Crypto Whale Gets Rekt: $50M Liquidation as Bitcoin (BTC) Smashes All-Time High

Blood in the water—and it's not retail traders' this time. Bitcoin's parabolic surge to new record highs just triggered one of the year's most brutal leveraged takedowns.

The casualty: A cocky short-seller who forgot the first rule of crypto casinos. When the house (read: market makers) calls your bluff, margin comes knocking.

Liquidation carnage hit $50 million as BTC defied 'overbought' screeching from analysts who've been wrong since $20k. The lesson? In a bull market, trying to outsmart dumb money often makes you the dumbest guy in the room.

Meanwhile, institutional FOMO accelerates—because nothing brings Wall Street to the table like watching someone else get liquidated first.

BTC’s Latest Peak Liqudates Massive Whale

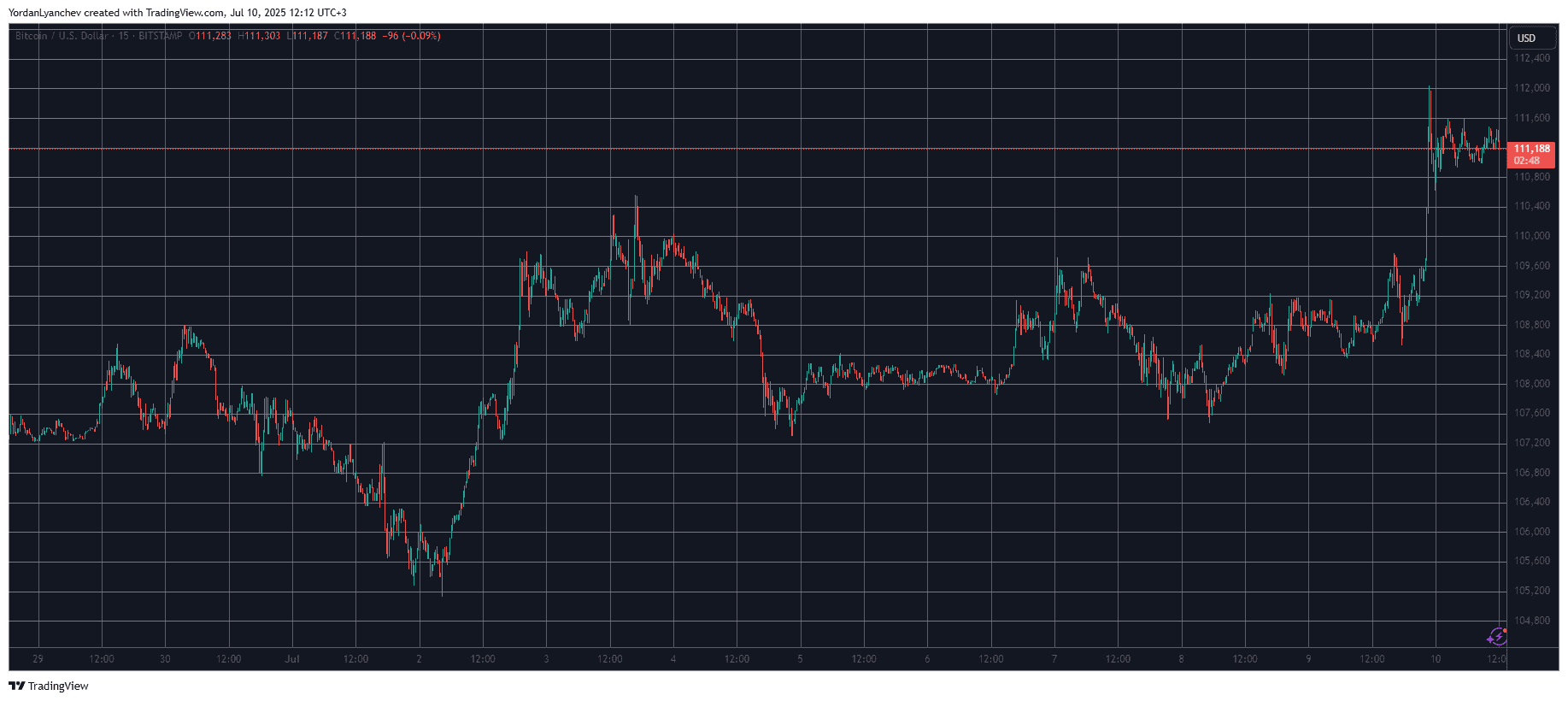

Recall that the primary cryptocurrency began the month with stagnation and even a brief correction that drove it to just over $105,000. However, it reacted well at this point, erased all losses, and even jumped past $110,000 a day later.

It couldn’t maintain its run and returned to $108,000, where it spent most of the weekend. Monday started with another breakout attempt, but to no avail as the bears emerged at $109,600 and pushed it south.

