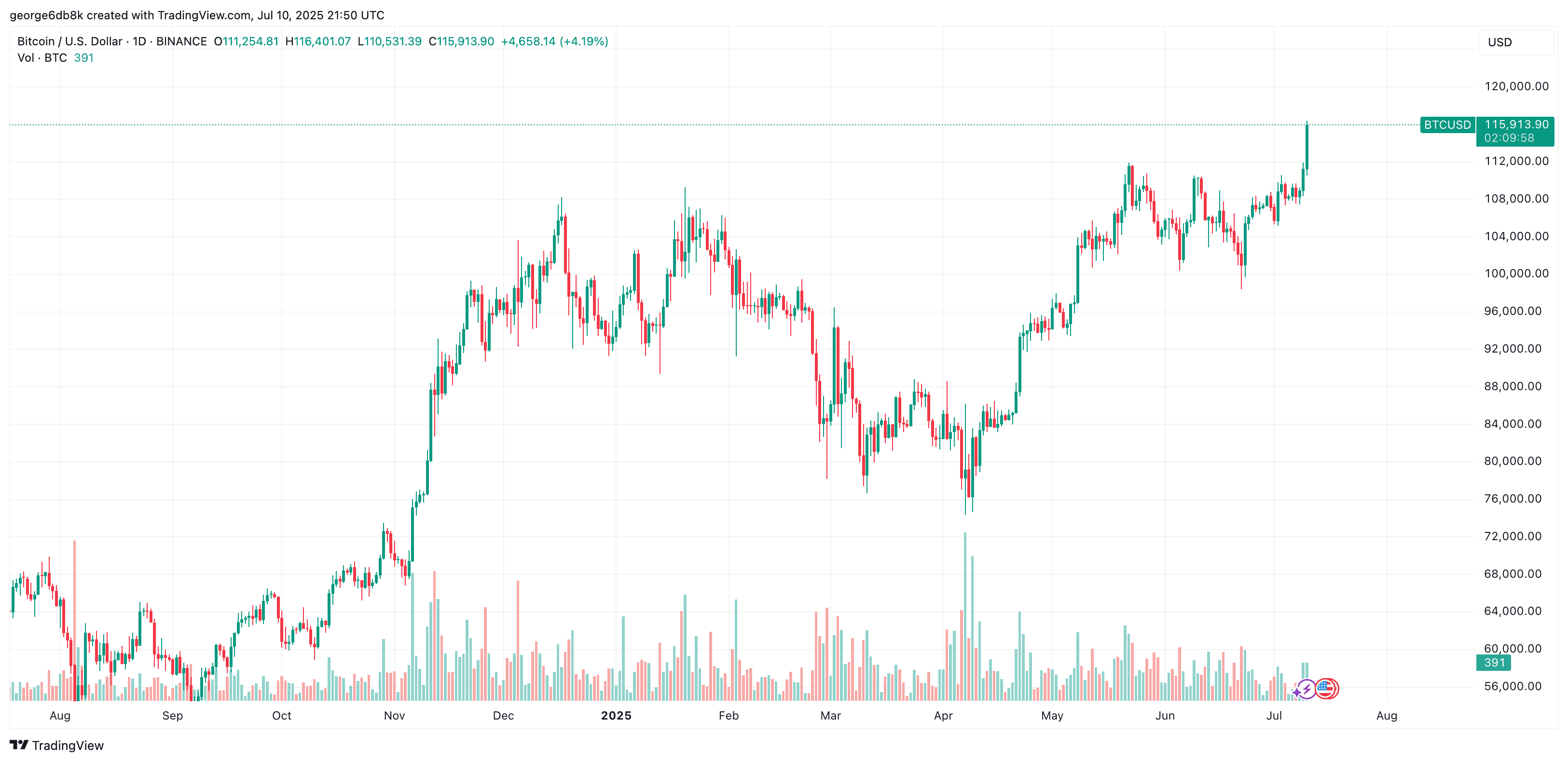

🚀 Bitcoin Shatters $116,000 as $1B Short Squeeze Triggers Market Frenzy

Bitcoin just detonated a financial shockwave—blasting past $116,000 while vaporizing nearly $1 billion in bearish bets. The mother of all short squeezes is here, and the suits are scrambling.

### Blood in the derivatives pool

Leveraged traders who bet against BTC now face margin calls sharper than a Satoshi whitepaper. Liquidation cascades feed the rally as algorithms compound the pain—classic crypto market physics.

### Wall Street's dangerous game

Institutional short positions are getting wrecked faster than a DeFi protocol audit. Meanwhile, retail FOMO surges as Bitcoin laughs at 'overbought' RSI readings—again. Some things never change.

This isn't just a pump. It's a full-system reset for anyone still doubting digital gold's dominance. Just don't tell the Fed—they're still trying to mint a CBDC that nobody wants.

Source: TradingView

Source: TradingView

The MOVE comes at the expense of short traders, who lost a combined total of around $940 million in the past day, according to data from Coinglass. This has caused a massive short squeeze, which is a common term used to describe a situation where short traders get liquidated and, as they do, this pushes the price upwards even further.

At the time of this writing, the total liquidations are at about $1 billion and 94% of that accounts for sellers, which is pretty indicative of the absolute domination by the buyers.

The rest of the market is also charting considerable gains – ETH is approaching $3,000, XRP is trading close to $2.6, while the total cryptocurrency market capitalization is almost $3.7 trillion.