XRP at a Crossroads: 5 Make-or-Break Price Predictions for May 2025

Ripple’s legal saga drags on—but traders are still betting big. Here’s where analysts see XRP heading next month.

1. The Bull Case: $1.50 or Bust

If SEC settlement rumors gain traction, whales could pump XRP past its 2021 highs. Just don’t ask about ’utility.’

2. The Stablecoin Scenario: Flat at $0.50

Another month of regulatory limbo leaves XRP stuck in neutral—perfect for hedge funds playing volatility.

3. The Dark Horse: CBDC Partnerships

Central bank deals (real or imagined) might spark a 30% surge. Cue the press release pump-and-dump.

4. The Bear Trap: Crash to $0.30

Another exchange delisting wave could trigger stop losses. Bonus pain if Bitcoin corrects sharply.

5. The Wildcard: Elon Tweets

Because in 2025, even ’legacy’ cryptos still dance to meme lords. Place your bets—the house always wins.

5 Ripple (XRP) Price Predictions to Watch in May

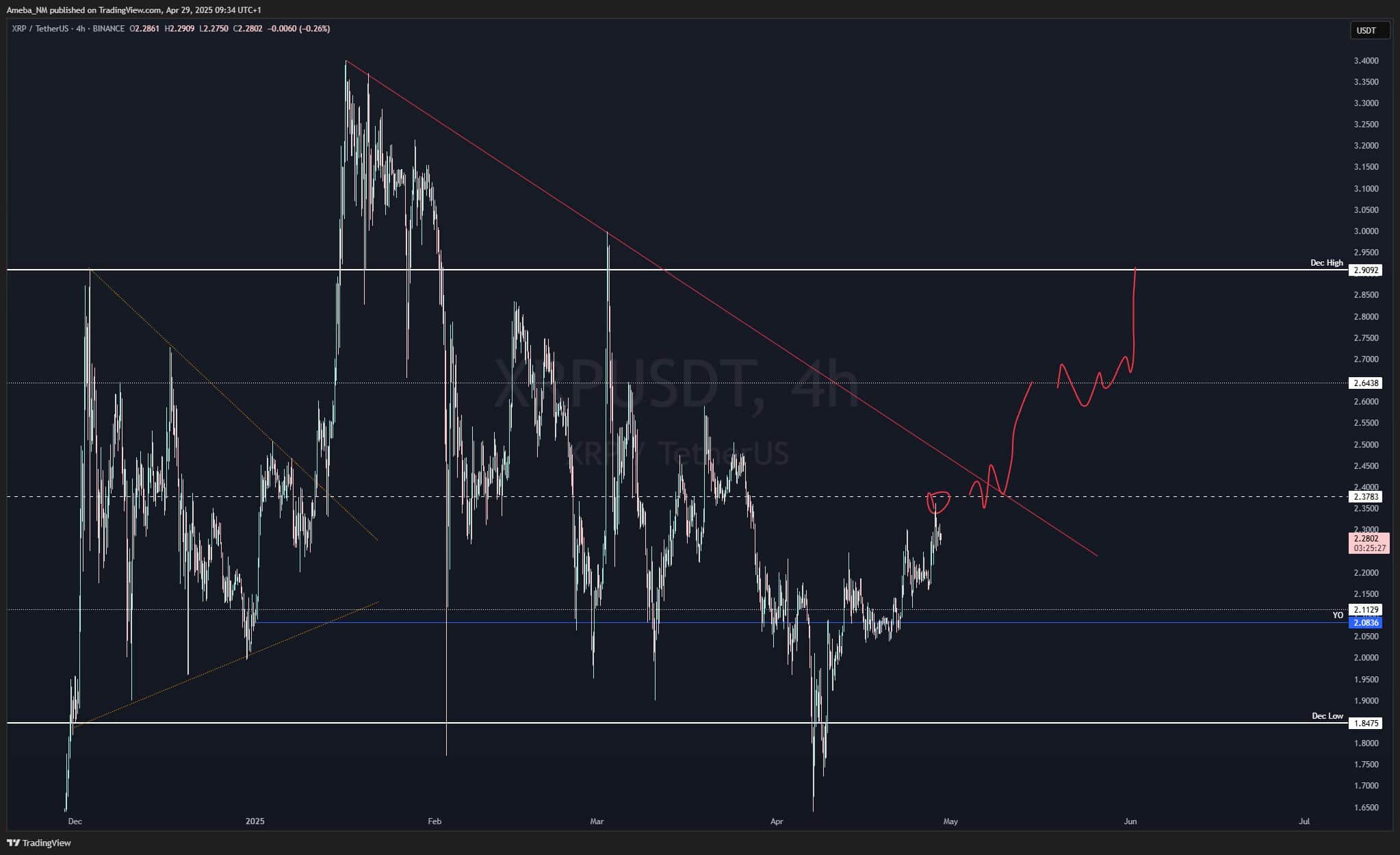

First in line we have an analysis from the popular analyst on X using the monicker Ameba. He took it to social media recently, to reveal that the first target he is looking at is located at around $2.90. This would represent an increase of around 26%.

I wanted to see a tap of [the] mid range, which is what happened over the weekend shortly after [the] weekly open.

The next play wto the upside would be above the mid range for me, on a potential breakout scenario.

