Is This the Calm Before XLM’s Explosive Leap to $0.50?

Stellar's native token shows eerie stability while technical indicators scream accumulation phase.

The Silence Before the Storm

XLM trades in a tightening range that historically precedes major breakouts. Volume patterns suggest institutional positioning ahead of what could be a 100%+ move from current levels.

Infrastructure Developments Fuel Optimism

Stellar's recent enterprise partnerships and cross-border payment solutions gain traction while traditional finance struggles with legacy systems. The network processes transactions at speeds that make traditional banking look like medieval messengers.

Market Psychology at Play

Retail investors remain skeptical—exactly when seasoned traders start accumulating positions. The $0.50 target represents a psychological barrier that could trigger FOMO across crypto markets once broken.

Of course, watching XLM's potential surge makes one wonder why traditional banks need three business days to transfer what blockchain moves in seconds—but hey, those marble lobbies don't pay for themselves.

XLM Holds Near Key $0.35 Level

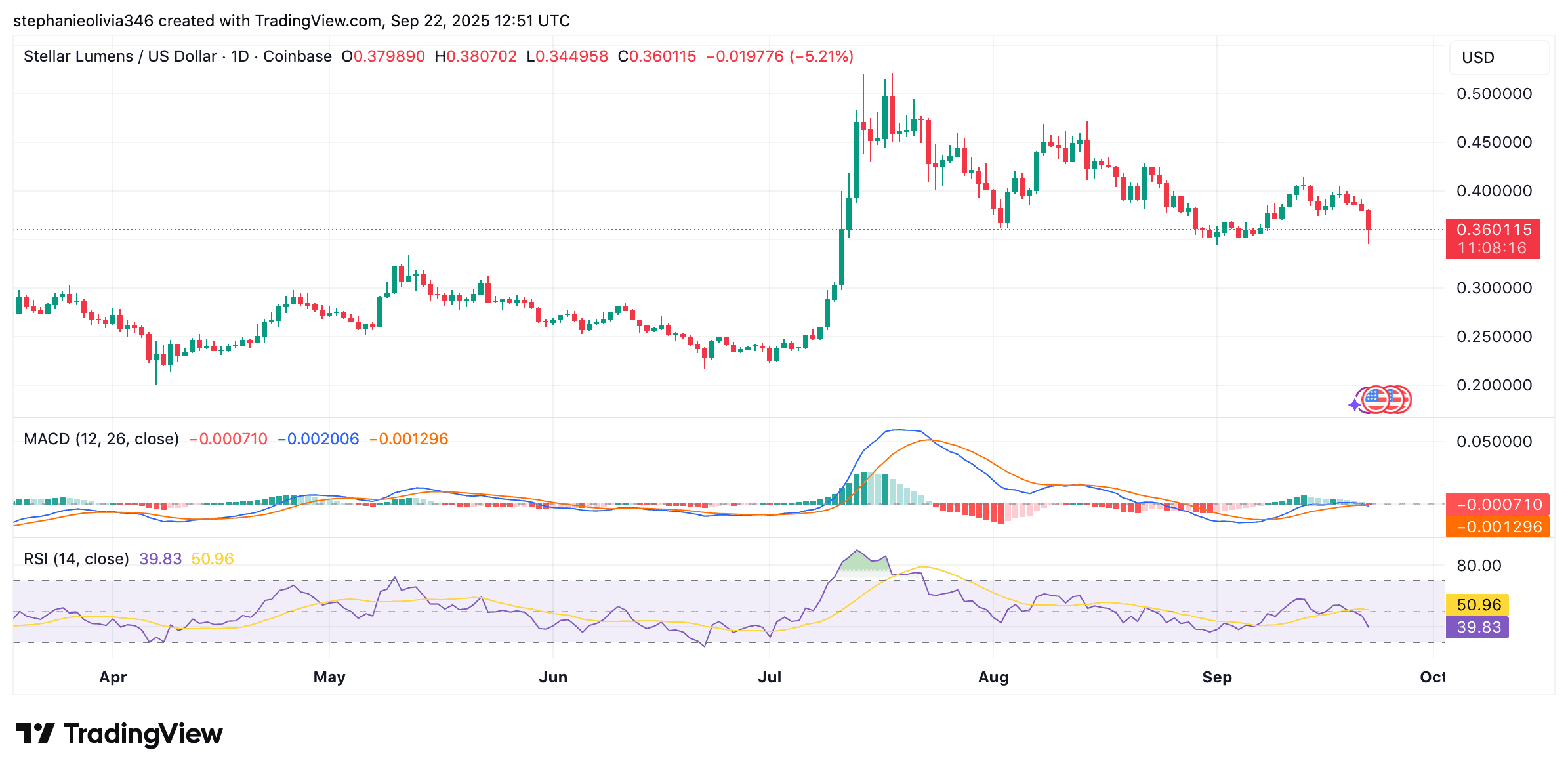

Stellar (XLM) is trading at $0.36 after falling 7% in the past 24 hours. Over the last week, the asset has declined by 5%. The current price sits just above a key support zone at $0.35, a level that has previously shown strong buying interest.

