3 AI Predictions: Is 2025 Finally the Year Altcoins Explode?

Artificial intelligence meets cryptocurrency speculation in the ultimate market forecast showdown.

The AI Oracle Speaks

Three sophisticated algorithms analyzed market patterns, historical data, and blockchain metrics to deliver their verdict on the long-awaited altseason. Each AI brought unique analytical frameworks to the table—from neural networks trained on decade-long market cycles to machine learning models tracking whale movements and retail sentiment.

Consensus or Chaos?

While two models pointed toward significant altcoin momentum building through Q2 2025, the third remained skeptical—citing regulatory headwinds and institutional dominance continuing to suppress smaller cap assets. The divergence highlights the inherent unpredictability of crypto markets, where even the most advanced algorithms can't account for Elon Musk's next tweet or sudden regulatory crackdowns.

Patterns Emerge

Historical data suggests altseasons typically follow Bitcoin dominance peaks, with capital rotating into smaller projects once BTC stabilizes. The AIs tracked similar patterns emerging in current market structures, though timing predictions varied widely—from immediate breakout scenarios to late-2025 crescendos.

Wall Street's Crypto Conundrum

Traditional finance veterans watching from the sidelines might want to stick to their spreadsheets—because in crypto land, even the smartest algorithms can't guarantee whether your altcoin portfolio will moon or become digital wallpaper. Sometimes the only prediction that matters is whether your exchange will still be solvent when you try to cash out.

The Chances are Good

ChatGPT estimated that such a development is quite possible, given that the CoinMarketCap “Altcoin Season Index” is still low. Currently, the ratio is around 27 (out of 100), meaning the big MOVE has yet to happen.

The index compares the performance of altcoins to Bitcoin (BTC) over a 90-day period, taking into account the top 50 cryptocurrencies by market capitalization. Historically, readings above 75 signal that capital is rotating into alts.

It is important to note that ChatGPT is most bullish on Ethereum (ETH), estimating that smaller digital assets may not experience major price surges. Recall that the second-largest cryptocurrency already beat its price record this year, rising to just shy of $5,000. However, the crypto community is full of analysts who believe a new top could be knocking on the door.

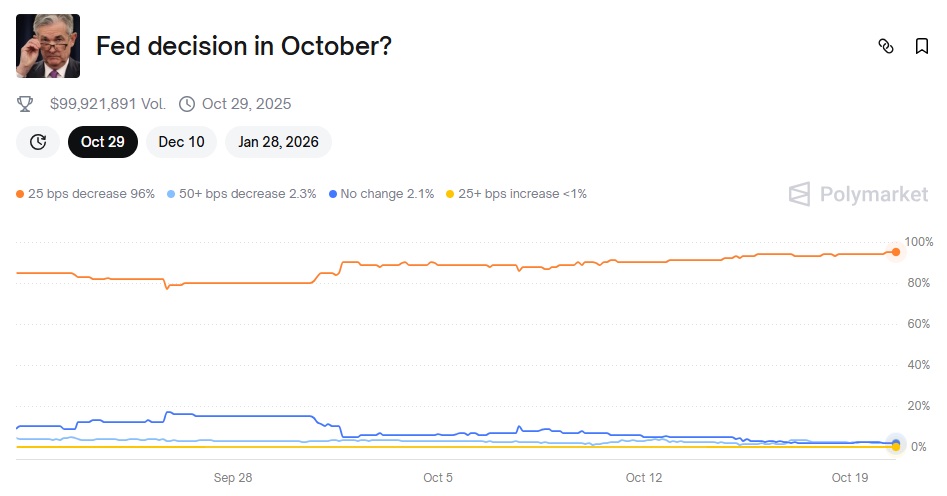

Grok, the AI chatbot built into the social media platform X, is also optimistic that the alts may experience a significant rally soon. It claimed that the main catalyst for that WOULD be the potential lowering of interest rates in the United States. Fed’s Chair Jerome Powell recently hinted that the central bank will decrease the benchmark, thus making money-borrowing cheaper and pushing investors towards riskier assets such as cryptocurrencies. According to Polymarket, the odds of a rate cut of 0.25% on October 29 are 96%.

At the same time, Grok made a disclaimer that the altseason may be delayed to the very end of 2025 or even the beginning of 2026.

Not Like the Ones Before

We also asked Perplexity about its take on the matter. It assumed that altseason is “strongly anticipated,” but it may have a different dynamic than the ones from previous years.

“Careful position scaling and timing will be key for investors to capitalize on the upcoming altcoin opportunities likely to emerge toward the end of the year,” it said.