South Korea’s Crypto Titans Are Fueling These Red-Hot Altcoins in 2025

Seoul's blockchain heavyweights are throwing their weight behind a new wave of altcoins—and the market's eating it up.

These aren't your grandma's speculative tokens. Backed by Korea's most formidable crypto exchanges and institutional investors, select altcoins are posting triple-digit gains while Bitcoin flatlines.

The 'Kimchi Premium' goes institutional

Remember when retail traders drove Korea's infamous crypto premiums? Now it's the country's regulated giants—Upbit, Bithumb, Korbit—pumping liquidity into handpicked projects. Their stamp of approval moves markets faster than any whitepaper.

Gaming tokens lead the charge

Korean VCs can't resist play-to-earn projects. Three gaming altcoins in their portfolios have surged 200%+ this quarter alone. Never mind that most gamers still prefer fun over financialization—the metaverse narrative sells.

Regulators blink—for now

The FSA's 'light touch' approach continues (surprise—tax revenue talks louder than consumer protection). But with leverage creeping back into altcoin trading, how long until the next 'Leek Cutting Season' begins?

As always in crypto: the bigger the backers, the harder the fall when music stops. But tonight? The Gangnam party rages on.

FORT Leads the Way

Multiple leading altcoins have recorded slight price drops over the past 24 hours following the US Federal Reserve’s decision to keep interest rates unchanged and the ongoing tension in the Middle East. However, three lesser-known tokens have defied the ongoing trend, posting substantial gains.

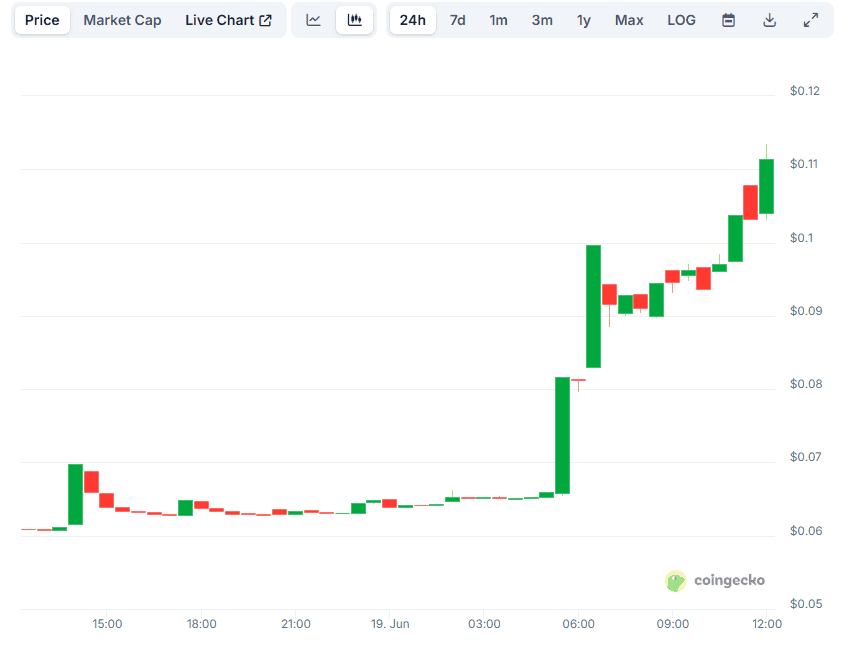

Forta (FORT), a cryptocurrency with a market capitalization of just under $70 million, saw its valuation skyrocketing by roughly 100% on a daily scale. It soared to as high as $0.11, a level last observed in early April.

Another token well in the green today, albeit registering a more modest increase, is Huma Finance (HUMA), which spiked by 6% to almost $0.04.

The most likely factor fueling the rally of the aforementioned assets is the support from the second-largest crypto exchange in South Korea, Bithumb, which introduced the FORT/KRW and HUMA/KRW trading pairs to its users.

Raydium (RAY) also experienced a significant green candle on its daily price chart. Currently, it trades at around $2.22, representing a 10% increase for the day, while its market capitalization surged past $600 million.

The resurgence comes shortly after South Korea’s largest crypto exchange listed the RAY/KRW and RAY/USDT trading pairs.

The uptrend in the mentioned altcoins comes as no surprise. With nearly 20 million users combined, Upbit and Bithumb significantly boost the visibility and accessibility of these tokens. Their backing also enhances liquidity and positively impacts their reputation.

Not the First Time

At the start of June, the price of Ravencoin (RVN) exploded by 75% after Upbit launched the RVN/KRW trading pair on its platform. It charted additional gains in the following days, hitting a five-month high on June 11. In the past week, though, RVN lost some steam, dropping by 24%.

Other cryptocurrencies that have recently caught the eye of South Korea’s leading crypto exchange include Pocket Network (POKT) and Livepeer (LPT).

The price of the former skyrocketed by 350% towards the end of May when the company introduced the POKT/KRW pair. For its part, LPT pumped by 80% after Upbit listed the LPT/KRW and LPT/USDT pairs.