Altcoins Bleed Out as Bitcoin’s $95K Rally Hits a Wall (Weekend Watch)

Crypto markets recoil after BTC’s failed breakout—here’s who got wrecked.

The Domino Effect

Bitcoin’s rejection at $95K triggered a cascade of altcoin liquidations. Ethereum, Solana, and meme coins led the nosedive—classic ’risk-off’ behavior when BTC stumbles.

Biggest Losers

Layer-2 tokens and DeFi bluechips saw double-digit dips. Meanwhile, exchange tokens like BNB weathered the storm slightly better (centralization has its perks, apparently).

Silver Lining Playbook

This pullback mirrors Q1 2024’s ’healthy correction’ pattern. Traders now hunting for oversold RSI gems—because nothing fuels crypto like recency bias and FOMO.

Bonus jab: Wall Street analysts still calling this a ’bubble’ as their gold ETFs bleed AUM. Stay salty.

BTC Rally Paused

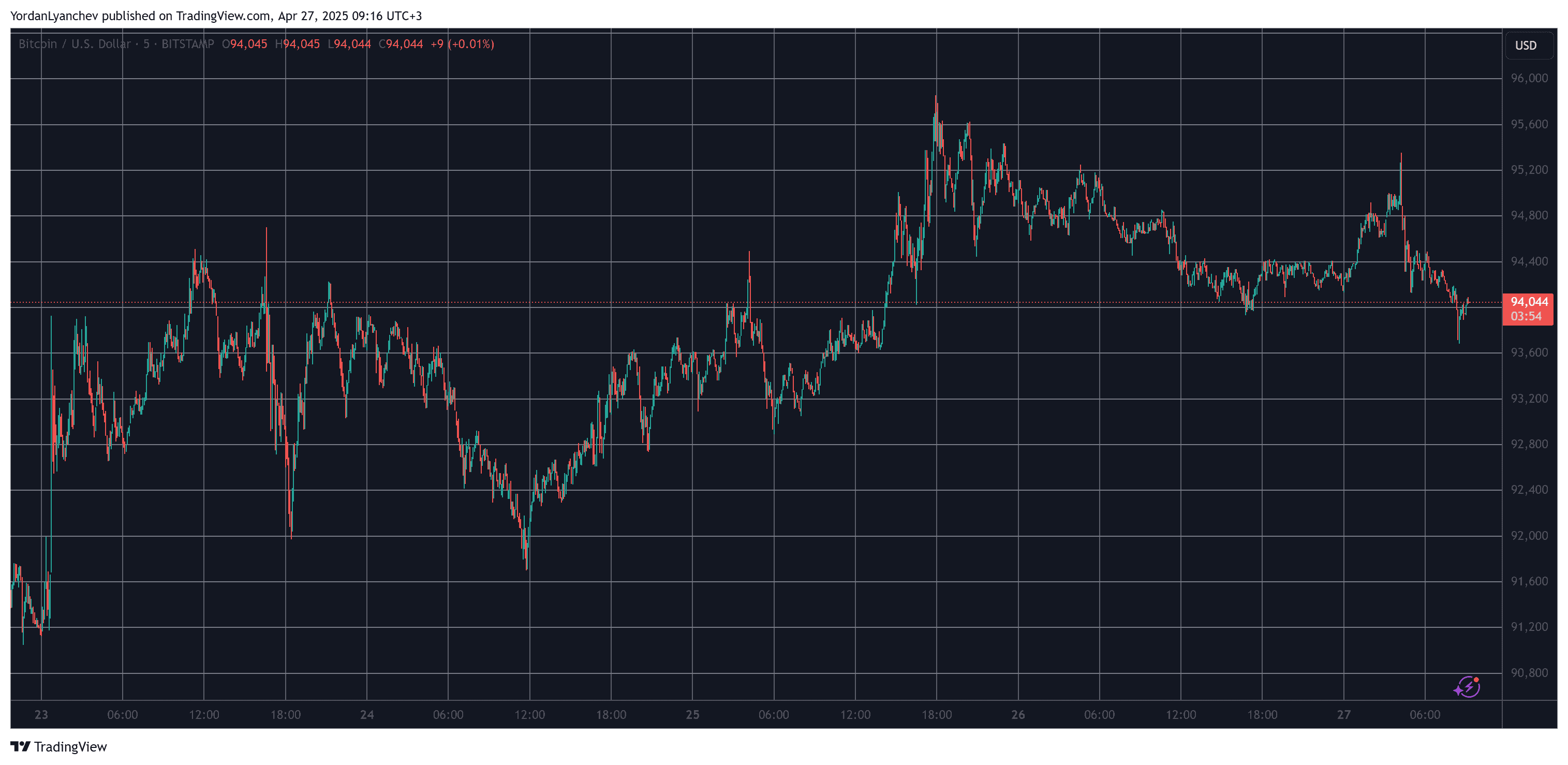

It was a great week for the primary cryptocurrency. It began on Monday with a breakout from the short-term upper range boundary at $86,000 that sent BTC above $87,000. The asset continued its run on Tuesday and it finally jumped past $90,000 – for the first time since early March.

