SEI Primed for a 40% Explosion – Here’s Why Traders Are Buzzing

Rumors swirl as SEI shows bullish signals that could send it skyrocketing. Is this the next altcoin to watch—or just another overhyped token in the crypto circus?

Market whispers suggest a perfect storm of liquidity and speculation. The charts don’t lie—unless they do (looking at you, 2021 memecoins).

Key drivers? Whale accumulation, ecosystem growth, and that sweet, sweet fear of missing out. Even traditional finance bros are sneaking glances at their Coinbase apps between golf swings.

One cynical truth? The bigger the rally, the harder the bagholders fall. Trade accordingly.

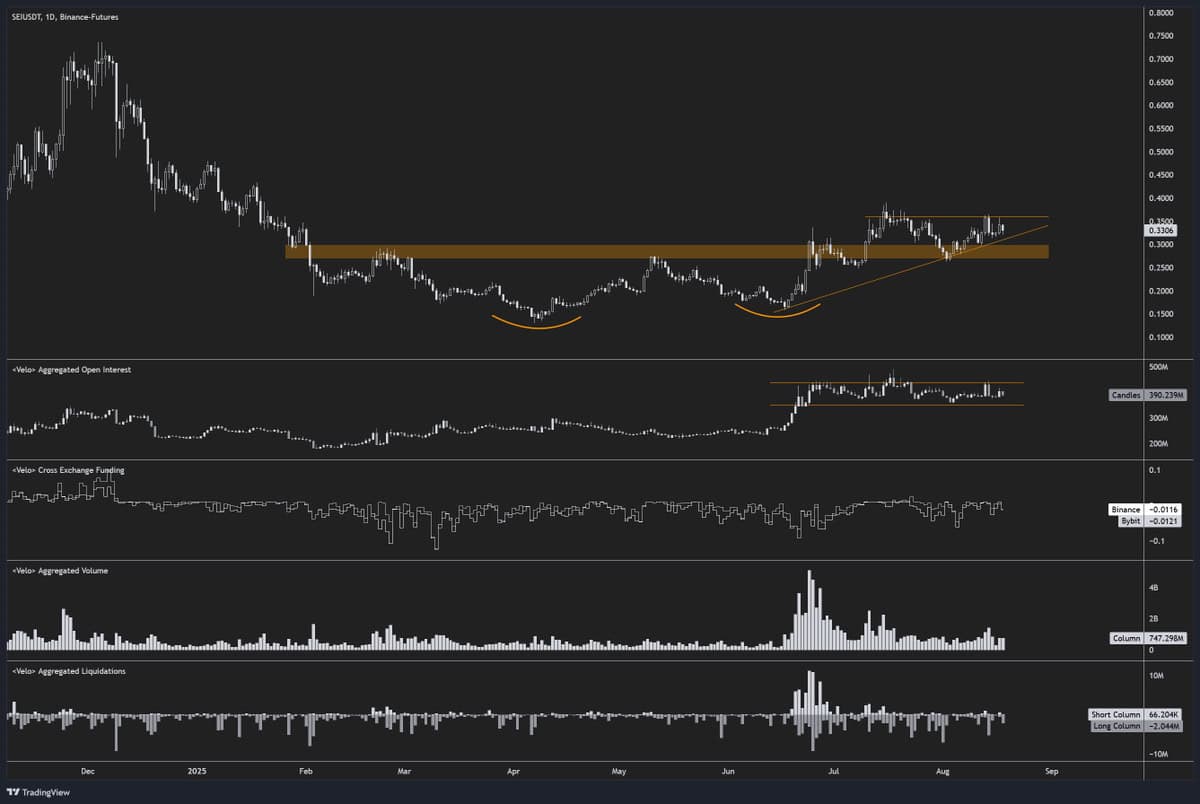

Price Consolidation Sets the Stage

SEI was trading around $0.32 at press time, after a 5% drop in the past 24 hours. Despite the decline, analysts are watching the price closely. On the 4-hour chart, SEI has been moving within a symmetrical triangle pattern. This formation, marked by lower highs and higher lows, often leads to strong directional moves.

The token is trading just below the $0.33 level, which aligns with the 50% Fibonacci retracement. Analyst Ali Martinez pointed to $0.31 as a possible short-term dip level.

Notably, this area is near the 0.382 Fibonacci line at $0.317. He added that a move above $0.35 could be the trigger for a breakout toward $0.44, which WOULD represent a 40% gain from current prices.

$SEI at $0.31 will be a buy-the-dip opportunity before an explosive breakout to $0.44! pic.twitter.com/ro5HcpG8qR

— Ali (@ali_charts) August 18, 2025

New Infrastructure in Focus

Sei Labs recently launched Monaco, a new protocol designed for institutional trading. Monaco runs on a Central Limit Order Book model and is built to support high-speed transactions. The Sei Network blog reports that it offers execution under one millisecond and settlement around 400 milliseconds.

