Analyst Issues Critical Warning: Ripple Investors Must Stop Buying XRP After This Date

XRP holders face a looming deadline that could reshape their investment strategy—one prominent analyst says the clock is ticking.

The Countdown Begins

Market watchers are sounding alarms about a specific cutoff date that could trigger significant volatility. Those accumulating XRP positions might want to reconsider their timing—getting caught on the wrong side of this timeline could mean watching gains evaporate overnight.

Regulatory Shadows Loom

While the analyst didn't specify exact figures, the warning hinges on regulatory milestones rather than technical indicators. Traditional finance might shrug at another crypto deadline, but then again they're still trying to figure out how to short NFTs.

Strategic Pivot Ahead

Smart money isn't waiting for the expiration date—they're already rebalancing portfolios. This isn't about abandoning ship entirely, but rather navigating through what could become extremely choppy waters. Sometimes the best trade is the one you don't make.

Is the Bull Cycle Near Its End?

Ripple’s native cryptocurrency has been among the highlights of the current bull phase, with its price rising to an all-time high of over $3.65 in mid-July. Despite sporadic resurgences since then, though, XRP has been in a downtrend and currently trades below $3 following the most recent correction in the crypto market.

Moreover, some analysts believe the bull cycle might be coming to an end, alerting investors to be cautious about increasing their exposure. The popular X user STEPH IS crypto pointed out XRP’s historical performance during previous bull markets. He argued that if history repeats itself, the peak might arrive in one or two months and could be followed by a substantial pullback.

In 2018, XRP’s price skyrocketed to $3.40, but later that year, it fell well below $0.30. In April 2021, the valuation surged to almost $2, followed by another collapse to sub-$0.50 territory.

The analysis triggered an immediate reaction from the XRP army. Many of the people commenting on the post disagreed with the prediction, claiming that the X user had not taken into consideration the current market conditions and the asset’s growing adoption.

More Room for Growth?

Contrary to the aforementioned warning, multiple analysts remain optimistic that XRP has yet to chart impressive gains. X user Gordon envisioned “a monumental run” to a new all-time high of almost $6.

Crypto enthusiast Javon Marks was even more bullish, forecasting a spike above $9.60. They highlighted Fibonacci levels as markers for potential targets, stating that the 1.618 extension stands at $9.63, whereas the 2.618 extension stretches above the ridiculous (at least as of now) $123.

Meanwhile, the rising odds of lowering interest rates in the United States next month and the possible approval of the first spot XRP ETF in the world’s largest economy support the bullish theory. Decreasing the benchmark will make borrowing money cheaper and is likely to increase interest in risk-on assets, such as cryptocurrencies.

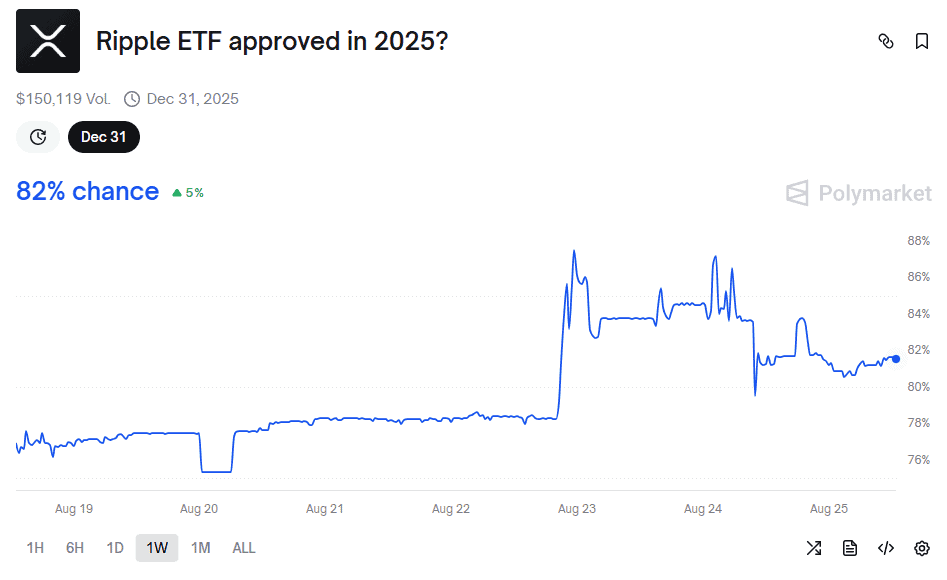

The potential green light of a spot XRP ETF will allow investors to purchase shares in a fund that directly holds the token, providing exposure to its price movements. This is also expected to generate additional interest and could be beneficial for the price. Polymarket estimates that the chances of approval before the end of the year currently stand at around 82%.