Ethereum at a Crossroads: Will ETH Break Out or Succumb to Fading Bullish Momentum?

Ethereum's price action has traders on edge as consolidation drags on—and that once-promising bullish energy starts looking suspiciously like 2018 deja vu.

The patience game

ETH's chart paints a classic standoff between hopeful holders and skeptical sellers. Every minor rally gets met with equal resistance, while dips find just enough buyers to prevent collapse.

Technical tightrope

Key moving averages coil like springs beneath the current price. Either they'll launch the next leg up...or snap violently if support fails. Meanwhile, institutional traders keep stacking ETH futures—whether that's smart positioning or dumb money remains to be seen.

One thing's certain: in crypto, 'consolidation' is just banker-speak for 'we have no idea what happens next.' The market's either building momentum for a breakout...or quietly lining up dominoes for the next great crypto faceplant.

Technical Analysis

By ShayanMarkets

The Daily Chart

On the daily timeframe, ETH remains inside an ascending channel, consistently finding support around the $2,400 area while struggling to break above the $2,800 mark.

The upper boundary of this channel, combined with the 200-day moving average and a key order block formed in February, is acting as a heavy resistance element. Each test of this level has led to a rejection, but so far, the structure hasn’t broken down, indicating that bulls are still in control for now.

Momentum, however, is weakening. The RSI hovers around the midline at 51, reflecting indecision and a lack of strong directional drive. If ETH can reclaim the upper range and flip the $2,700–$2,800 area into support, it could initiate a new leg higher toward $3,000 and above. On the flip side, a breakdown below $2,400 WOULD shift the bias bearish, exposing the $2,150 support zone.

The 4-Hour Chart

Zooming in on the 4H chart, ETH is still grinding within the same rising channel. After the recent drop from $2,875 to $2,430, the price retraced into the 0.5–0.618 Fibonacci zone, but has been rejected to the downside and is now consolidating below it. This area, between $2,600 and $2,700, has repeatedly acted as a supply zone, rejecting bullish attempts multiple times. For short-term traders, this remains the key level to flip.

Until this resistance breaks, ETH may continue its range-bound behavior. The RSI has recovered slightly from oversold conditions, now sitting NEAR 52. While this suggests a slight uptick in momentum, there’s still no clear sign of bullish dominance. If the bulls fail to break above this key fib zone soon, another drop toward the lower boundary of the channel near $2,400 is likely.

Sentiment Analysis

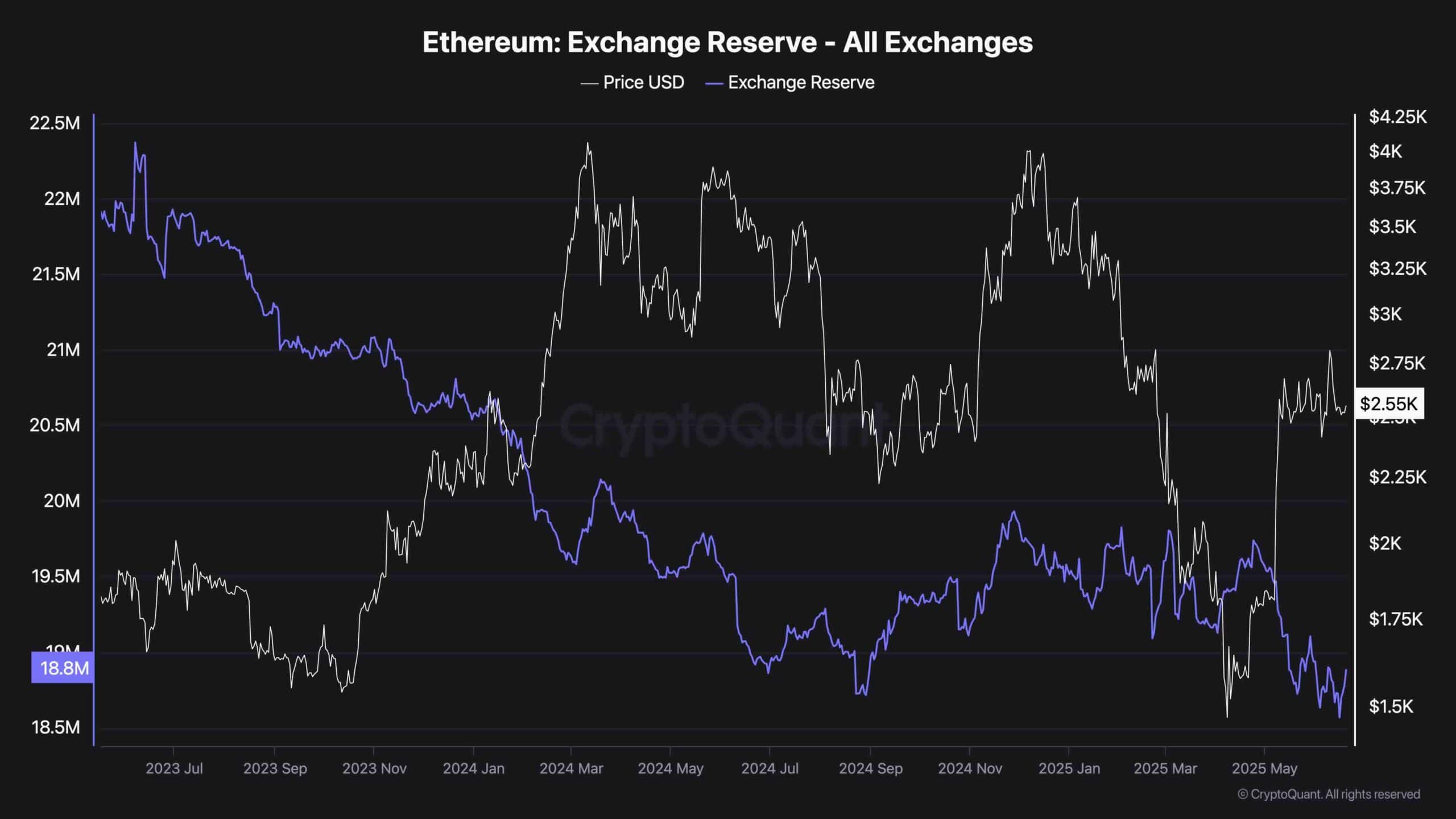

One of the most important long-term signals for ethereum remains the consistent downtrend in exchange reserves. Currently sitting at 18.8 million ETH, this is one of the lowest levels in recent history. Exchange reserve data indicates how much ETH is held on centralized trading platforms, meaning a downtrend signals that coins are being withdrawn into self-custody, staking, or cold wallets.

Historically, sustained drops in exchange reserves suggest a supply squeeze narrative building beneath the surface. Fewer tokens on exchanges reduce the available selling pressure and can lead to explosive upside when demand rises.

Even as ETH struggles to break out technically, this silent accumulation phase shows confidence among long-term holders. If this trend continues, it may act as a powerful tailwind once technical resistance levels are finally breached.