Gordon said, “SEI is building the infrastructure for a decentralized Wall Street,” describing Monaco as the first DeFi app directly incubated by Sei Labs. Another analyst, Byzantine General, noted that SEI “held up super well while the rest of the market dipped,” following the announcement.

Market Data Remains Steady

Open interest in SEI futures is holding at stable levels. This suggests that traders remain engaged without adding high levels of leverage. Volume remains consistent after the early June breakout.

Funding rates on Binance are currently at -0.012%. This shows short positioning is present, which may create pressure if the price begins to rise. Liquidations have stayed low, which often indicates a lack of panic in the market.

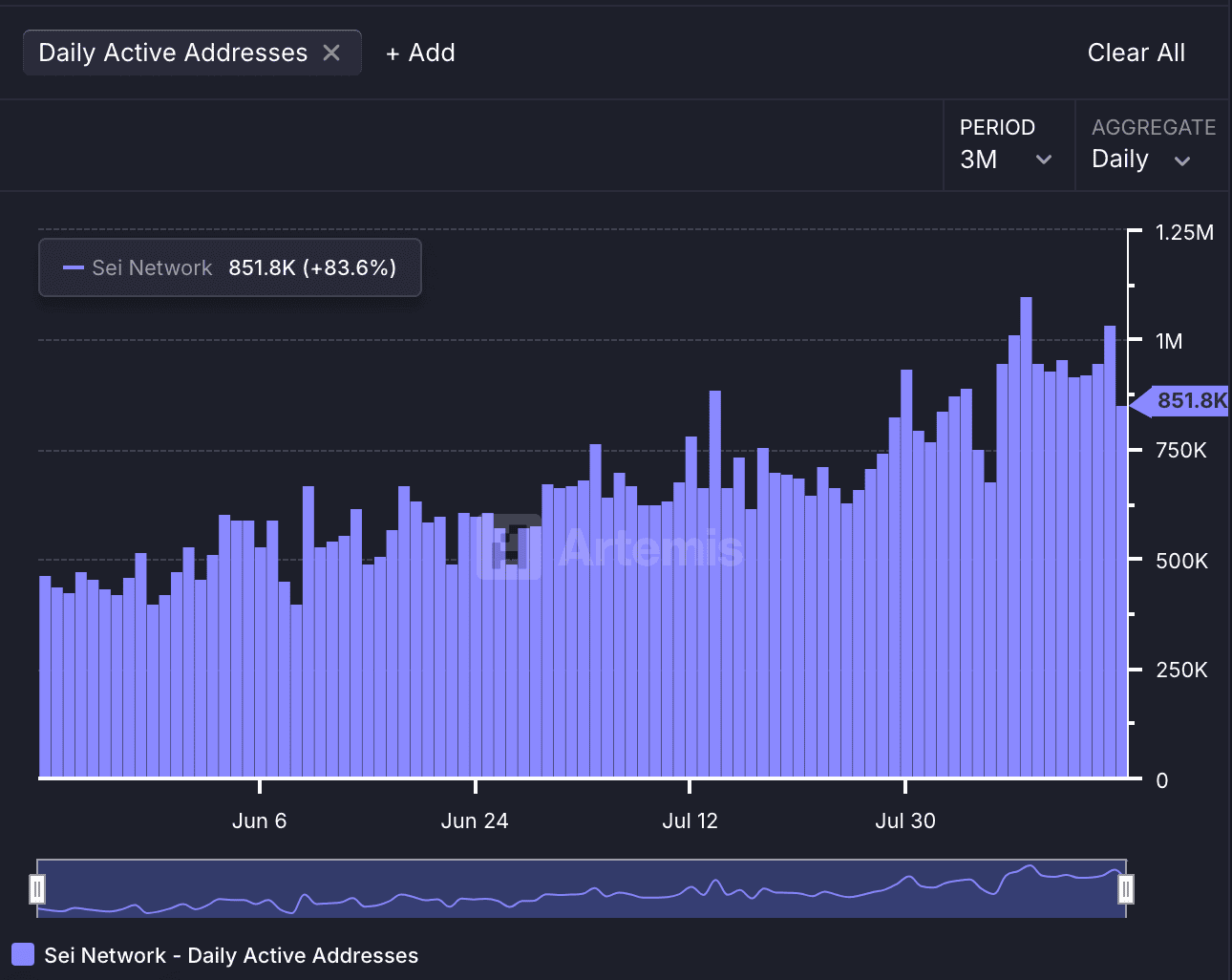

User Activity on the Rise

Daily activity on the Sei Network has grown steadily. Data from Artemis shows over 851,000 daily active addresses, which is a 22% rise in the past month. Over a three-month span, the number is up by 84%. Some days have crossed one million users.

Meanwhile, this growth reflects more users interacting with the network. The timing coincides with the release of Monaco, which may have helped boost activity.