3 Proven ChatGPT Hacks to Pinpoint Your Ideal Ripple (XRP) Buy Zone in 2025

AI meets crypto trading—here's how to weaponize ChatGPT for XRP entries while Wall Street overcomplicates things.

1. Decode Market Sentiment Like a Hedge Fund Bot (Without the Fees)

Scrape real-time XRP chatter—bullish whispers, FUD eruptions, even that one influencer's 3 AM caffeine rant. ChatGPT cuts through noise faster than a trader dumping bags after SEC news.

2. Backtest Strategies Before Your Capital Bleeds Out

Simulate 2021's 500% pump or 2023's 60% crash scenarios in seconds. No Excel hell, no 'HODL regrets'—just cold, algorithmic hindsight.

3. Set Alerts That Actually Work (Unlike Your Exchange's 'Maintenance' Notifications)

Program custom triggers for Ripple's ODL flows or whale wallet movements. Get pinged before CEX spreads widen—because someone's always front-running retail.

Pro tip: The 'perfect entry' doesn't exist—but AI gets you closer than that 'trust me bro' Telegram group. Just remember: ChatGPT won't save you when the Fed flips the liquidity switch.

Assistance with Technical Analysis

Whether you believe technical analysis works or not, many traders use it to gauge the effectiveness of an entry and to also identify potential exits. In general, it remains one of the most common practices for crafting strategies.

You can upload a chart to ChatGPT and use it to interpret technical indicators such as:

- Moving averages

- Relative strengh index

- Support and resistance levels, and much more.

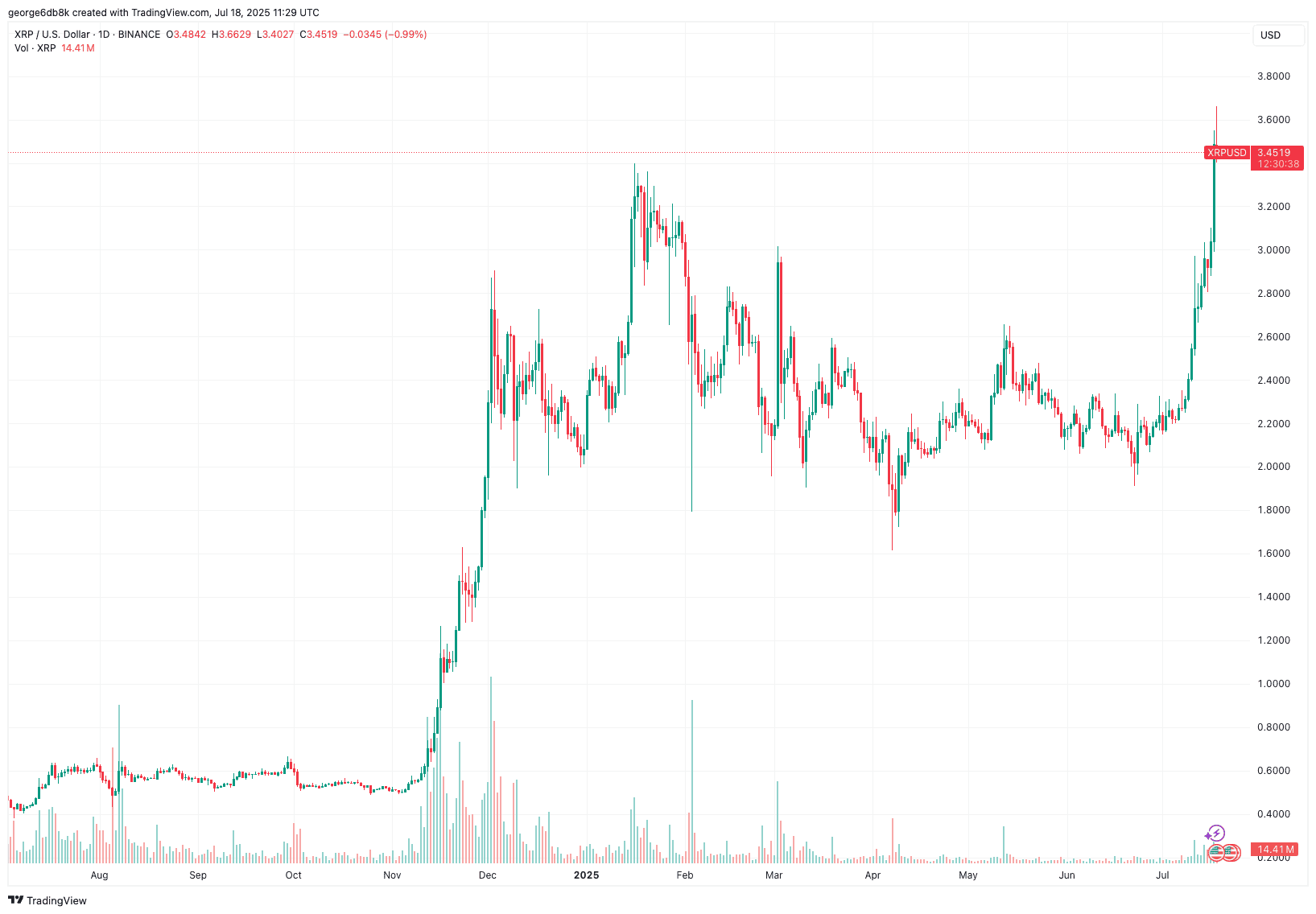

Let’s check out an example. We have uploaded the following chart:

