Whales & Institutions Fuel XRP’s Meteoric Rally—Is This the Start of a New Crypto Bull Run?

Ripple’s XRP isn’t just climbing—it’s sprinting. Institutional money and whale wallets are piling in, turning what looked like a slow grind into a full-blown frenzy. Here’s why the smart money’s betting big.

### The Whale Effect: Big Players Dive In

When crypto whales move, markets ripple (pun intended). XRP’s recent surge isn’t retail FOMO—it’s cold, calculated accumulation by players with deep pockets. The kind that don’t panic-sell when Twitter screams ‘dip.’

### Institutions Join the Party—Late, as Usual

Hedge funds and crypto-native funds are finally catching on, chasing momentum like they invented it. Because nothing says ‘alpha’ like buying after a 50% pump. At least they’re consistent.

### The Bottom Line: This Rally Has Legs

Unlike meme-coins that rise and crash on Elon’s whim, XRP’s move feels different—liquidity, volume, and real demand. But hey, this is crypto. If you’re not slightly cynical, you haven’t been paying attention.

Institutional Adoption and Market Growth

XRP is trading at $3.23 after gaining 8% over the past week, though it slipped 2% in the last day. According to analyst David_kml, adoption among major banks and payment firms is expanding, with more institutions using the XRP Ledger for cross-border transactions. The shift signals a growing role for the network in global payments.

$XRP is seeing strong growth with increasing institutional interest and wider adoption in global payments.

Core Highlights:

➝ Price: $3.25

➝ Leading banks and payment companies are using the $XRP Ledger

➝ Indicates rising confidence and the potential for a major price… pic.twitter.com/kZ87sM8q9m

— David_kml (@David_kml1) August 14, 2025

Partnership activity is on the rise, transaction volumes are climbing, and fintech engagement remains strong. Another factor adding to momentum is the resolution of Ripple Labs’ long-standing case with the US SEC.

Some analysts are likening the current market structure to Ethereum’s 2016 breakout, which was followed by an extended rally.

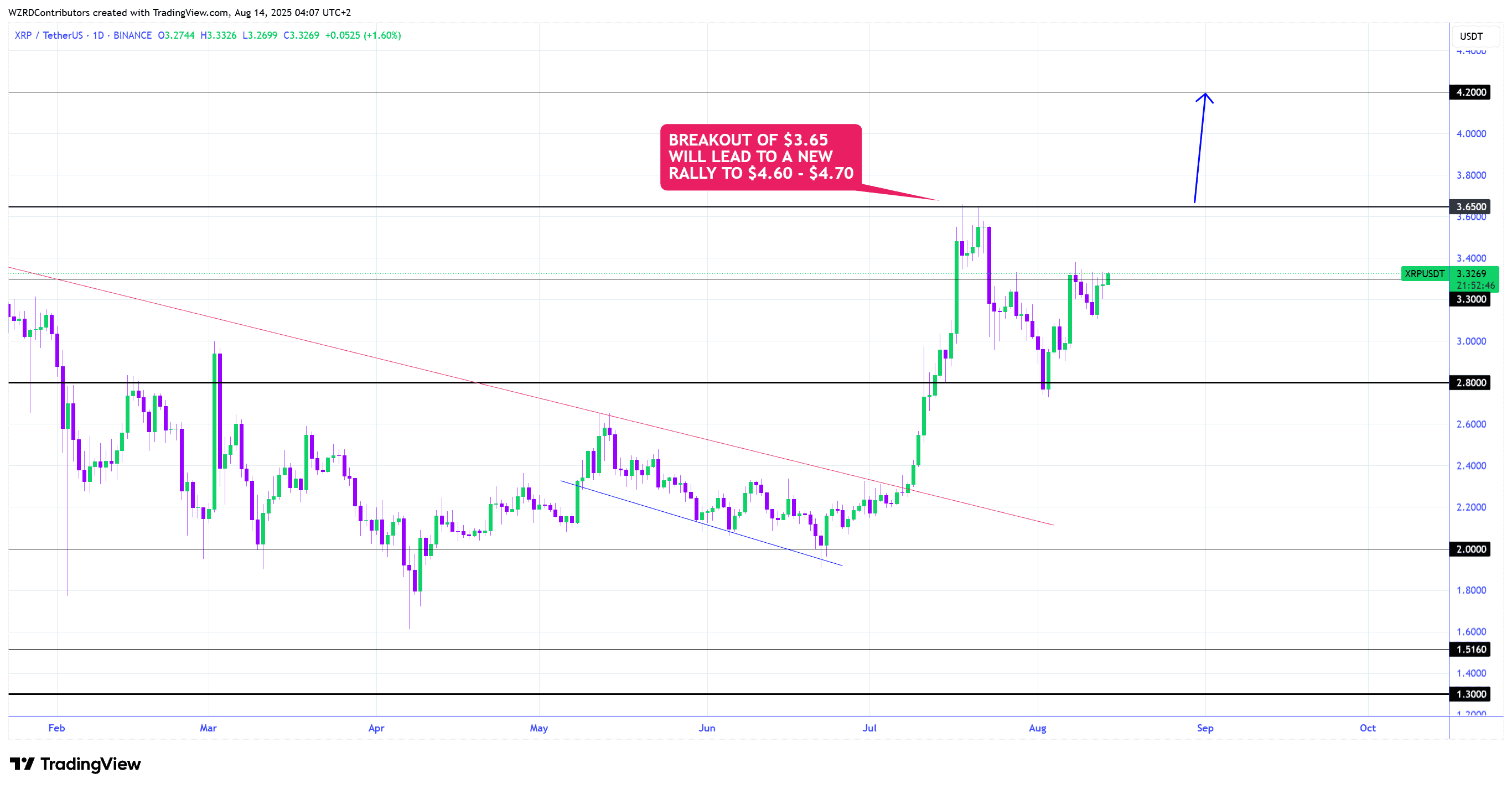

Technical Outlook and Key Levels

Analyst CRYPTOWZRD described the latest daily close as indecisive, noting a similar pattern for XRP/BTC. The token is sitting NEAR $3.3 resistance. A move higher could bring $3.65 into view, while $3.23 serves as intraday support and $3.4 as the next resistance level to watch.

Notably, the recent intraday action has been narrow, but CRYPTOWZRD sees potential for follow-through if buyers push above short-term resistance.

“Above the $3.4 resistance target we will get the next trade opportunity as our current position will already be secured,” he said.

According to coverage published by CryptoPotato, MikybullCrypto projected that XRP could reach between $6 and $8 before peaking in the current cycle. His view is based on a breakout over the $2.60–$2.80 range on the monthly chart after years of consolidation.

Whale Activity and Market Influence

Data from analyst Ali Martinez indicates that large holders have purchased 320 million XRP in three days, worth about $1 billion at current market prices. Heavy accumulation of this type can reduce short-term selling pressure and may sway sentiment among retail traders.

A similar build-up in July was followed by a rally that pushed XRP past $3.60 to a record high. Market observers are watching to see if this buying wave leads to another strong advance.