Ethereum’s Bullish Reversal Signals Major Momentum Shift - Here’s the 2025 Outlook

Ethereum flips the script as institutional money floods back into digital assets.

The Technical Breakout

Ethereum shattered key resistance levels that had traders watching since the last cycle. The move signals more than just temporary enthusiasm—it reflects fundamental protocol upgrades finally gaining mainstream recognition.

DeFi's Sleeping Giant Awakens

Layer-2 solutions are processing transactions at speeds that make traditional finance look like it's running on dial-up. The merge completed years ago continues paying dividends as Ethereum becomes the backbone for everything from tokenized real estate to corporate treasury strategies.

What Traders Are Watching

Options markets show smart money positioning for continued upside through year-end. The volatility crush that had sidelined institutional players reversed course faster than a hedge fund dumping meme stocks.

Regulatory clarity—or the lack thereof—remains the wildcard that could either fuel the rally or trigger profit-taking. But for now, Ethereum's chart speaks louder than any bureaucrat's uncertainty.

The smart contract pioneer isn't just riding Bitcoin's coattails—it's carving its own path while traditional finance still tries to understand what an NFT actually does.

Ethereum Breaks Resistance and Holds Support

Ethereum has moved above a key level at $4,100. This price rejected ETH three times earlier this year. Each time, the price failed to continue higher and dropped back.

Notably, that level is no longer acting as resistance. The price broke above it in mid-2025. It then came back down to test the same area. This time, it held as support. The structure now shows a clean breakout followed by a retest. This is often seen as a shift toward a stronger trend. Price targets above this level sit NEAR $5,300, $6,800, and $8,400 based on recent chart projections.

ETH is currently down 16% from its recent high. It is trading near its 100-day moving average. This is the same pattern seen earlier in the year. At that time, ETH dropped to the same zone, then quickly moved higher.

The chart shows the 50-day and 100-day moving averages forming a support area. In previous moves, this zone triggered renewed buying. Merlijn The Trader commented:

$ETH IS BACK IN BUY THE DIP ZONE

Last time it launched straight after.

Ignore it now, and you’ll be chasing when ethereum is 5 digits. pic.twitter.com/7We1dJA95X

— Merlijn The Trader (@MerlijnTrader) September 23, 2025

His latest chart shows this area marked again as a possible entry point. The price zone is around $3,700 to $3,800.

