $23 at press time. It is down over 9% in the last 24 hours and nearly 5% over the past week. The drop follows a broader pullback across the crypto market.

CryptoWZRD noted that LINK “closed strongly bearish as LINKBTC declined,” but added that the token is still holding support NEAR $23. The post warned that “moving below it will offer a short,” pointing to this level as a key area to watch.

Moreover, a long-term chart shared by Ali Martinez shows LINK forming a symmetrical triangle. The asset is now testing the top of that pattern. The setup suggests one more MOVE down toward $22–$24, followed by a potential breakout to the upside.

Fibonacci projections on the chart mark the next targets at $31, then $52, and finally $98. Martinez said, “Chainlink $LINK: One more dip before $100,” suggesting the breakout could follow soon if current levels hold.

Chainlink $LINK: One more dip before $100! pic.twitter.com/Ws2E95FTO1

— Ali (@ali_charts) August 25, 2025

Chainlink has also secured a new partnership with Japanese financial firm SBI Holdings. The deal will focus on integrating Chainlink’s oracle technology into financial applications. While the broader market has pulled back, this news has kept attention on LINK during a time of increased activity across the network.