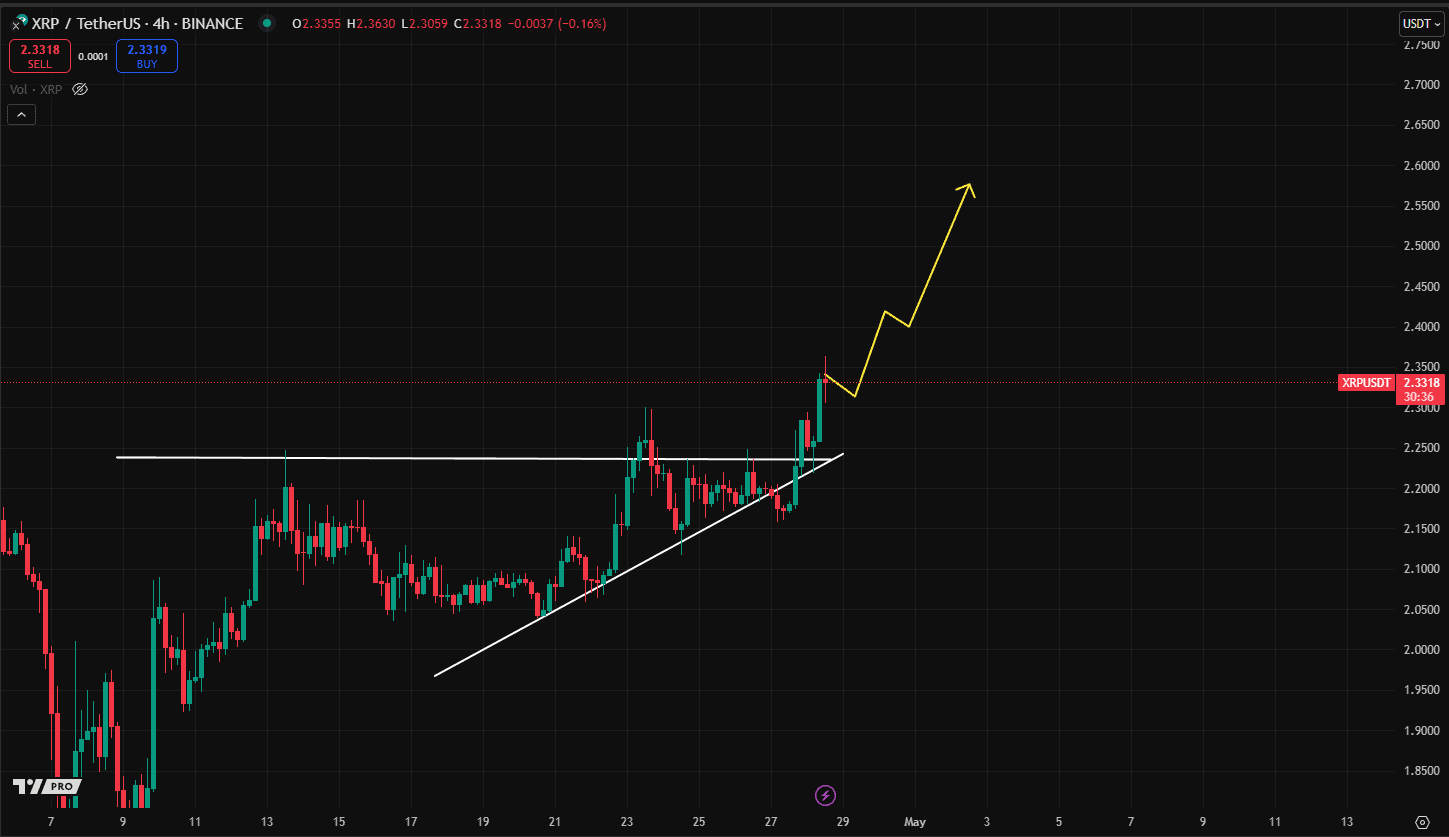

It appears that this particular notion is also supported by another trader. Joe Swanson bases his analysis on an inverse Head & Shoulders pattern which, according to him, has been broken to the upside, confirming a bullish wedge breakout and flipping the key resistance to support, while also forming a higher low.

Momentum [is] building for a storng move up! – He said, attaching a chart with a $3 price prediction in the short term.

Duo Nine, a well-known trading analyst noted in a Ripple price analysis for CryptoPotato that even if the bulls are able to make it to $3, they would have to face a considerable selling pressure. That’s stemming from the fact that this level has been tested twice in the near past. The XRP price got rejected twice there.

Another XRP price prediction comes from Crypto Virtuos, who told his 81,000 followers that the next target to keep an eye on is $2.5. This would represent an increase of around 10% from current prices.

As previously posted, XRP has broken out and is looking strong. Initial target is $2.5. This is the biggest hurdle on the way right now. Start of the week looks good.

More Shocking XRP Price Predicitons

While the above three seem more conservative to the opportunistic traders, here are some wild and borderline unrealistic Ripple price predictions. Some of the following are not predicted to happen in May but are worth watching nonetheless, especially if the fundamentals behind them start yielding merit.

First in line, we have Oscar Ramos. He cited an analysis by Bitwise, outlining that when XRP ETFs are approved in the US, the asset’s price will go parabolic. His target is around $29 by 2030.

Next in line is another popular XRP price commentator on X called Brett, who said XRP could reach between $33 and $50 by 2027, citing Sistine Research. This would materialize a rally between 1500% and 2500%.

And lastly, the most outrageous prediction for XRP’s valuation. John Squire, a social media influencer with around 500,000 followers said that it’s possible for the cryptocurrency to reach $100. Of course, to sound the side of objectivity, this would put XRP’s total market cap at around $6 trillion, which is twice as large as the entire crytpocurrency market right now.

Why is the XRP Price Up This Week?

Price predictions aside, it’s worth noting that there are some fundamental developments behind XRP’s recent price movements. The most evident one is that ProShares received the SEC’s approval to launch three separate XRP ETFs. Namely, these are the Ultra XRP ETF (2x leverage), Short XRP ETF, and Ultra Short XRP ETF (-2x leverage).

As the names suggest, these are not spot XRP ETFs – they are based on derivative products and do not require ownership of the underlying asset.

Although this is not what the community expected, the positive impact on the market seems clear as many investors take it as a positive signal coming from the country’s financial watchdog.