Ethereum Exit Queue Surges: $3.7B in ETH Stuck—What’s Driving the Rush?

The Ethereum exit queue is back in the spotlight as a staggering 808,880 ETH—worth $3.7 billion—gets bottlenecked. Is this a sign of shifting sentiment or just another day in crypto’s rollercoaster market?

### Why the Sudden Exodus?

Validators are piling into the exit queue, but the reasons aren’t entirely clear. Some point to profit-taking, while others speculate about looming protocol changes. Either way, the backlog is real—and growing.

### The $3.7B Traffic Jam

With billions locked up, liquidity takes a hit. Traders and institutions alike are feeling the pinch, though Ethereum’s die-hards insist it’s just a speed bump. (Cue eye rolls from traditional finance.)

### What’s Next for ETH?

Will this surge trigger a domino effect—or will the queue clear without a ripple? One thing’s certain: in crypto, even the exits are volatile.

A Fortnight’s Wait

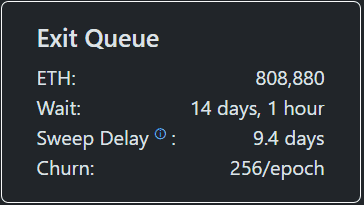

Ethereum’s Validator Queue, which serves as a gauge for determining interest in staking and unstaking, has recorded an exit queue not seen before. At the time of writing, the wait time to leave, i.e., unstake, stands at a staggering 14 days, with 808,880 ETH worth about $3.7 billion, as the network’s epoch limit has been reached.

An epoch is the time it takes for validators to propose and attest to the creation of blocks, with each one averaging 6.4 minutes. Churn refers to the amount of ETH that can enter and exit per epoch, serving as a safety mechanism to prevent instability. Sweep delay, simply put, refers to the time it takes for a withdrawal to reach your wallet address after passing through the exit queue.

By contrast, the queue to start staking ETH is about half the size of the waiting list, with the current number standing at 374,136, worth approximately $1.7 billion, and with a wait time of 6 days.

CryptoPotato recently reported a similar level of exit queue activity, noting a shift in investor strategies rather than it being solely caused by profit-taking from the price action of the leading altcoin.

What Could Be Causing It?

The debate on X regarding the extraordinary wait time to unstake ETH is heated, with many investors and traders weighing in and providing their opinions on the matter.

The co-founder of the Redstone oracle service, Marcin, noted that this could have started last month, when a previous spike in exit activity was observed, with Tron’s founder, Justin Sun, withdrawing $600 million worth of ETH from the AAVE protocol.

What happens when Justin SUN withdraws 600M of $ETH from Aave?

• ETH Borrow & Lend rates spike![]()

• The backbone of DeFi, LST looping, is temporarily unprofitable

• The market stETH / ETH rate depegs ~0.3%

How DeFi’s biggest moves can suddenly spook leverage loopers pic.twitter.com/G1GesdZdEc

— Marcin | Lending Supercharged![]() (@MarcinRedStone) July 23, 2025

(@MarcinRedStone) July 23, 2025

There is a popular strategy of staking ETH on Lido, the current leader in liquid staking protocols. Users WOULD receive stETH as a result, use it on Aave to borrow more Ether, and repeat for higher yields. It’s possible that many traders have copied this and wanted to exit when they saw Sun close out his massive position.

An analyst noted that the upcoming launch of ETH staking ETFs may have caused a spike in unstaking, as investors prepared for these funds to go live following the SEC’s ruling that staking activities and liquid staking tokens are not securities.

Another key point was profit-taking, as ethereum neared its all-time high (ATH) of $4,891.70 from 2021, prompting many traders to capitulate on the rally and take out their winnings.

The rising tide of treasury companies focusing on the altcoin with the highest market capitalization could also be contributing to this, as they seek to reinvest what they have staked so far, further exacerbating network congestion.