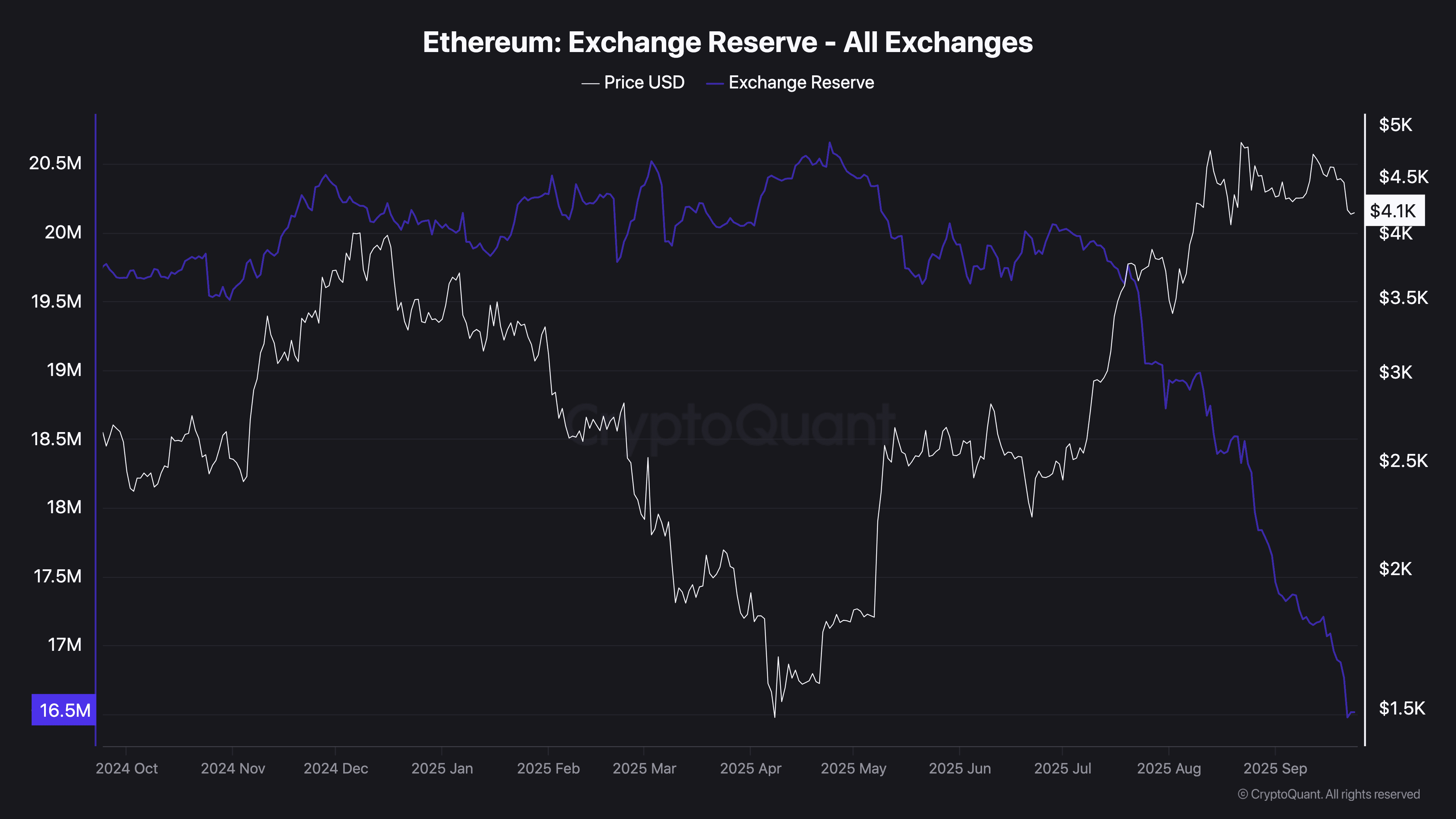

Exchange Reserves Fall to New Low

Data from CryptoQuant shows a steady drop in ETH held on exchanges. Total exchange reserves have fallen to about 16.5 million ETH. This is the lowest level recorded in over a year.

Lower reserves often mean fewer coins are available for trading. This happens when investors move coins to wallets or staking platforms. At the same time, ETH price remains near $4,100. This may suggest accumulation continues even as price consolidates.

Futures Market Shows Liquidations and Short Bias

Earlier this week, ETH dropped below the $4,150 range low. The MOVE triggered stop-losses and liquidations before the price somewhat recovered above it. The wick shows a fast bounce after a sharp decline, a sign that buyers stepped in quickly.

Open interest fell during the move. This indicates many Leveraged positions were closed. Funding rates also flipped negative on platforms like Binance and OKX. This suggests traders were leaning short. Byzantine General commented:

If $ETH is gonna bounce, it WOULD probably makes sense that it bounces after taking out the range low. pic.twitter.com/jYYRybtzMO

— Byzantine General (@ByzGeneral) September 23, 2025

Not all data supports a clear move higher. Analyst Ted pointed out that Ethereum-linked stocks like SharpLink Gaming and BitMine are down from their recent highs. He wrote:

“Until the stocks recover, ETH will most likely bleed.”

While on-chain activity points to reduced selling pressure, broader sentiment appears mixed. Price remains above key support, and some indicators suggest buyers are active. Traders now watch for confirmation of a trend shift in the days ahead.