Bitcoin Defies Chaos: Surges from $98K to $108K Despite Geopolitical Storm – Weekly Crypto Rundown

Bitcoin laughs in the face of global turmoil—again. While politicians scramble and markets tremble, the OG crypto just punched through another resistance level like it’s 2021 all over again. Here’s why this isn’t your average ‘safe haven’ narrative.

The Numbers Don’t Lie (Unlike Some Balance Sheets)

$98K to $108K in seven days. No ETFs, no Fed pivot, just pure ‘orange pill’ energy. Traders who bet against this rally are now nursing losses—and probably regretting their life choices.

Geopolitics? What Geopolitics?

While traditional assets flinch at every headline, Bitcoin’s volatility looks almost… disciplined. Funny how a ‘speculative asset’ behaves more rationally than fiat currencies when the world goes sideways.

The Cynic’s Corner

Let’s be real—Wall Street still hates that they can’t control this. Meanwhile, Bitcoin keeps cutting through noise like a hot wallet through weak security. Stay salty, bankers.

Market Data

Source: Quantify Crypto

Source: Quantify Crypto

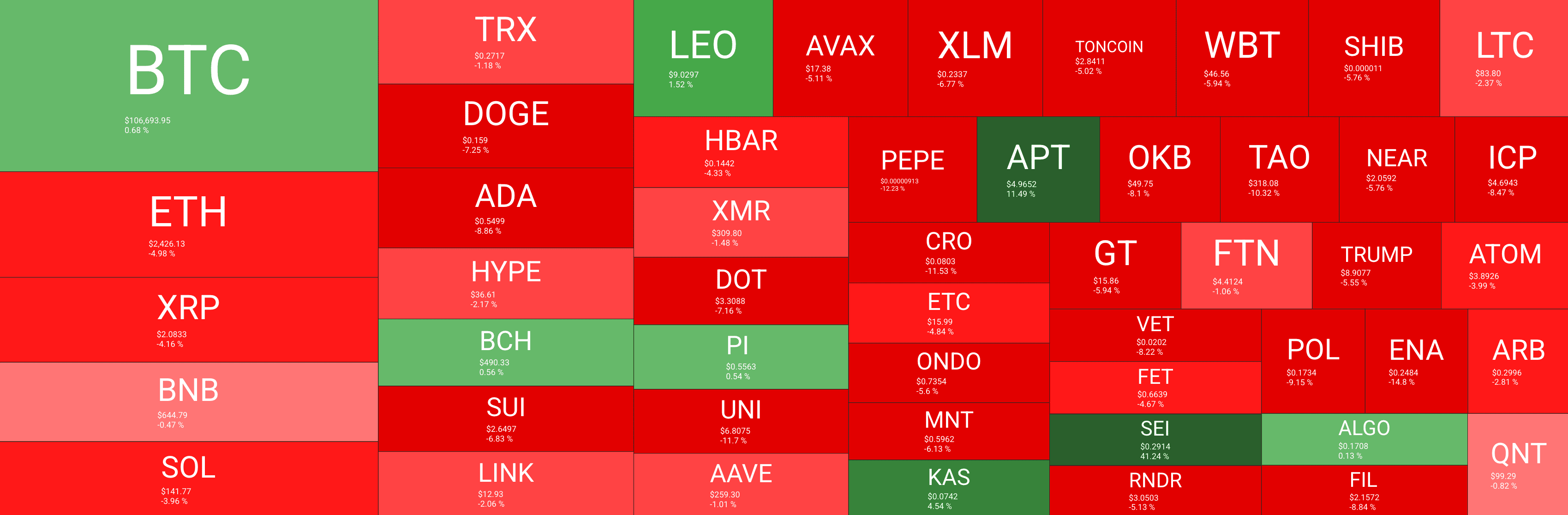

Market Cap: $3.384T | 24H Vol: $84B | BTC Dominance: 62.7%

BTC: $106,693 (+0.6%) | ETH: $2,426 (-5%) | XRP: $2.08 (-4%)

This Week’s Crypto Headlines You Can’t Miss

Over the past couple of weeks, market participants have sold about 720,000 BTC, the majority of which was off-loaded by relatively new holders. It’s very impressive that the market was able to absorb this quantity without falling off a cliff.

The LTH/STH ratio is creeping up. This particularly positive on-chain metric has previously been the precursor to massive rallies such as the one from $28K to $60K and from $60K to $100,000. We know that history doesn’t repeat, but will it rhyme?

In an interesting report from this week, the popular crypto analytics firm Santiment released its insights into some of the more exciting coins to watch as we are stepping into the third quarter of the year. Some of them might surprise you.

The world’s leading oracle providing – Chainlink – has teamed up with one of the world’s leading payment networks – Mastercard. The partnership aims to enable a whopping 3 billion Mastercard cardholders to buy crypto seamlessly.

Many expected the Ripple v. SEC case to come to a halt this week, but unfortunately for XRP holders, the judge didn’t grant the parties’ motion for indicative ruling. This basically means that Ripple is now facing a choice – to continue with the appeal or to drop it entirely.

Circle, the world’s second-largest stablecoin issuer, is now sitting at a valuation of more than $66 billion, following the most recent increases in its share values. The company is now trailing Coinbase after what seems to be a very successful initial public offering.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and HYPE – click here for the complete price analysis.