We also inserted the following prompt. Note how we start with a prompt to identify the current price – we want to make sure that ChatGPT reads the chart properly:

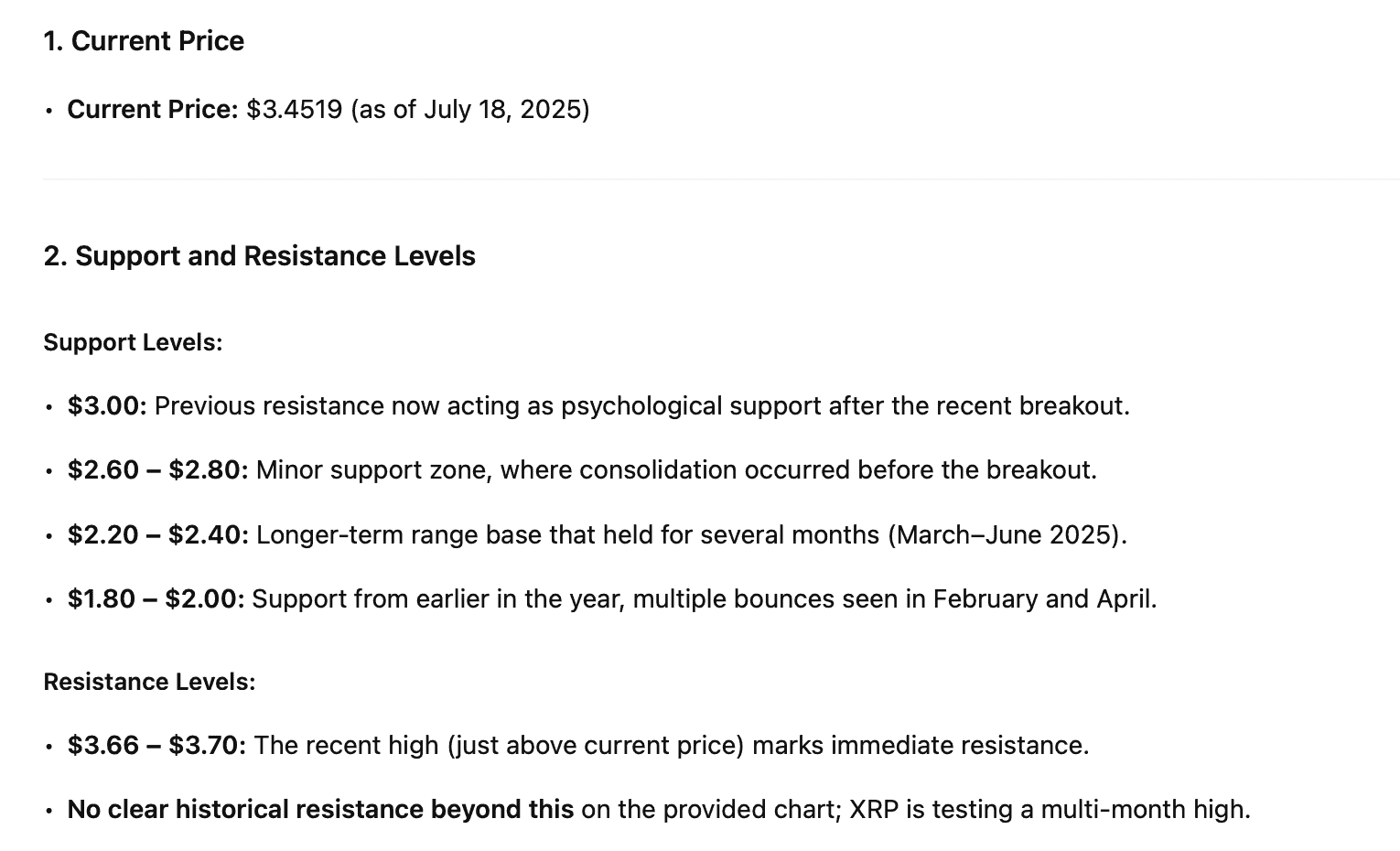

The AI then returned the following answer to our first two questions:

As you can see, it provided a correct answer to the first question and then provided the main support and resistance levels with certain argumentation for it. The previous all-time high is not flagged as a support because the price is hovering above it and it’s still uncertain as to whether it has been flipped as support or not – the bot needs further confirmation, perhaps in the form of a few consecutive daily candle closes above it.

