TD Signal Flashes Bullish for Dogecoin – Is $0.50 the Next Target?

Dogecoin's TD Sequential indicator just triggered a buy signal—sparking speculation about a potential run toward the $0.50 mark.

Technical Breakout or Meme Hype?

The cryptocurrency’s chart shows a clear bullish setup, with the TD indicator flashing green after weeks of consolidation. Traders are watching key resistance levels as DOGE attempts to break out of its recent range.

Market sentiment shifted almost overnight. Retail investors piled in following the signal, while institutional players remain cautiously optimistic. The move comes amid renewed interest in meme coins and broader crypto market strength.

Can Dogecoin Really Hit $0.50?

Historical patterns suggest Dogecoin tends to surprise when technicals align with social momentum. The $0.50 target represents a significant psychological barrier—one that would require sustained buying pressure and favorable market conditions.

Of course, in crypto land, even the most reliable indicators sometimes amount to little more than fancy astrology for finance bros. But with Dogecoin, stranger things have happened.

TD Sequential Indicator Points to a Bounce

Dogecoin (DOGE) has steadied after a sharp decline to $0.238 and is now trading around $0.24. On the 4-hour chart, the TD Sequential indicator showed a red “9” candle at the recent low, a reading that traders often watch for signs of selling exhaustion.

Analyst Ali Martinez noted,

Dogecoin $DOGE ready to bounce as the TD flashes buy signal! pic.twitter.com/3PcwuyomPB

— Ali (@ali_charts) September 22, 2025

Earlier appearances of this signal on the same timeframe were followed by short-term rebounds, raising the possibility of another MOVE higher if the current low holds.

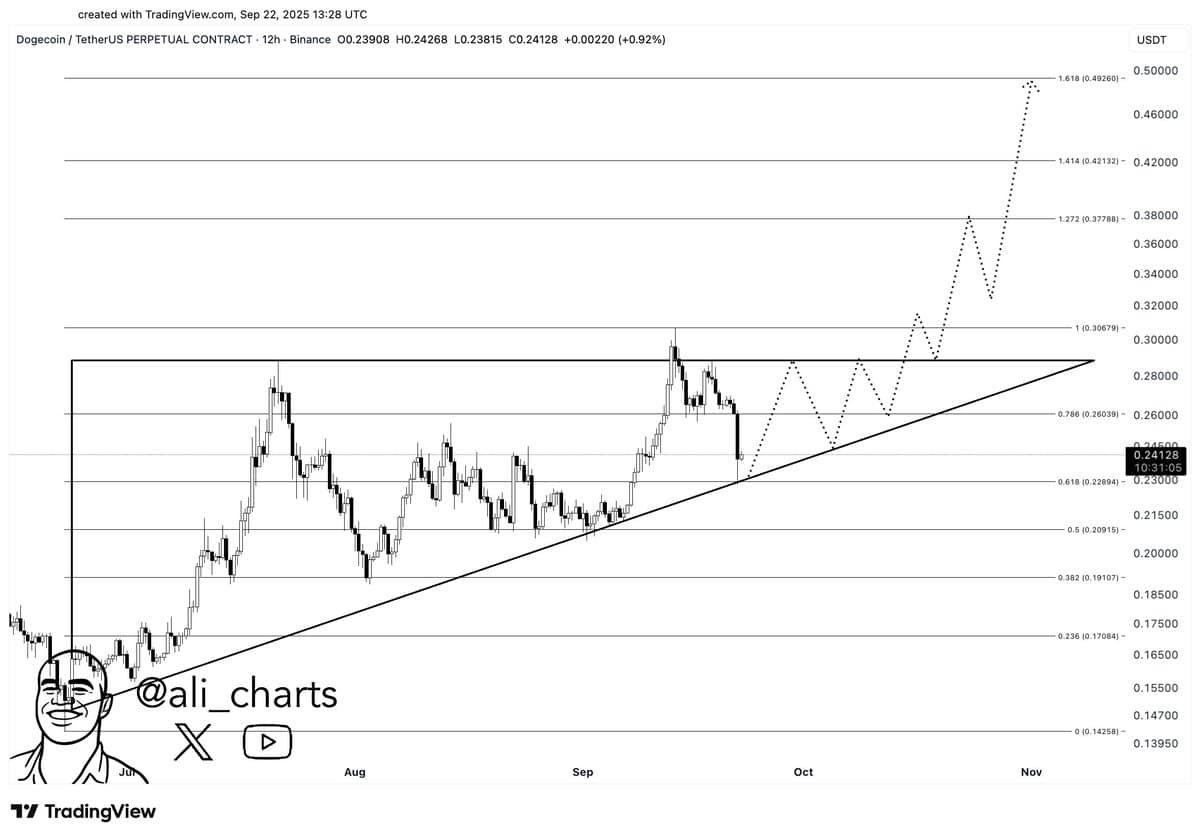

On the 12-hour chart, DOGE remains NEAR $0.24, sitting on an ascending trendline that has supported the price since June. This zone also coincides with the 0.786 Fibonacci retracement level of $0.26, creating a support cluster.

Martinez added,

“This is a great zone to buy Dogecoin $DOGE before a bullish breakout to $0.50!”

He believes the price will consolidate between $0.26 and $0.30 before attempting to break resistance near $0.31. If the resistance is cleared, targets of $0.38, $0.42, and finally $0.50 will be set.

RSI Recovery from Oversold

Analyst Trader Tardigrade observed that Doge has moved out of oversold conditions on the Relative Strength Index (RSI). The metric dipped into the oversold zone during the recent pullback, then rebounded, signaling a shift in short-term momentum.

$Doge/4-hour#Dogecoin has moved out of the Oversold Zone on the RSI pic.twitter.com/g8fSrOnt3k

— Trader Tardigrade (@TATrader_Alan) September 23, 2025

In early August, a similar move on the RSI was followed by a recovery rally. With the price now near $0.245, this setup suggests potential for a climb back toward the $0.30–0.32 range if buying activity continues.

ETF Listing Brings Institutional Entry

Dogecoin also gained attention with the launch of the 21Shares Dogecoin ETF (TDOG), now listed on the Depository Trust & Clearing Corporation (DTCC). The fund offers exposure to Dogecoin price action without the need to hold tokens directly, echoing the model used by Bitcoin ETFs.

At the time of writing, DOGE trades at around $0.24 with a 24-hour volume of $3.55 billion. The price is up 1% in the past day but remains down 9% over the week. As we recently reported, market data shows retail futures activity in a neutral range, suggesting that institutional flows may be playing a larger role in current trading.