Ethereum’s Next Act: Bold Price Predictions Emerge as ETH Defies Market Gravity

Ethereum isn’t just holding its ground—it’s rewriting the rules. While traditional finance still debates crypto’s legitimacy, ETH’s recent performance has analysts scrambling to adjust their models. Here’s what the smart money sees coming.

The Bull Case: Scaling Solutions Fuel Optimism

Layer-2 adoption and successful Dencun upgrades have slashed gas fees to pennies. Suddenly, institutional DeFi looks less like a pipe dream and more like an inevitability—if you ignore the usual Wall Street skeptics who still think blockchain is just for buying monkey JPEGs.

The Bear Trap: Volatility Remains King

Don’t pop the champagne yet. Macroeconomic headwinds and regulatory shadowboxing could trigger short-term pullbacks. But ETH’s fundamentals? Stronger than a banker’s martini at 3pm on a Friday.

The Bottom Line

Whether ETH hits $10K or tests $2K support next week, one thing’s clear: Ethereum continues to be the blockchain that matters—while legacy finance plays catch-up.

What’s Next?

The price of ethereum has risen over 40% in the past month, currently trading just north of $2,550. However, numerous market observers believe this is only the beginning of a major rally that may last in the near future.

Michael van de Poppe assumed that the sub $2,400 levels observed a few weeks ago resembled “an incredibly good buying opportunity.” He thinks ETH will start “attacking the highs” in the short term, claiming that a breakout above $3,000 could mark the beginning of a new bull run.

The X users, Sensei and Lucky, also gave their two cents. The former noted that the price has recently consolidated between $2,400 and $2,700, envisioning a MOVE to the upside and a pump beyond $3,200.

Lucky, a popular analyst with more than 2.2 million followers, revealed that ETH has been “heavily outperforming” BTC in the current quarter. The analyst sees this momentum continuing and expects further price growth for the second-largest cryptocurrency.

Ethereum is heavily outperforming $BTC in this quarter. This shows more money flowing into $ETH, and in my opinion, this momentum will continue, and we will see more highs in ETH, especially the low and mid caps. pic.twitter.com/DQaJ6T42kG

— Lucky (@LLuciano_BTC) May 26, 2025

For his part, Merlijn The Trader shared a chart showing that ETH inflows into accumulation wallets have surged in the past few days. “Something big is coming. You don’t stack like this unless you know what’s next. And what’s next isn’t normal, it’s historic,” the analyst predicted.

Known for their steady inflows and minimal outgoing transactions, accumulation wallets are closely watched by analysts and traders for signs of investor confidence and long-term positioning.

Keep an Eye on These Important Factors

The recent inflows into spot Ethereum ETFs suggest that ETH could indeed be on the verge of a further price upswing. SoSoValue data indicates that in the past few days, these funds have attracted more capital than they’ve lost, reflecting a boost in investor confidence. In fact, the last date when netflows were negative was May 15.

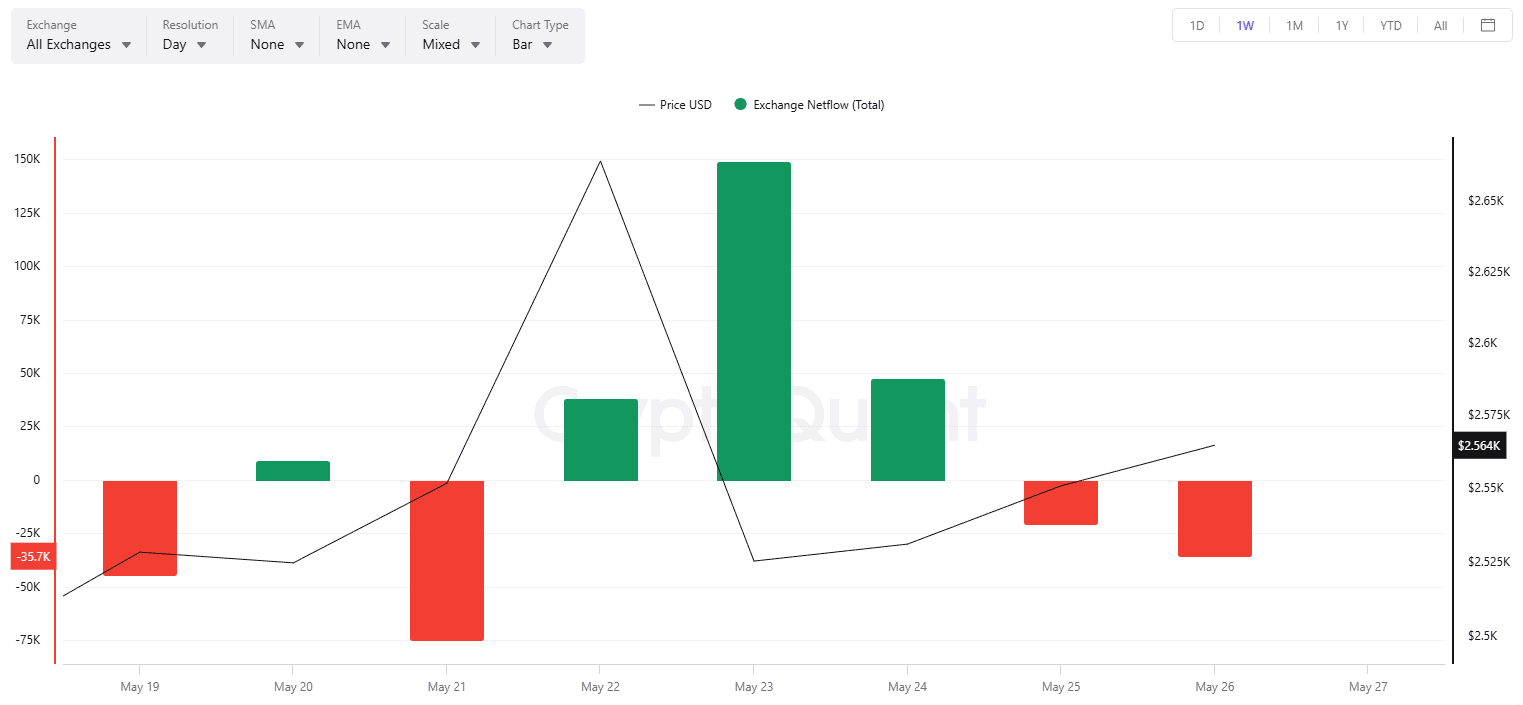

On the contrary, exchange netflows have been predominantly positive in the past week. This suggests that some investors have shifted from self-custody towards centralized exchanges, which increases the immediate selling pressure.