After another day of consolidation on Tuesday and most of Wednesday, the cryptocurrency finally shot up on Wednesday evening. Perhaps due to Donald Trump’s call for lower interest rates, BTC skyrocketed past $110,000 and continued climbing to break its previous all-time high, setting a new one at $112,000 (on most exchanges).

Although it has retraced by about a grand since then, its MOVE to the upside caused a painful liquidation for a certain whale. Data from CoinGlass shows that someone was wrecked for over $51 million yesterday.

BTC’s market cap now stands above $2.210 trillion, while its dominance over the alts is down to 62.4%.

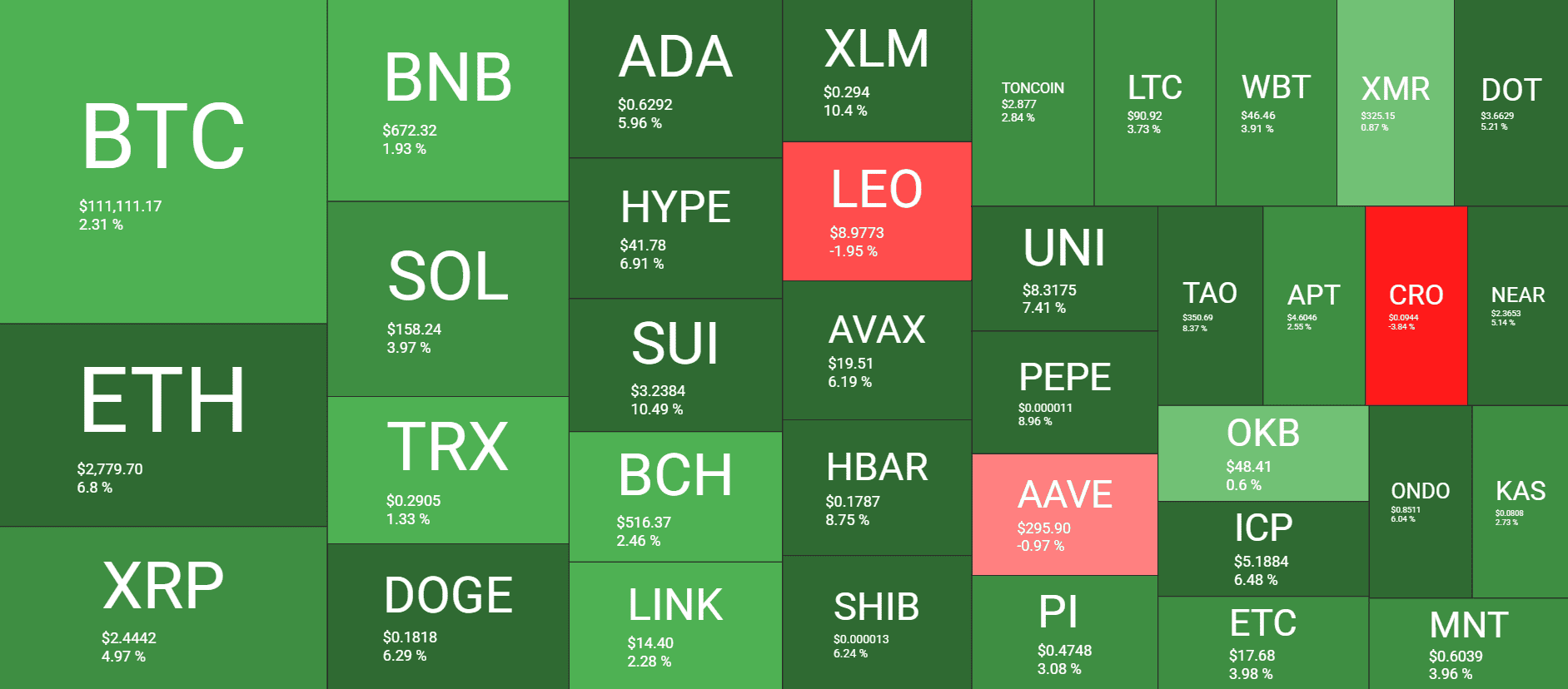

Alts in Green

The declining BTC dominance in times of price pumps means that alts have performed better, a lot better. This is evident from many larger-cap ones, such as ETH, which tapped $2,800 for the first time in weeks.

DOGE, ADA, HYPE, SUI, XLM, AVAX, HBAR, and SHIB are also well in the green, with gains of up to 10-11%.

The biggest increases come from some lower-cap alts, such as PENGU, which has skyrocketed by over 34% amid rumors of a spot ETF. WIF (15%) and Fartcoin (13%) follow suit.

The cumulative market cap of all crypto assets has risen by approximately $100 billion since yesterday and is up to $3.540 trillion on CG.