After a minor retracement, BTC kept climbing and tapped $92,000 on Wednesday. The culmination came on Friday when the bulls really stepped up on the gas pedal and sent the cryptocurrency flying to just shy of $96,000. This became its highest price in exactly two months.

The weekend has been a lot calmer, as Bitcoin failed to overcome that resistance despite another attempt earlier on Sunday. As of now, though, BTC remains around two grand away from its local peak. Its market capitalization has slipped below $1.870 trillion on CG, while its dominance over the alts stands tall at 61.3%.

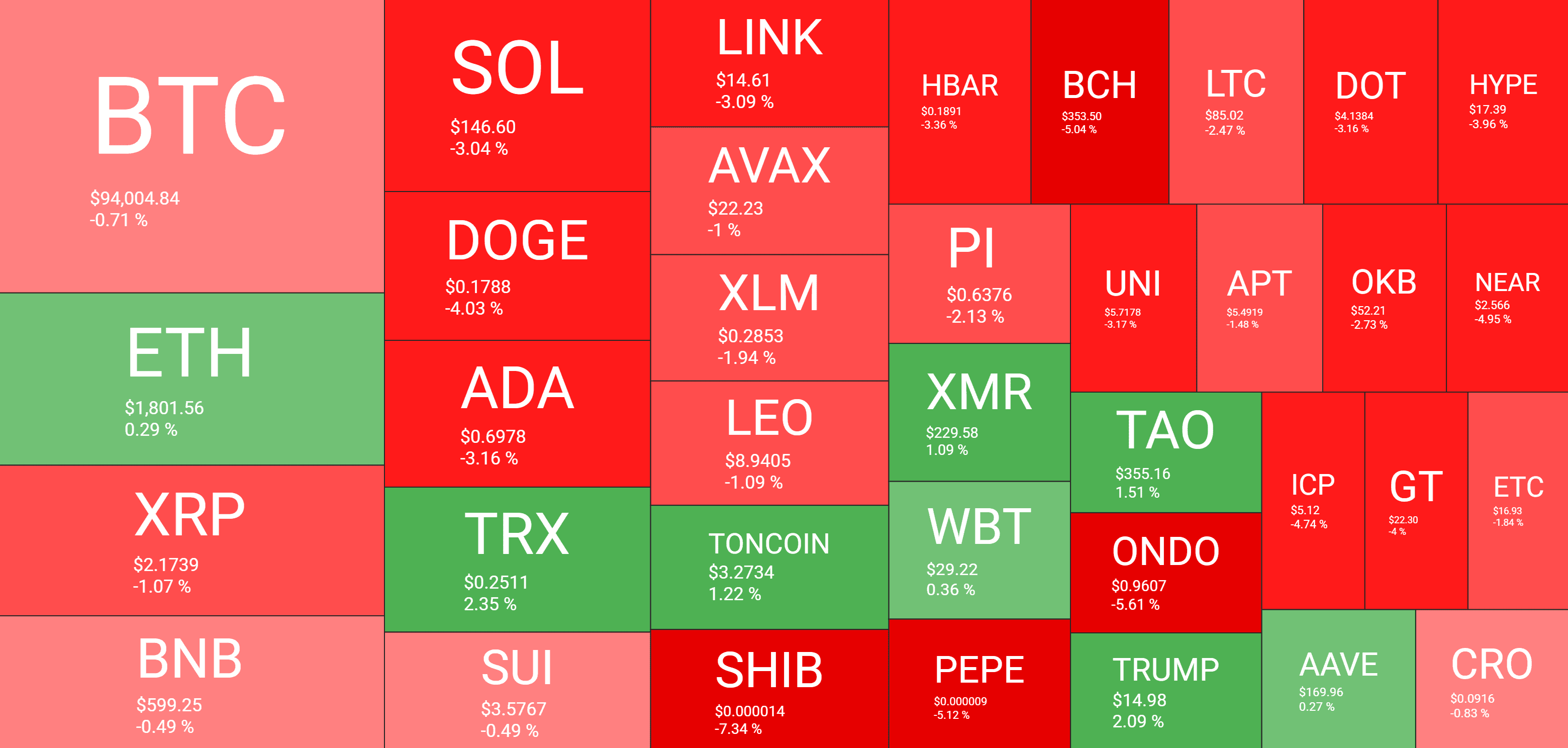

Alts Retrace

Most altcoins have dropped even more over the past day than BTC. In fact, only ETH and TRX are slightly in the green from the larger caps.

In contrast, some of yesterday’s top performers, such as PEPE and SHIB, have dropped by well over 5% each. ADA, SOL, DOGE, LINK, AVAX, and XRP are also in the red.

The cumulative market capitalization of all crypto assets has declined by around $40 billion since yesterday and roughly $70 billion since the Friday peak.