Crypto Whales Gobble Up Nearly $1 Billion Dip as Markets Reel

Mass liquidations trigger feeding frenzy among major holders.

Market Mechanics

Nearly a billion dollars got flushed from leveraged positions in 24 hours—creating prime buying conditions for those with deep pockets. Whales didn't just dip a toe in; they plunged headfirst into discounted BTC and ETH.

Strategic Accumulation

While retail traders licked wounds, institutional wallets activated cold storage transfers. Accumulation patterns mirror classic buy-the-fear playbooks—just with more zeroes attached.

Liquidity Paradox

For every forced seller, there's a whale waiting with limit orders below spot. The market's brutality becomes its own cleansing mechanism—though watching hedge funds cry over margin calls does add a certain schadenfreude to the process.

This isn't panic—it's predatory arithmetic executed at scale. The real question isn't why whales bought, but why anyone still thinks leverage trading against them is a good idea.

Crypto Market Slides, But Whale Buying Signals Resilience

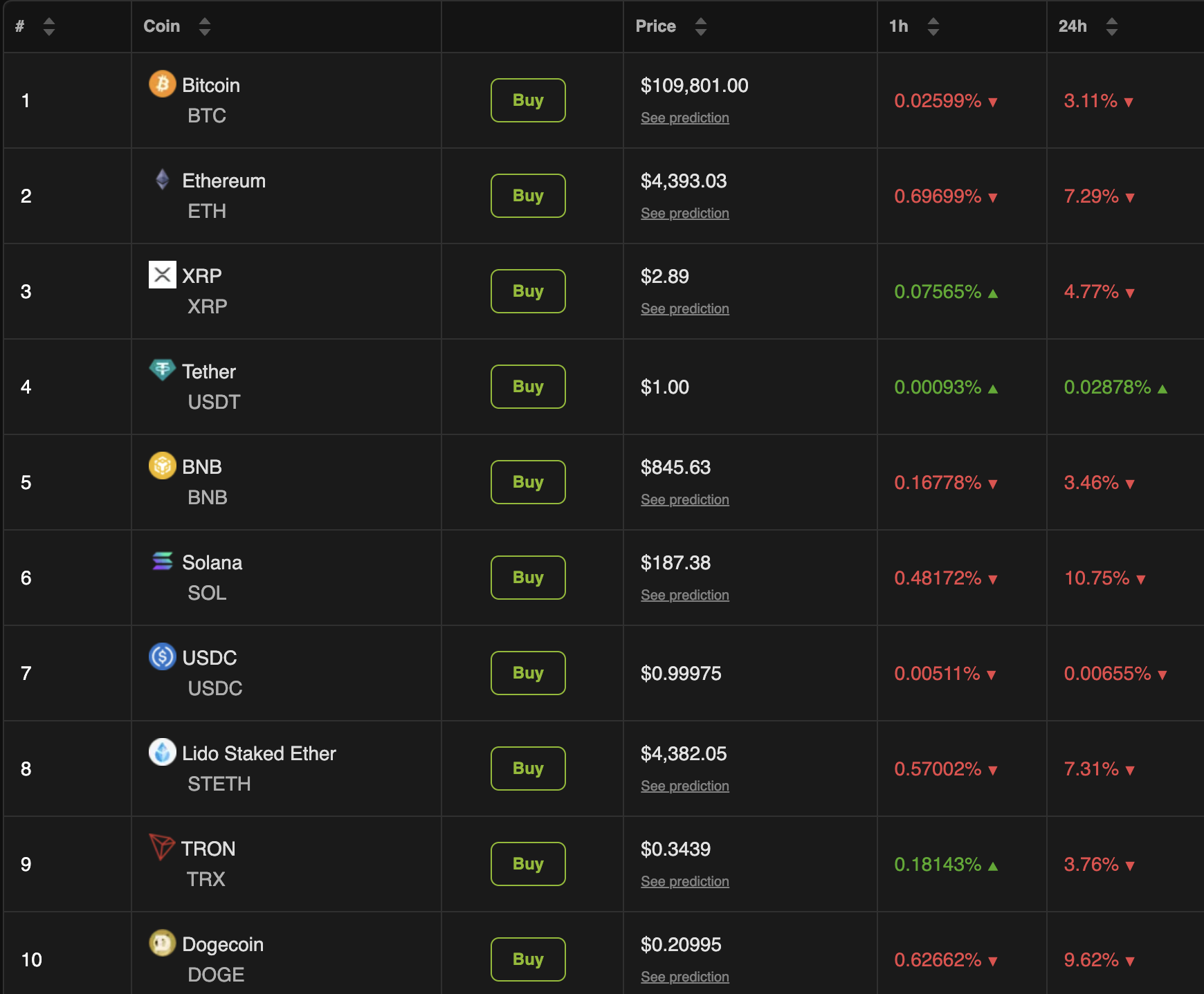

BeInCrypto Markets data showed that the global crypto market cap stood at $3.86 trillion, with all major coins in red. Among the top 10 coins, Solana (SOL) was the biggest loser, dipping 10.75%.

Moreover, Bitcoin (BTC) fell below the $110,000 threshold to trade at $109,801, a 3.11% drop over the past day. ethereum (ETH) faced a steeper decline.

