Crypto Bloodbath: $150 Billion Evaporates as Bitcoin Crashes Below $117K – What’s Next?

Crypto markets just got sucker-punched. A brutal sell-off wiped out $150 billion in value as Bitcoin—the bellwether of digital assets—tumbled below $117,000. Here’s the damage.

### The Domino Effect

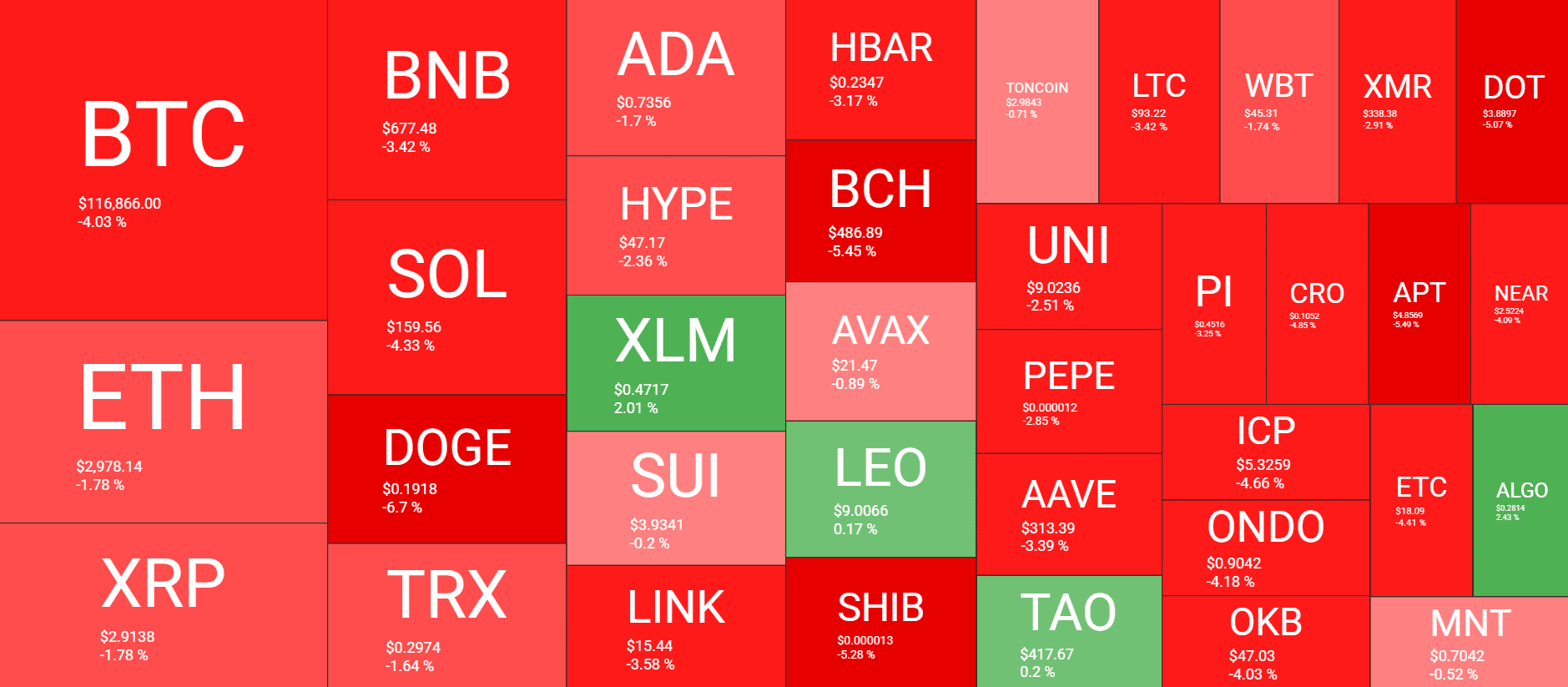

When Bitcoin sneezes, the whole market catches a cold. Altcoins bled out in sympathy, with double-digit drops across major tokens. Even 'stable' projects got rocked—proof that crypto’s volatility isn’t just a meme.

### Who’s Holding the Bag?

Leveraged longs got liquidated en masse. Retail traders? Panic-selling. Institutional players? Probably loading up at a discount—because nothing makes Wall Street happier than a fire sale (except maybe your transaction fees).

### The Silver Lining

History says this is par for the course. Bitcoin’s survived worse—remember the -80% drops? Bulls argue this is a healthy correction, not a death spiral. But try telling that to the guy who YOLO’d his savings at the top.

Markets move fast. Sentiment moves faster. One thing’s certain: crypto winters build the next cycle’s millionaires—assuming they don’t paper-hand first.