In terms of resistance, because XRP is in price discovery, ChatGPT correctly assumed that there is “no clear historical resistance beyond this on the provided chart.”

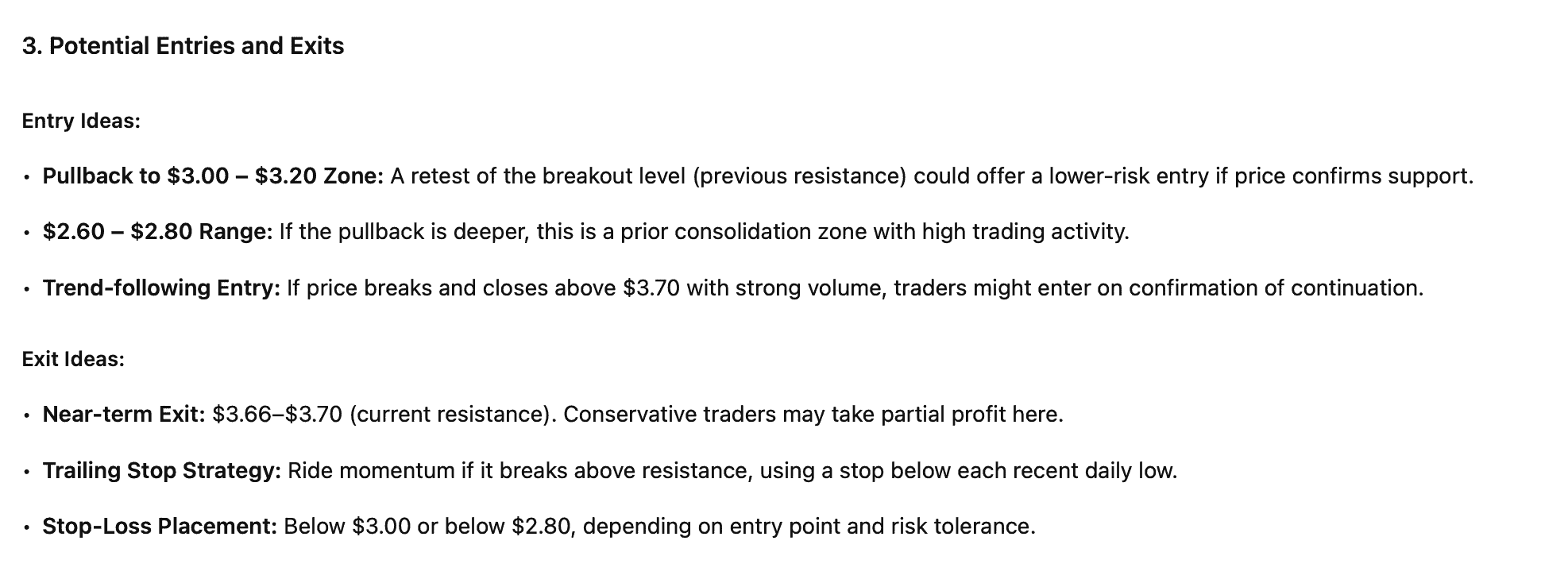

The more interesting part is to see what types of entries it has provided. This is what it returned as an answer to the third question:

Now, whether or not this fits your trading style is an entirely different question, but you can modify the prompts to be more precise and tailored to your particular strategy. In addition, you can also feed it with more information so that it also takes some fundamentals into consideration, which brings us to point number two.

Sentiment Aggregation from news and Social Media

ChatGPT can easily summarize recent sentiment surrounding XRP by scanning news headlines, interpreting Reddit or Twitter posts, flagging major developments, and so forth.

However, the caveat here is that if you’re not that tech-savvy and can’t build some sort of an automation, you will have to manually feed the bot with the headlines and materials you want it to summarize and interpret.

Fortunately, there are plenty of aggregation resources out there that you can use to quickly compile headlines from the past 24 hours or from the past week, for instance, and then feed them into ChatGPT for it to work with.

As a bonus tip here: consider giving ChatGPT a certain role. Instead of just prompting it with a simple task such as “summarize these articles,” you can go a lot more in-depth. A more professional-looking prompt could be something like:

Respond as if you are a professional swing trader with a focus on cryptocurrencies. Analyze the contents of the following URLs in depth and provide answers to the following queries:

Macro and On-Chain Data Interpretation

Just as it can read trading charts, ChatGPT can also read on-chain graphs that provide contextual information for a certain coin based on its technical fundamentals.

For instnace, the FLOW in and out of exchanges can be a critical parameter to gauge investor sentiment – increased exchange inflows could be a sign of an incoming selling pressure, while outflows typical signal stronger underlying spot market conditions.

Therefore, make sure to also use this to your ChatGPT-provided analysis for a fuller breakdown and a more cohesive strategy.

Having said all of the above, I WOULD like to reiterate that none of it is financial advice. You should always conduct your own research. Tools such as ChatGPT (or other AI-based agents) can be used to your advantage but always approach them with a grain of salt and verify the information they provide.