Ethereum Whales Dump 684K ETH—Did the Market Flinch?

Crypto’s big players just cashed out hard—dropping a staggering 684,000 ETH tokens in one go. Was it a calculated exit or just another Tuesday for whales playing with retail investors’ emotions?

Price impact? Minimal—because when has logic ever dictated crypto markets? ETH barely blinked, proving once again that whale moves are more about drama than actual disruption. Classic finance theater.

Meanwhile, the rest of us peasants keep hodling like our wallets depend on it. Spoiler: They do.

Source: IntoTheBlock

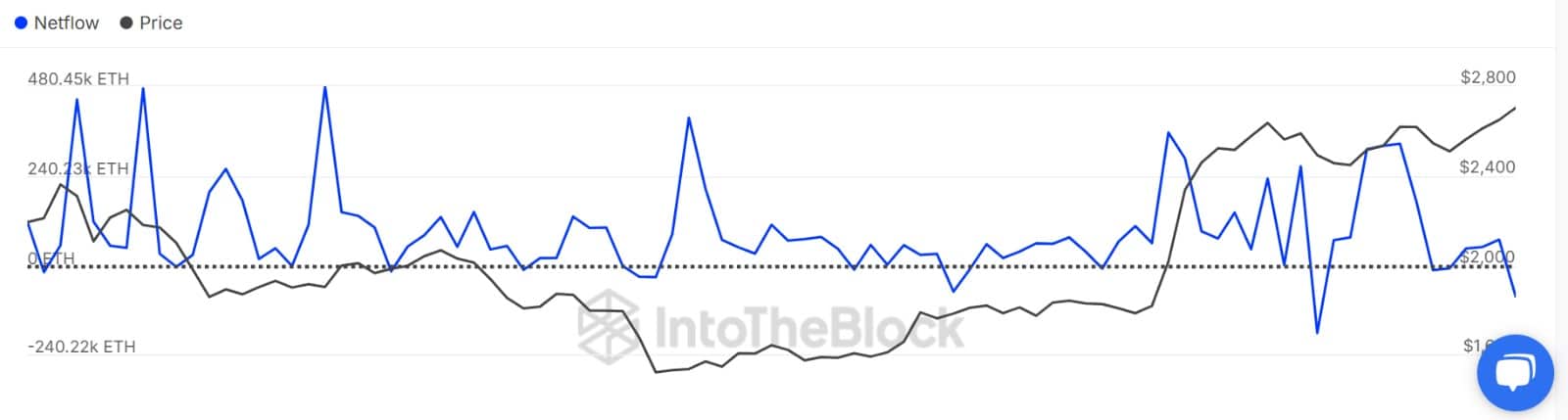

The two deposits have not happened in isolation but within a broader selling spree among whales. Over the past day, Ethereum whales have offloaded a total of 684.1k ETH tokens.

This signals a massive exchange outflow.

As such, large holders’ netflow has dipped to negative territory, hitting -83.5k. When a large holder’s netflow hits a negative value, it indicates that whales have sold more than they have bought.

Thus, there’s more capital outflow, reflecting a strong lack of confidence from large holders.

Source: CryptoQuant

In addition to the rising selling activity from whales, the Ethereum market has been taken over by sellers. Looking at Taker’s buy-sell ratio, sellers have dominated, with the metric dropping to a weekly low.

When this metric drops to a negative value, it suggests that sellers are outpacing buyers.

Source: CryptoQuant

This selling activity has seen the exchange supply ratio surge to a weekly high. This not only arises from increased selling activity, but also risks further sell pressure.

Oversupply leads to lower prices if demand drops.

Impact on ETH

Undoubtedly, the rising selling activity across the market has negatively affected Ethereum’s price movement, which dropped 3.95% over the last day until press time.

Therefore, a continuation of the current selling activity could see ETH breach the consolidation range and drop to $2324.

However, if the market manages to absorb the sell-side pressure, the altcoin will continue to hold within the range and trade between $2.4k and $2.7k. A breakout from this zone will need a cooldown in selling activity.

Subscribe to our must read daily newsletter