BTC Slips Below $117K

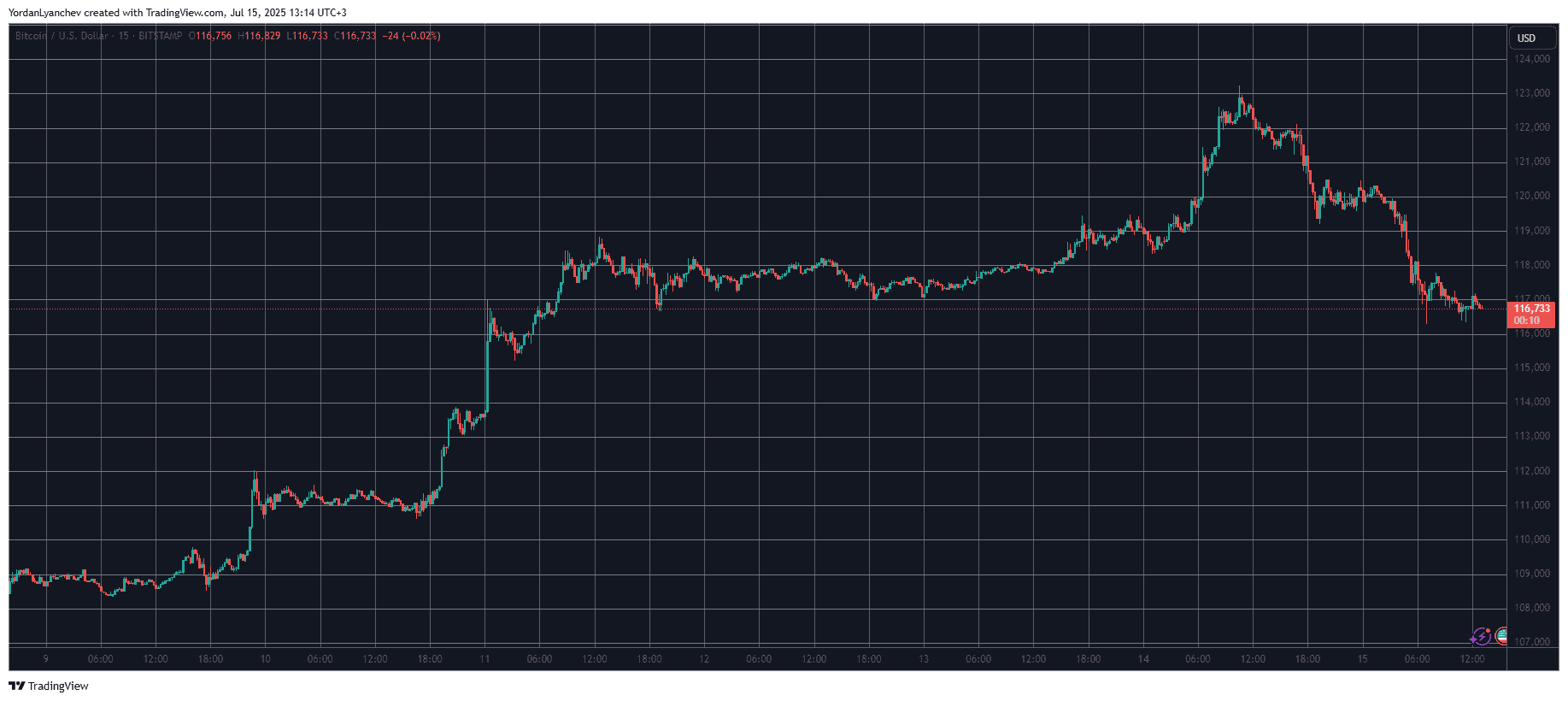

What a week it has been in the cryptocurrency world. Less than seven days ago, bitcoin’s price was stuck between $105,000 and $110,000 with little to no fluctuations and a lack of a clear future direction. However, the landscape quickly changed on Wednesday evening when BTC pumped above the upper boundary and tapped a new all-time high at $112,000.

The gains continued in the following couple of days, and BTC peaked at almost $119,000 on Friday. The weekend went mostly quietly, with BTC standing a few grand below its record.

The bulls went back on the offensive on Sunday evening and especially on Monday, when it surged past $120,000 and tapped a new ATH at just over $123,000. This meant that the cryptocurrency had added roughly $15,000 in about five days, and here are some of the possible reasons behind that impressive run.

However, some warning signs started to appear. Additionally, TRUMP gave Russia a 50-day deadline to reach a peace deal with Ukraine, and BTC began losing traction.

Earlier today, the asset fell below $117,000 and has remained there ever since. Its market cap has retreated to $2.320 trillion on CG, and its dominance over the alts is at 62.1%.

Alts in Retreat

Many altcoins experienced exponential gains over the past few days but have slipped on a daily scale. Dogecoin is among the poorest performers since yesterday, having lost almost 7% and trading close to $0.19. However, that could actually be good news for the largest meme coin.

BNB, SOL, HYPE, BCH, SHIB, LINK, and HBAR are also in the red with losses of up to 5.5%. ETH is below $3,000 after a 2% daily decline, while XRP has retreated to $2.9 following a similar decrease.

The cumulative market cap of all crypto assets has dropped by roughly $150 billion since yesterday’s peak to under $3.750 trillion on CG.