HYPE’s Price Surge: What’s Fueling the Rally Today?

HYPE rockets upward as traders pile in—but what’s really driving the pump?

Market movers or just another hype cycle? Here’s the breakdown.

Speculation runs wild. Some point to a rumored partnership, others whisper about an upcoming exchange listing. Meanwhile, the usual suspects on Crypto Twitter are already calling the next ATH.

Liquidity floods in. Trading volume spikes 300% in 24 hours as FOMO takes hold. Retail traders chase the green candles while whales quietly accumulate.

Reality check time. Remember: what goes up must come down—unless you’re Bitcoin (or so the bagholders say).

One cynical take? Just another Tuesday in crypto land, where fundamentals are optional and ‘number go up’ is the only theology that matters.

Price Nears Previous Peak

Hyperliquid (HYPE) is changing hands at $47, edging closer to its record level around $50. The token has recovered from the $34–$35 range, where it traded after a drop of roughly 20% earlier this month. It has since moved past the $44.70 area, which may act as support in the short term.

Market watcher McKenna said the MOVE higher has been “led by spot buying” with strong absorption from the AF. With the AF ratio above 5%, they believe selling pressure has eased. The analyst also pointed to supply sitting above $50, but expects “more than $5 million per day in buybacks” to absorb it in the weeks ahead.

$HYPE now approaching all time highs whilst open interest had a substantial wipeout.

Move up has been primarily driven by spot buying and absorption from the AF with AF ratio >5% indicating exhausted sellers.

Orderbook above $50 definitely has supply sitting there but new wave… pic.twitter.com/grdO2loT4K

— McKenna (@Crypto_McKenna) August 13, 2025

Positioning in Futures Markets

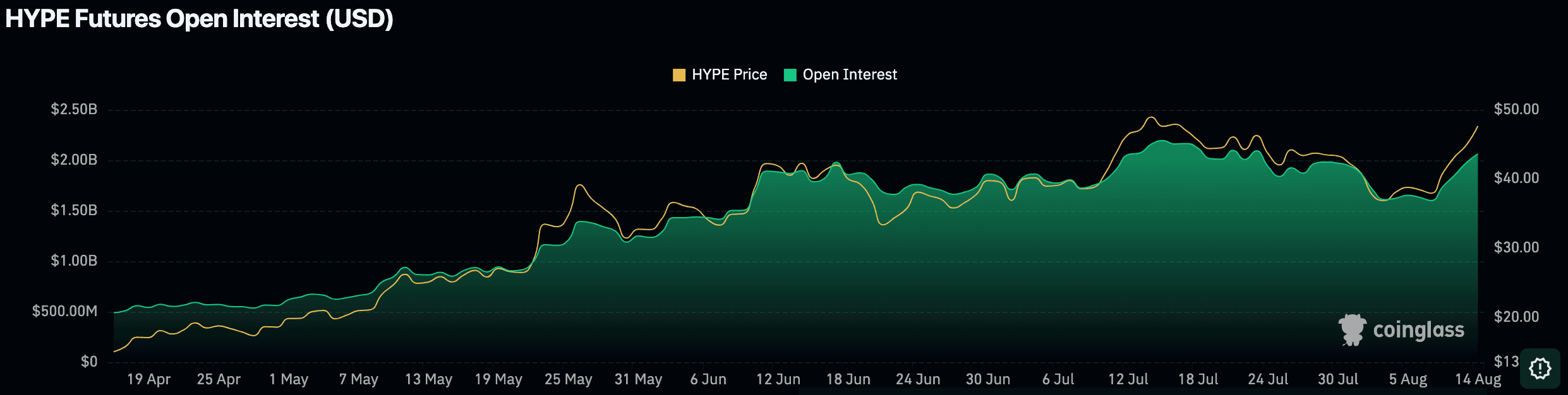

The decline earlier in August saw open interest fall by about 12%, equal to 4.8 million HYPE, as Leveraged positions were cut back. Current figures remain below the highs seen before that drop.

According to Coinglass, open interest has since risen 5% to $2.02 billion. The increase has come alongside the recent price rally, suggesting traders are opening new positions ahead of a potential break through $50.

Volume Growth and Market Balance

Trading volume over the past day is up 19% to $2.59 billion. Activity has been steady on the buy side, while funding rates remain NEAR neutral across major exchanges, showing no strong bias toward long or short positions.

McKenna noted that the rally has been built on spot market flows rather than heavy use of leverage, which often results in more durable price moves.

Network Activity and Analyst Outlook

Crypto Aman reported that Hyperliquid has generated more fees than any other network over the past month, with a share of this revenue allocated to HYPE buybacks. This program continues to add consistent demand for the token.

Hyperliquid topped all networks in fees generated over the past 30 days, allocating part of the revenue to $HYPE buybacks.

Are you holding $HYPE? pic.twitter.com/MBrhQBuJPZ

— crypto Aman (@cryptoamanclub) August 13, 2025

Analyst Rand suggested that “$100 could be in play in the coming months” if current conditions hold. A move through $50 WOULD place HYPE in new territory with little historical resistance.