The altcoin slipped below $4,500 to $4,393, marking a 7.29% decrease in the same period. ETH is now 11.1% below its all-time high, achieved on Sunday.

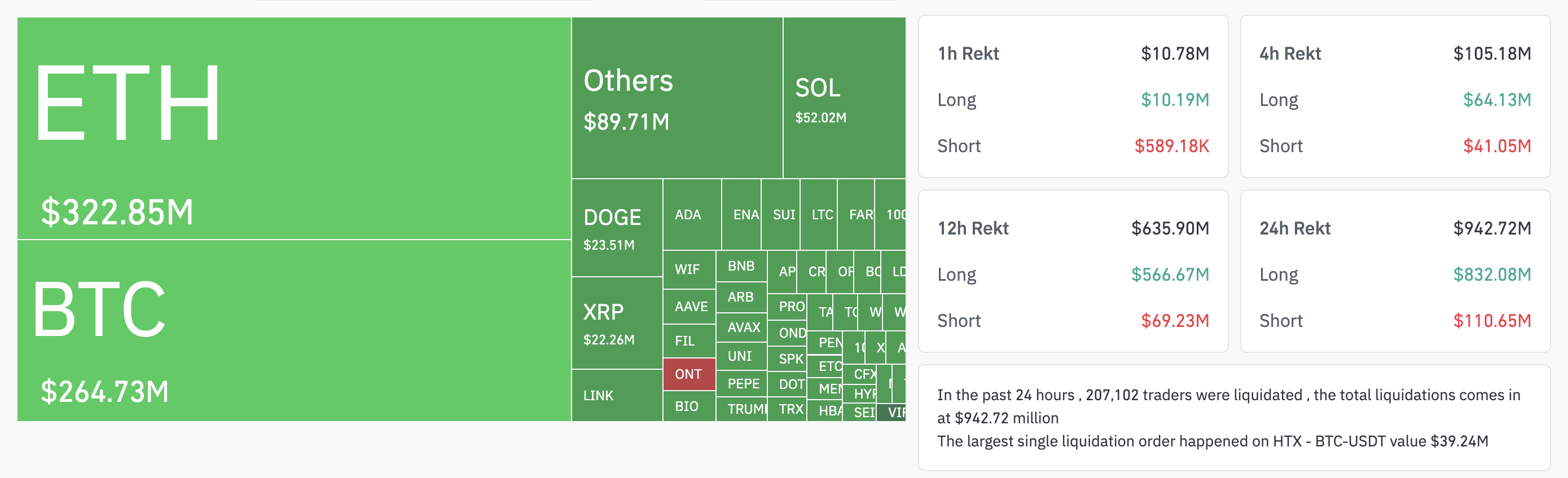

Amid this dip, crypto liquidations surged. According to data from Coinglass, 207,102 traders were liquidated over the past 24 hours, with liquidations totaling $942.72 million.

Of this amount, $832 million came from long positions. The largest single liquidation was recorded on HTX, involving a BTC-USDT trade worth $39.24 million.

Ethereum saw the highest liquidations at $322.85 million, including $279.79 million in longs. Bitcoin followed with $264.73 million in total liquidations.

The primary catalyst for the latter market movement appears to be a bitcoin flash crash, triggered by a whale offloading a substantial BTC holding.

![]() Why did Bitcoin dump?

Why did Bitcoin dump?![]()

A whale dumped 24,000 $BTC (~$2.7B) within minutes.

⁰That one MOVE caused a quick $4,000 drop and wiped out tons of traders through liquidations.

There wasn’t any big news or reason.

⁰Even #ETH was pumping earlier – then suddenly crashed too.

This… pic.twitter.com/wqCIi3ykF3

Meanwhile, economist and vocal Bitcoin critic Peter Schiff commented on the decline, noting that BTC’s drop raises concerns.

“Bitcoin just dropped below $109K, down 13% from its high less than two weeks ago. Given all the HYPE and corporate buying, this weakness should be cause for concern. At a minimum, a decline to about $75K is in play, just below $MSTR’s average cost. Sell now and buy back lower,” Schiff posted.

Nonetheless, investors appear unfazed by Schiff’s warnings, with buying-the-dip sentiment remaining strong across the market. Lookonchain, a blockchain analytics firm, reported that a crypto whale (bc1qgf) acquired 455 BTC valued at nearly $50.75 million.

“Since July 18, he has bought 2,419 BTC ($280.87 million) at $116,104 avg — now sitting on a $16 million+ loss,” the firm wrote.

Lookonchain noted that another swing-trading OTC whale (0xd8d0) invested 99.03 million USDC (USDC) to purchase 10,000 ETH worth nearly $43.67 million and 500 Bitcoins valued at around $54.99 million.

Furthermore, BitMine Immersion, the largest public holder of ETH, added another 4,871 coins to its holdings. The firm now holds 1,718,770 ETH valued at $7.65 billion.

Lastly, a whale address (0x4097) resurfaced after four years of dormancy, withdrawing 6,334 ETH worth $28.08 million from Kraken. Thus, this buying spree suggests that some market participants view the current dip as an opportunity rather than a long-term threat.