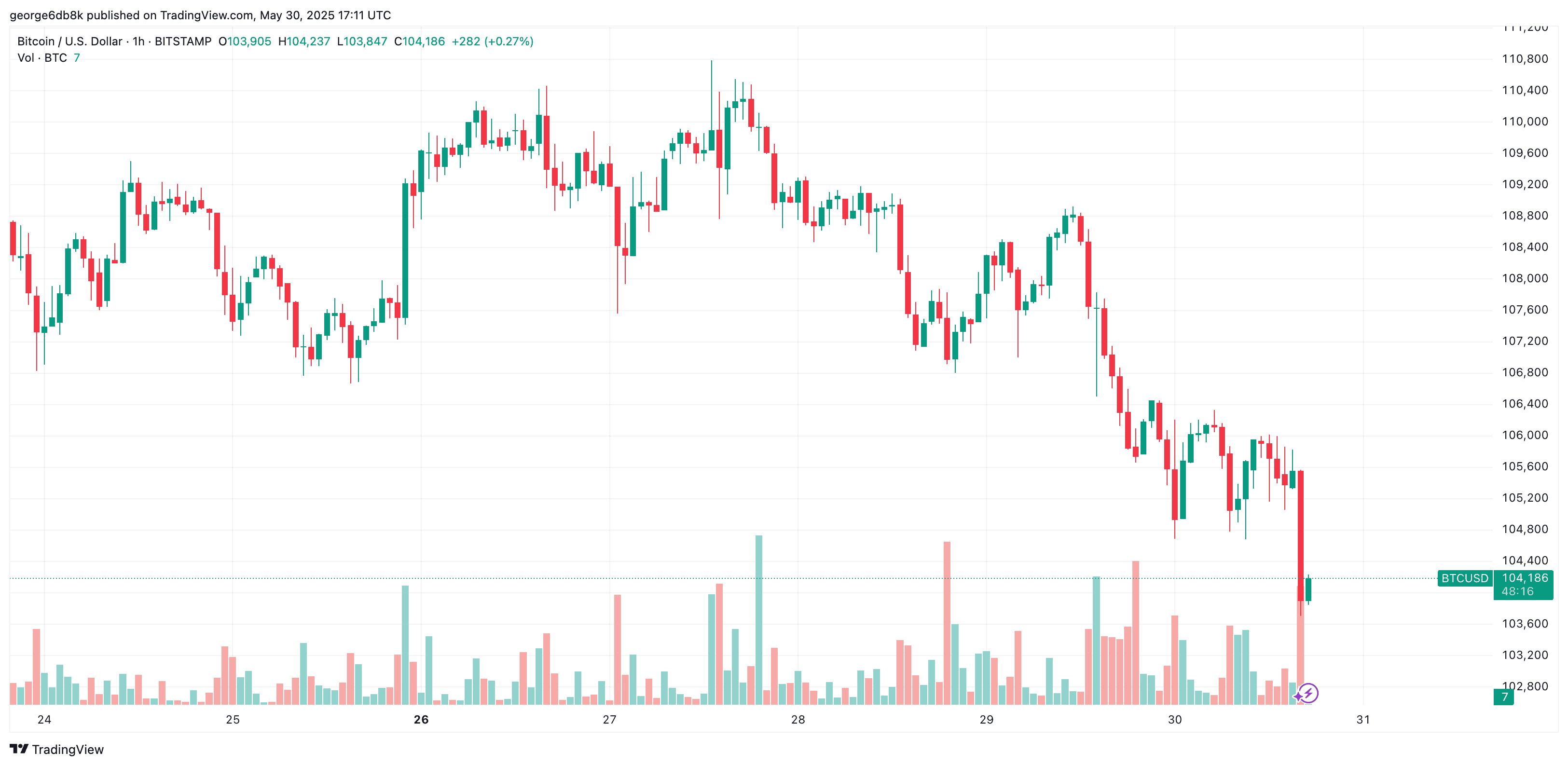

Bitcoin Plunges to $104K Amid US-China Geopolitical Storm

Digital gold gets a reality check as macro tensions trigger sell-off.

Geopolitical tremors shake crypto markets

Bitcoin’s $104K nosedive exposes crypto’s lingering sensitivity to traditional finance chaos—just when you thought decoupling was inevitable. Wall Street’s ’risk-off’ playbook strikes again, proving even decentralized assets can’t outrun old-school power struggles. Cue the institutional traders pretending this was ’priced in’ all along.Silver lining? At least it’s not Terra-level carnage... yet.

Source: TradingView

Source: TradingView

Over the past one hour alone, the liquidated BTC positions surpassed $226 million, where a whopping $220 million of that were longs.

This comes as broader stock markets also chart notable declines. The S&P 500, Nasdaq, and the Small Cap 2000 are all down by more than 1%, while the DJI is down by 0.6%, at the time of this writing.

The drop comes amid escalating tensions between the US and China. Donald TRUMP said that China has “violated” the agreement, ending his post on Truth Social in a way that promises retaliation. It appears that the markets are bracing for it.

Meanwhile, China responded, urging the US to “immediately correct its erroneous actions, cease discriminatory restrictions against China and jointly uphold the consensus reached at the high-level talks in Geneva.”