According to crypto analyst Ali Martinez, the recent dip was not unexpected. He stated,

“Stellar $XLM dipped to $0.35 as expected. If this level holds, consolidation toward the triangle’s apex could set up a breakout to $0.50.”

The $0.35 area remains an important zone for traders watching for a shift in trend.

Notably, the 12-hour chart shows a descending triangle formation, which has been developing over the last several weeks. XLM is now NEAR the lower support boundary of this pattern. The price has respected this range before, making the current level a key point to watch.

If the support holds, the pattern suggests that the price could begin to coil within the triangle. This setup may lead to a breakout above the descending trendline. Based on Fibonacci retracement levels, the next resistance areas are near $0.4, $0.42, and $0.44.

If the breakout plays out fully, XLM could reach $0.50. A break below $0.35, however, may push the asset lower to the $0.34–$0.33 range.

Indicators Show Weak Momentum

On the daily chart, the MACD shows bearish signs. The MACD line is below the signal line, and both remain in negative territory. The histogram bars are red and widening, which reflects growing selling pressure.

The RSI is now at 39, below the mid-point of 50. This reading confirms that current momentum favors sellers. While not in oversold territory yet, the RSI is approaching levels where buyers have stepped in before.

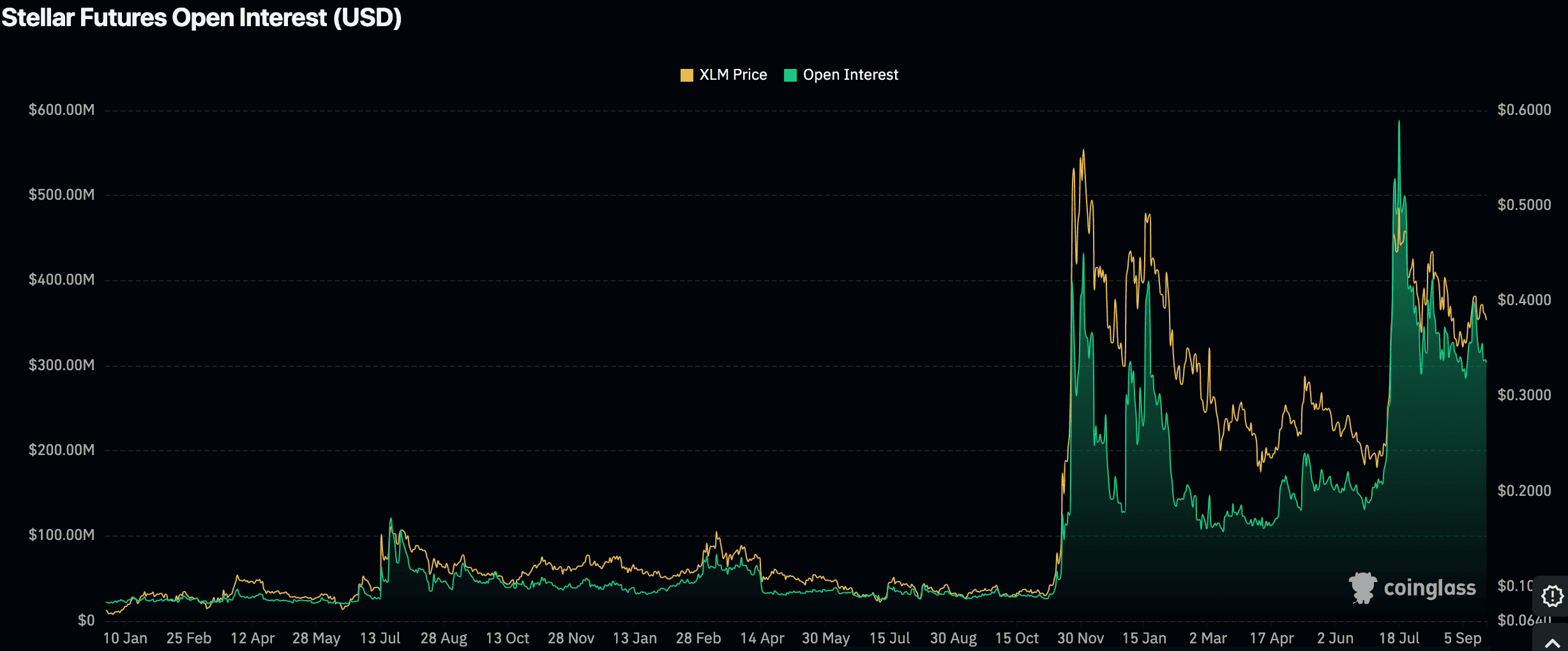

Data from Coinglass shows that XLM futures open interest surged in late October and early November, peaking above $500 million during a strong price MOVE toward $0.60. Since then, open interest has declined along with price, returning to more moderate levels.

Meanwhile, the drop in open interest may reflect reduced activity from Leveraged positions. This type of cooling off often follows periods of heightened speculation and can be a sign that traders are waiting for a clearer direction.