ETH Dominates, BNB Hits ATH, BTC Takes a Breather: The Week’s Crypto Heatmap

Ethereum steals the show while Binance Coin breaks records—Bitcoin? Just cooling its heels.

ETH's spotlight moment

No fluke—Ethereum's surge proves DeFi's heartbeat is stronger than ever. Whales are stacking, traders are flipping, and the network's burning more gas than a SpaceX launch.

BNB's relentless rally

Binance's golden child tapped another all-time high this week. CZ probably toasted with champagne while traditional bankers cried into their spreadsheets.

BTC's 'chill' phase

Bitcoin dipped under its 30-day average—call it a nap after last month's ETF-fueled adrenaline rush. Hodlers aren't sweating; paper hands already bailed.

Closing shot: Meanwhile, Wall Street still thinks 'blockchain' is a type of Scandinavian furniture.

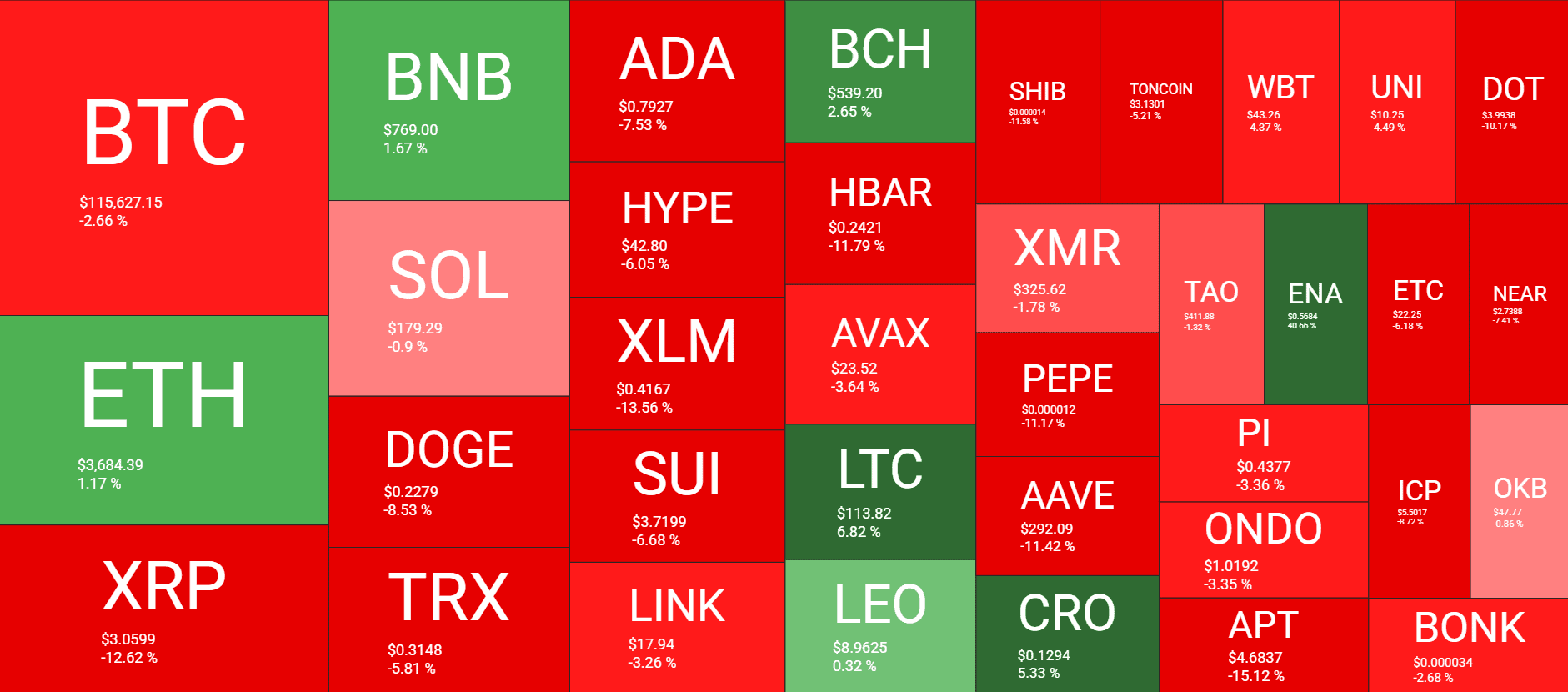

Market Data

Market Cap: $3.876T | 24H Vol: $265B | BTC Dominance: 59.4%

BTC: $115,670 (-2.6%) | ETH: $3,684 (+1.2%) | XRP: $3.06 (-13%)

This Week’s Crypto Headlines You Can’t Miss

. As mentioned above, the Ethereum ETFs have enjoyed the past few weeks, attracting billions of dollars in net inflows. As usual, BlackRock’s ETHA has stood out the most as it became the 3rd-fastest fund to reach the $10 billion AUM milestone within its initial year.

. Ripple’s native token was among the top performers lately, but its price suddenly crashed from over $3.4 to $3 within 48 hours. At first, the community blamed it on a speculative MOVE by Upbit, but further reports suggested that one of the company’s co-founders might have sold $140 million worth of XRP.

. The now-permanent bitcoin proponent, Kiyosaki, believes people should aim to distinguish themselves from the ‘regular investor’ stereotype. As such, they need to focus on accumulating real bitcoin, gold, and silver, instead of opting for ETFs.

. As it appears that BTC’s consolidation may have come to an end, one indicator suggests the asset’s future price performance. The now-completed Hash Ribbons signal indicates that miners may have finished their capitulation phase, which is typically good news for bitcoin’s price.

. Whenever BTC pumps hard, analysts and monitoring resources try to determine what’s the primary fuel for that surge. According to CryptoQuant, the latest price revival that took bitcoin to over $123,000 was driven mostly by institutions, as retail is nowhere to be found.

. The altseason HYPE really caught on in the past several days as many reps surged to new peaks, including BNB. Analysts at Bitfinex confirmed the narrative, stating that investors have shifted their focus to more speculative digital assets instead of the market leader.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and HYPE – click here for the complete price analysis.