Altcoins Bleed Out While Bitcoin Battles to Hold $110K: Critical Market Update

Bitcoin's brutal fight to defend the $110,000 level triggers massive altcoin carnage across crypto markets.

The Great Divergence

While Bitcoin struggles to maintain its footing above the psychological $110K barrier, alternative cryptocurrencies are getting absolutely slaughtered. This isn't just a dip—it's a full-scale capital rotation that's leaving altcoin portfolios bleeding out in dramatic fashion.

Market Mechanics Exposed

Traders are fleeing riskier alt positions and rushing toward Bitcoin's relative stability, creating a vicious cycle of selling pressure that's crushing smaller tokens. The pattern repeats like clockwork—when Bitcoin dominance asserts itself, altcoins don't just dip, they get decimated.

Survival of the Fittest

This brutal market action separates serious projects from mere speculation. While Bitcoin proves its resilience yet again, the altcoin space reveals its speculative excess—turns out creating a token with a animal mascot doesn't actually constitute a viable monetary policy. The crypto market's memory remains notoriously short, but the laws of financial gravity still apply—even in decentralized finance.

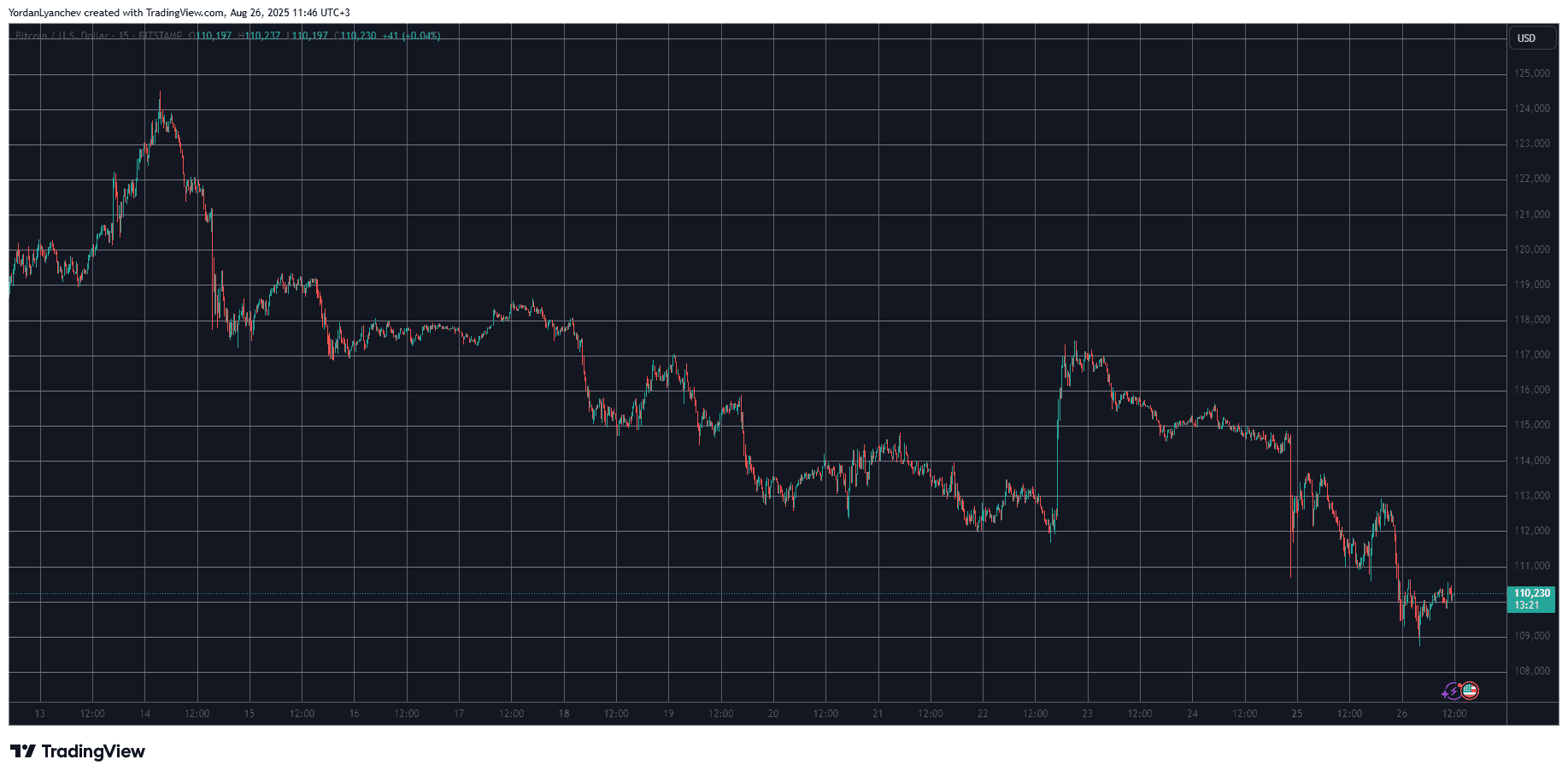

BTC’s New Local Low

The past several days have been quite volatile for the primary cryptocurrency. Its price was gradually declining for most of the previous week, and bottomed (at the time) at just under $112,000 on Friday before Jerome Powell’s speech.

