Whales Gobble Up 800,000 LINK as 5.5 Million Tokens Flee Exchanges in Major Accumulation Move

Crypto whales are making waves with a massive LINK acquisition spree that's draining exchange reserves at an alarming rate.

The Great Chainlink Migration

While traditional finance types debate quarterly earnings, blockchain doesn't lie—someone just moved 800,000 LINK tokens into cold storage while 5.5 million vanished from trading platforms. That's not casual investing; that's strategic positioning.

Supply Shock Dynamics

When tokens exit exchanges, available liquidity shrinks. Basic economics—reduced supply against steady demand creates upward pressure. These whales aren't just betting on Chainlink's oracle dominance; they're banking on a structural shift in token distribution.

The Institutional Whisper

Five-point-five million tokens exiting exchanges signals more than retail sentiment. This scale of movement suggests sophisticated players positioning before potential catalysts—maybe they know something the spreadsheet jockeys don't.

Meanwhile, Wall Street still thinks 'blockchain' is a buzzword for PowerPoint presentations. Their loss—digital assets wait for no one.

Whales Accumulate as Price Weakens

Chainlink (LINK) whales added to their holdings during the latest price drop. Analyst Ali Martinez reported that addresses holding between 100,000 and 1,000,000 LINK increased their balances by more than 800,000 tokens as the price slipped toward $21.

Wallets in this range now control about 179.45 million LINK. He wrote,

Over 800,000 chainlink $LINK bought by whales in the recent dip! pic.twitter.com/g1nDZmXMZL

— Ali (@ali_charts) September 23, 2025

Interestingly, toward the end of last week, similar wallets added nearly 2 million LINK in just 48 hours, as CryptoPotato reported. At that time, the asset traded close to $24, with price action staying stable despite heavy buying.

Exchange Balances Fall With Heavy Withdrawals

In the same period, around 5.5 million LINK left exchanges in 24 hours. Data shows a sharp decline in supply on trading platforms, alongside a spike in outflow activity.

5.50 million Chainlink $LINK withdrawn from crypto exchanges in 24 hours! pic.twitter.com/uXGTkyQbHy

— Ali (@ali_charts) September 22, 2025

LINK has retreated from late August highs NEAR $26–27 and now trades closer to $21. Despite this, exchange balances have been trending lower since July, pointing to steady withdrawals. Removing tokens from exchanges is usually linked with long-term storage in private wallets, which reduces immediate selling pressure.

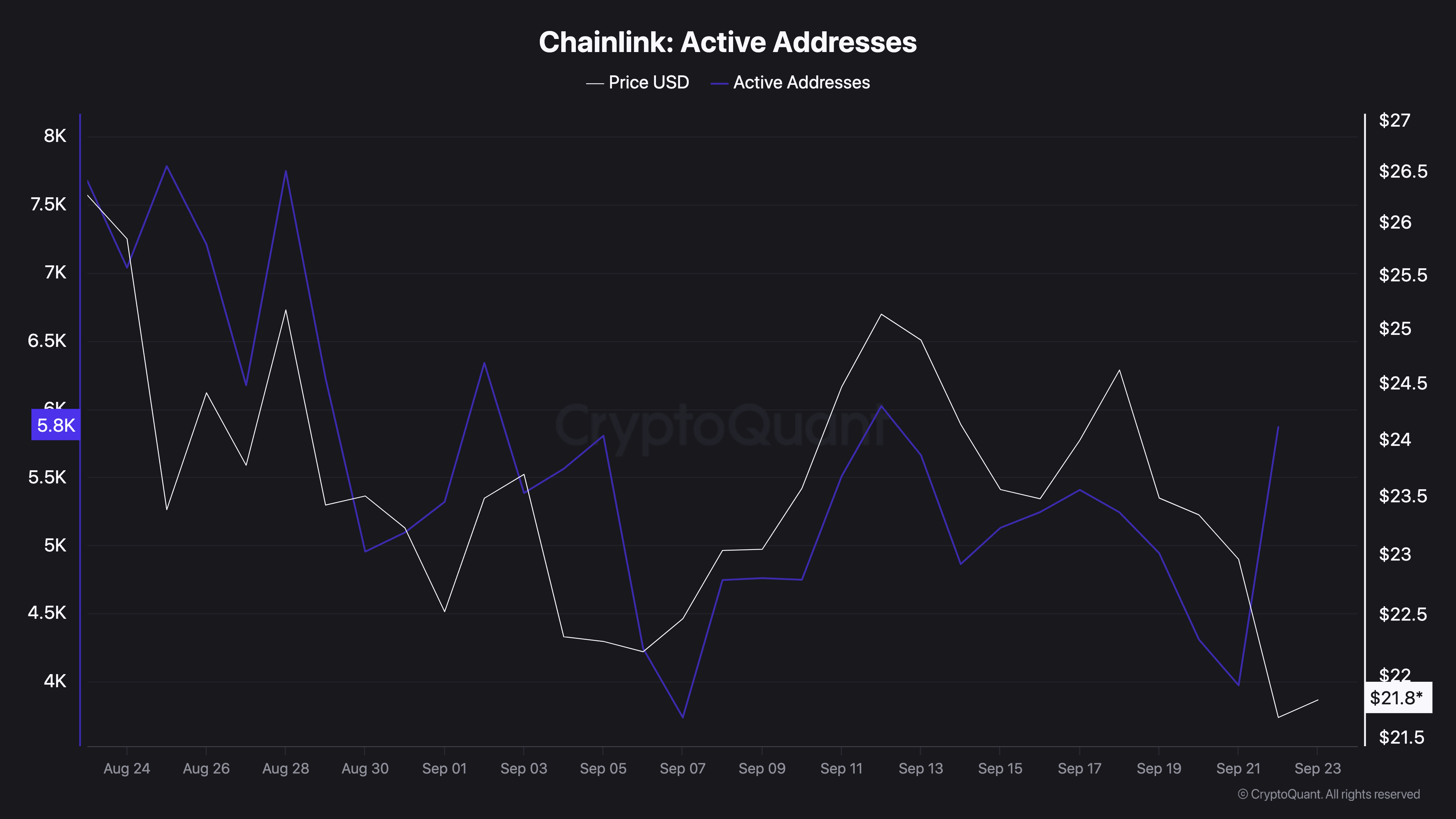

Additionally, on-chain data from CryptoQuant places current active addresses at 5,800, with a price of around $21.8. Both metrics have fallen since late August, when active addresses reached nearly 8,000 and LINK traded above $26.

Notably, the most recent readings show a lift from a mid-September low near 4,000 active addresses. This rebound suggests network use is recovering slightly, even while the token price remains close to its recent lows.

Technical Levels To Watch

Analyst CryptoWzrd noted that daily candles for LINK and LINKBTC closed bearish. They said,

“More healthy price action from LINKBTC is needed, as bullish candles are necessary to avoid a fake breakout.”

They identified $30 as resistance and $20 as key support. In the short term, maintaining levels above $22 may open a MOVE toward $24, while rejection could see the price slide to $19.80. Intraday charts remain volatile, and traders are watching for a clearer structure before confirming the next setup.

At the time of writing, Chainlink trades at around $22, with a 24-hour trading volume of $928.6 million. The token is up 3% in the past day but down 8% over the week.