XRP Whale Exodus: 40 Million Coins Dumped in 30 Days - Market Panic or Buying Opportunity?

Whales are making waves in the XRP market with a massive sell-off that's got everyone talking.

The Great XRP Exodus

Forty million Ripple tokens vanished from whale wallets over the past month - enough to make any crypto enthusiast sweat. The big question: are the smart money players seeing something the rest of us aren't?

Market Impact and Opportunities

While the numbers sound alarming, seasoned traders know whale movements often create prime buying windows. These large holders typically sell for reasons ranging from portfolio rebalancing to taking profits - not necessarily because they've lost faith in the technology.

The Silver Lining Playbook

History shows that whale sell-offs frequently precede retail buying opportunities. When big players cash out, they create liquidity and often temporary price dips that savvy investors exploit. It's the crypto equivalent of a Black Friday sale - just without the doorbusters.

Remember: in traditional finance, they teach you to buy when there's blood in the streets. In crypto, you buy when there's panic in the chats.

Large Holders Reduce Exposure

In the last 30 days, whales holding between 1 million and 10 million XRP reduced their collective balance from around 6.95 billion to 6.51 billion XRP. This change was shared by analyst Ali Martinez, based on on-chain data.

During this time, XRP’s price has fallen by 5% over the week and 1% in the last 24 hours. The price traded at $2.83 at press time. The steady decline in whale holdings aligns with the drop in price, suggesting that the sell pressure may have influenced the market.

Meanwhile, there were few pauses in this activity. Most of the movement appears consistent, pointing to a clear trend of reduced exposure. Large holders often adjust their positions in response to wider market signals or when locking in gains.

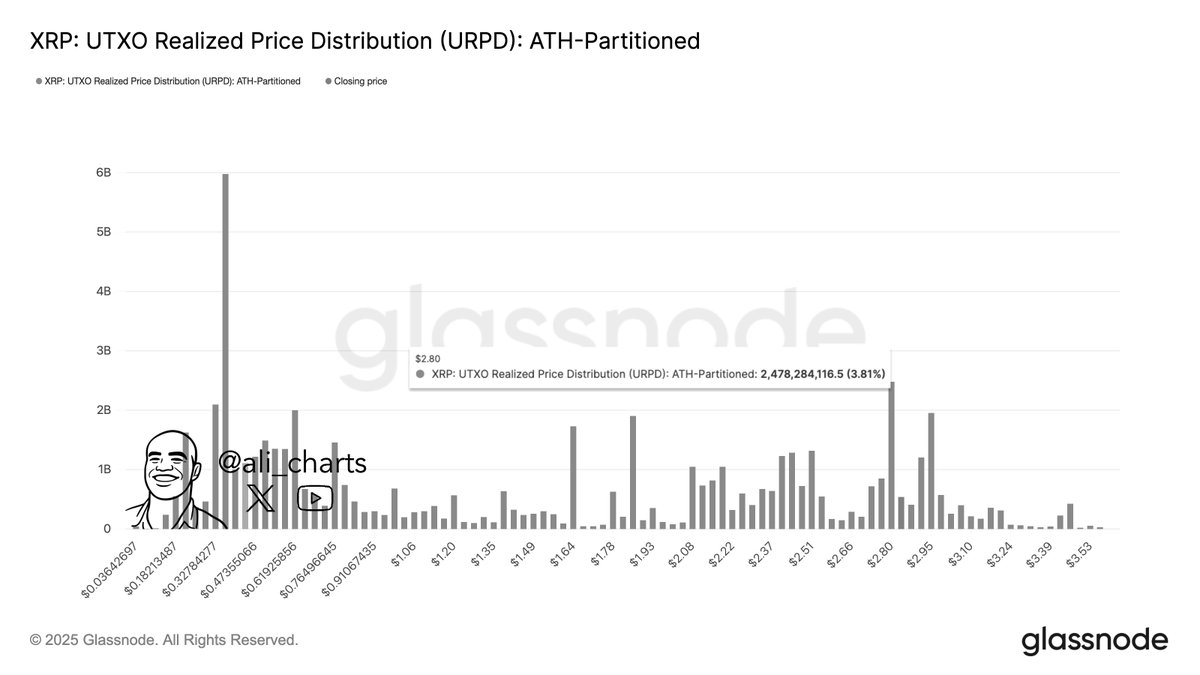

$2.80 Becomes a Key Support Zone

The price level of $2.80 has drawn attention due to high transaction volume in this range. Around 2.48 billion XRP changed hands at $2.80, making it the largest zone of realized value. This number accounts for almost 4% of the total supply.

Notably, this type of buying activity suggests that many holders entered the market at or near this level. If the price stays near $2.80, many may choose to hold or add more, creating a base for price stability. Buying interest often grows around these levels when the market turns uncertain.

If the price drops below $2.80, holders could begin to sell. This may lead to short-term losses for many and result in higher trading activity. “$2.80 is the most important support level for $XRP,” said Ali in a recent post, pointing to the weight of activity around this zone.

Watching Short-Term Price Points

Crypto analyst CRYPTOWZRD said that XRP’s price action shows mixed signals. A daily close above $2.89 is being watched as a short-term bullish sign. If the price holds, it may present a long entry.

A MOVE above $3 could lead to an upward move toward $3.1320. If XRP fails to hold $2.89, the price could remain flat.

“We now need to wait for the market to get the next healthy trade opportunity,” the analyst noted.

The daily chart also shows that XRP is testing a trendline. A breakout above $3.15 could open the door for a move toward $3.65 or a possible high. Until then, traders remain on alert for price direction.