🚀 Bitcoin Soars Past $116,000: The Crypto Bull Run Is Just Getting Started

Digital gold just got a turbocharge. Bitcoin smashed through $116,000 today as institutional money floods the market—proving Wall Street’s late arrival to the party yet again.

### The Dominoes Are Falling

Every skeptic’s favorite ‘bubble’ is now eating traditional assets for breakfast. With ETFs sucking up supply like a black hole and halving scarcity baked in, this rally’s got fundamentals for once.

### What’s Next? Watch These Triggers

• Miner capitulation? Not this cycle—hash rates hit ATHs last week.

• Altcoin leverage? Still frothy, but smart money’s stacking BTC.

• Macro tides? Even the Fed can’t rain on this parade.

### The Ironic Twist

Banks that mocked crypto now custody more BTC than Satoshi’s anonymous stash. Talk about eating crow—with a side of 24% annualized returns.

One thing’s clear: this isn’t 2021’s meme-fueled mania. The real question isn’t ‘if’ but ‘how high’—and which legacy finance dinosaurs will FOMO in next.

Fiscal Surge Triggers Flight to Hard Assets

Trump’s $3.3 trillion Big Beautiful Bill, signed on July 4, triggered an immediate $410 billion rise in US debt. The bill lifts the debt ceiling by $5 trillion and permanently extends key tax cuts.

Markets see this as inflationary. Investors are rotating out of bonds and into scarce assets like Bitcoin. The bill’s size and speed of implementation have amplified fears over fiscal discipline.

Bitcoin, with its fixed supply, is emerging again as a hedge against fiat debasement.

BlackRock’s spot Bitcoin ETF (IBIT) has reachedin assets under management. That’s triple what it held just 200 trading days ago.

By comparison, it took the largest gold ETF over 15 years to reach the same milestone. Institutional flows are now a powerful driver of price action, pushing bitcoin deeper into mainstream portfolios.

Fed Balance Sheet Shrinkage Tightens Liquidity

In June, the Federal Reserve reduced its balance sheet by $13 billion, bringing it to $6.66 trillion—the lowest since April 2020. The Fed has now cut over $2.3 trillion in assets over the last three years.

Meanwhile, Treasury holdings are down $1.56 trillion in that same period. With fewer buyers in the bond market and more debt being issued, investors are moving into alternative stores of value.

Bitcoin has become the top candidate.

BREAKING: The Federal Reserve’s balance sheet declined by -$13 billion in June, to $6.66 trillion, the lowest since April 2020.

Over the last 3 years, the Fed has reduced its asset holdings by -$2.31 trillion, or -26%.

During this period, the value of Treasury holdings has… pic.twitter.com/OGAVR5wjUd

Also, ethereum is trading near, upsince the Big Beautiful Bill became law. Solana, Avalanche, and other altcoins are also rallying.

Retail and institutional capital are returning. Meme coins and DeFi tokens are gaining traction as speculative sentiment returns. crypto is once again leading the risk-on cycle.

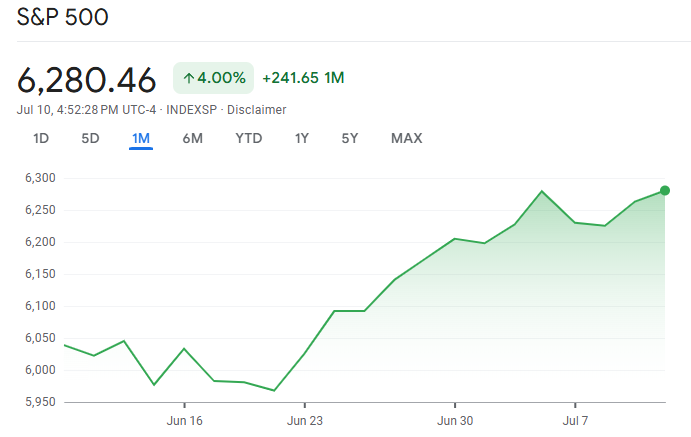

S&P 500 All-Time High: Risk-On Across the Board

The S&P 500 has surged 30% since its April 2025 low, hitting a new all-time high this week. This signals strong investor confidence in high-growth, high-risk assets.

Bitcoin benefits directly from this environment. As equities rally, crypto tends to follow. The market sees the Big Beautiful Bill as indirect stimulus—and it’s responding accordingly.

Bottom Line

Bitcoin’s latest all-time high is a response to structural changes—not hype. The Big Beautiful Bill expanded the deficit and shook confidence in US debt markets.

With inflation fears rising and institutional access growing, Bitcoin is becoming the macro hedge of choice. As crypto enters a new bull market, all eyes now turn to the Federal Reserve and rate cut decisions.