As the Fed Chair took the main stage, though, the asset’s trajectory reversed immediately and skyrocketed to over $117,000 following his somewhat promising comments about the upcoming FOMC meeting. That rally, though, was short-lived, and BTC quickly returned to $115,000 during the weekend.

The landscape worsened on Sunday evening when Bitcoin dumped by several grand to under $111,000, leaving over $300 million in liquidations within a single hour. After a minor recovery attempt on Monday, the bears took control once again later during the day and on early Tuesday morning and pushed BTC to its lowest position in almost seven weeks of just under $109,000.

Despite bouncing off to just over $110,000 as of press time, bitcoin is still over 1% down daily. Its market cap has tumbled below $2.2 trillion, while its dominance over the alts has rebounded slightly to 56.6% on CG.

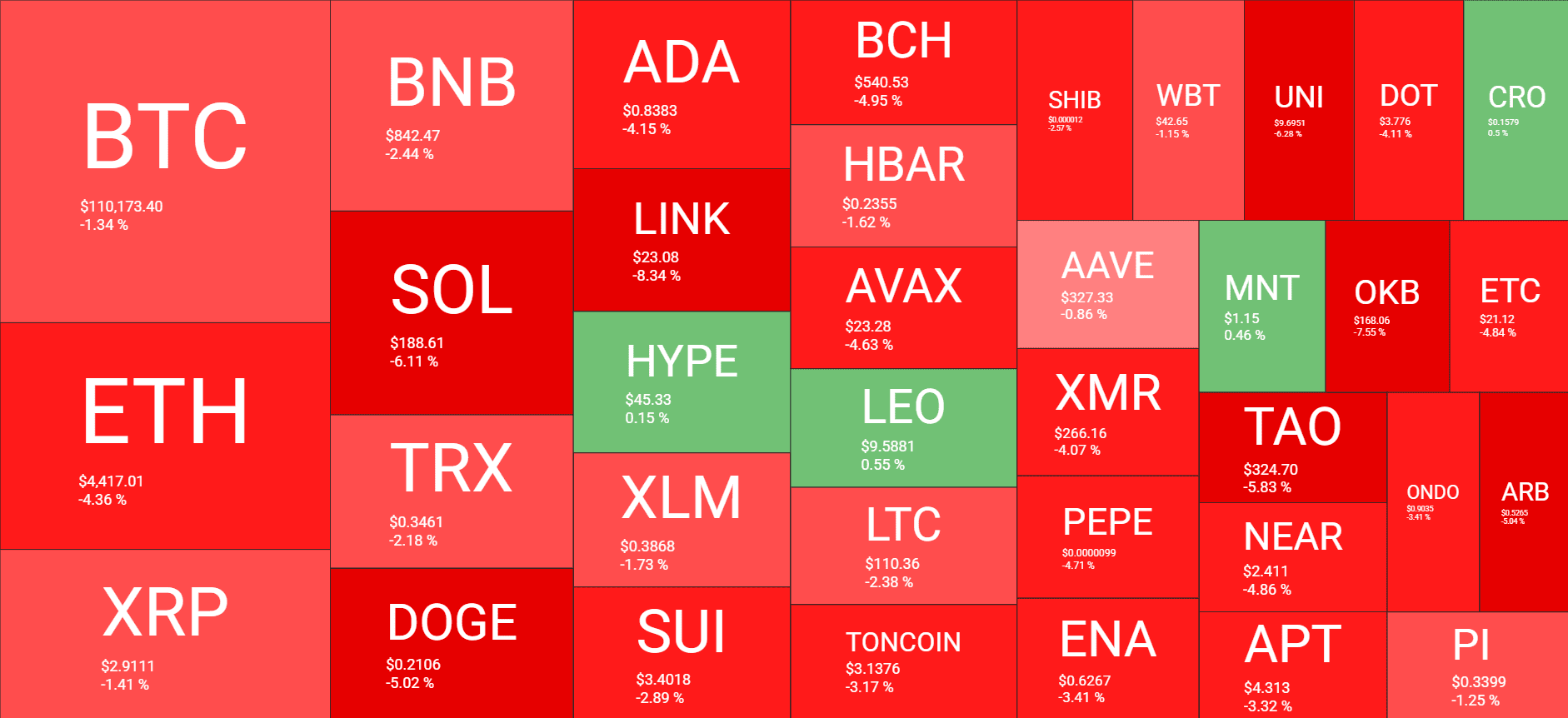

Alts in Freefall State

Most altcoins have marked even more substantial losses over the past day, including ETH, which took yesterday’s correction rather well but then dumped by roughly $600 since its latest ATH to around $4,300. It now trades inches above $4,400, but it’s still over 4% down on the day.

Even more painful declines come from SOL, DOGE, and LINK. Chainlink’s token has plunged by over 8% daily to $23. XRP, TRX, BNB, XLM, BCH, AVAX, and TON are also in the red.

The landscape with the mid-cap alts is similar, which is why the overall crypto market cap has seen another $60 billion disappear overnight and is down to $3.870 trillion on CG.