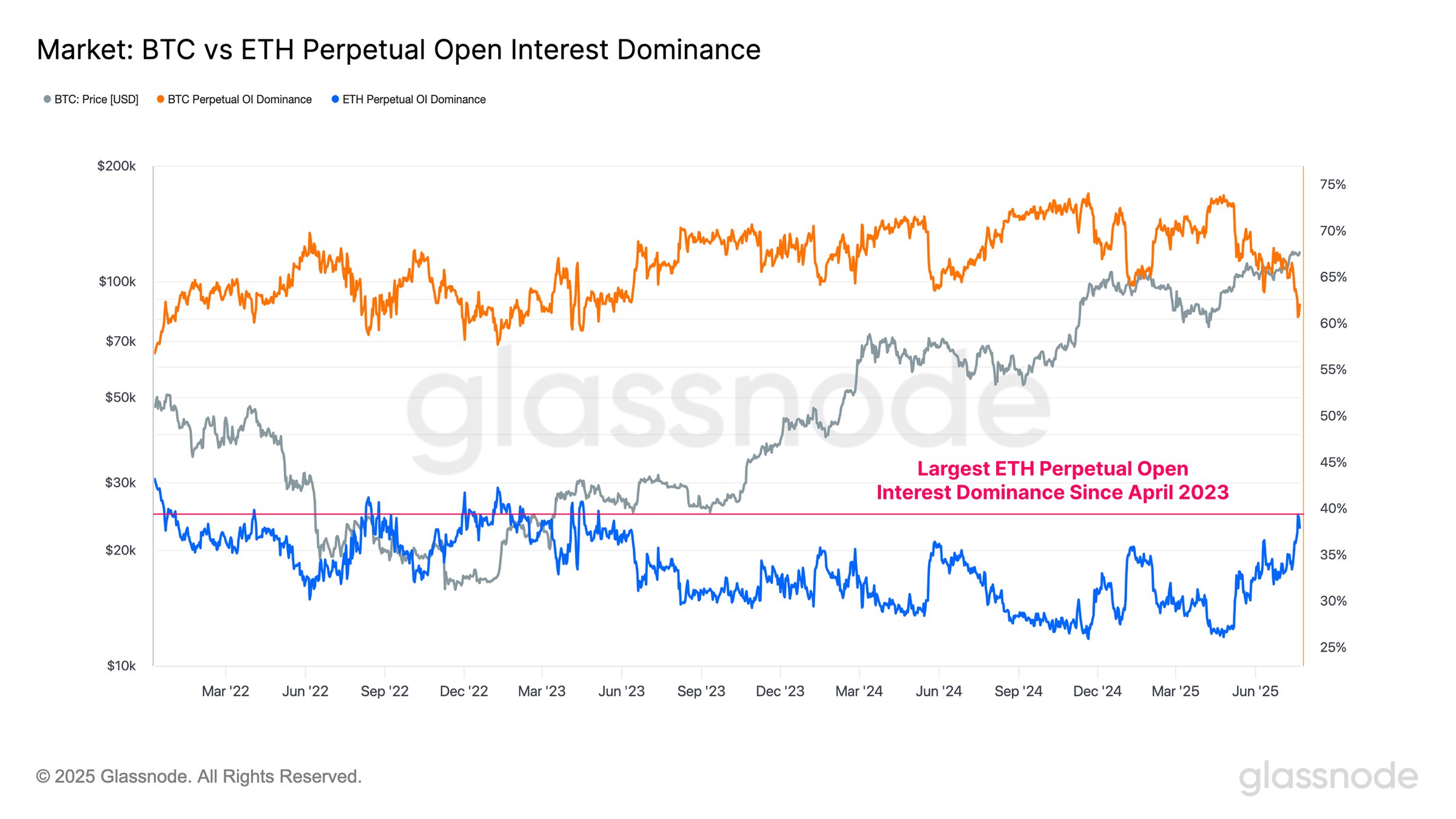

Ethereum Open Interest Soars to 2-Year High as Bitcoin Funds Flood In

Ethereum's derivatives market just woke up with a vengeance—open interest dominance hits levels not seen since the 2023 bull run. Here's why capital is rotating out of Bitcoin's shadow.

The Big Flip: ETH futures traders are gobbling up leverage while BTC stalls, signaling a potential altseason shift. Exchanges report contract volumes doubling in 48 hours.

Liquidity Tsunami: Bitcoin ETF inflows appear to be spilling over into ETH markets like a hedge fund drinking game gone wrong. (Wall Street still can't tell the difference between a smart contract and a Starbucks loyalty token.)

What's Next: With the dominance metric at a 24-month peak, all eyes are on whether Ethereum can finally break its correlation shackles—or if this is just another fakeout before the Fed ruins the party.

Comparison of BTC and ETH perpetual open interest. Source: Glassnode

Comparison of BTC and ETH perpetual open interest. Source: Glassnode

Standard Chartered had projected that ethereum could hit $4,000 by the end of 2025, which perfectly aligns with what’s playing out in treasury wallets, where Ethereum is now held in higher concentration than Bitcoin, with corporates controlling roughly 1% of Ethereum’s circulating supply.

Futures premiums climb as ETF inflows fuel conviction

Ethereum’s momentum has also pushed the futures premium to 8%, which is its highest reading in five months. This premium, which typically ranges between 5% and 10% in neutral markets, compensates for longer contract settlement times and reflects speculative appetite.

The kicker is that this increase comes right after Ethereum’s 55% price gain over the last three weeks, and yet the demand for leverage hasn’t cooled. The setup indicates traders still see room to load up if prices rise above $4,000 with more strength.

The options skew, which shows expectations for either upside or downside movement, has flipped back to neutral. A week ago, the 30-day delta skew showed 8% bullish sentiment, but that has now evened out. This reset, however, hasn’t pushed traders into defensive mode.

Professionals haven’t raised protection against pullbacks despite Ethereum hitting a seven-month high, which means they’re still comfortable with current exposure levels.

A major factor behind Ethereum’s recent strength is the influx of cash into spot ETFs. Between July 11 and last Friday, net inflows hit $4.23 billion, lifting total U.S.-listed Ether ETF assets under management to $17.24 billion. That inflow volume has been one of the strongest among crypto products this year and has helped fuel the recent surge in open interest dominance.

Meanwhile, StrategicEthReserve disclosed that more than 40 companies now hold at least 1,000 ETH in their corporate reserves. At today’s prices, that’s about $3.8 million per firm. Big holders include Bitmine Immersion Tech, SharpLink Gaming, and The Ether Machine, who together own $8.84 billion worth of Ethereum.

Bitcoin’s cooling off gives Ethereum space to climb

As Ethereum gains traction, Bitcoin is showing signs of fatigue. Its spot price recently tested the upper end of a wide range between $104,000 and $114,000, touching its all-time high before pulling back. That retracement dragged broader market sentiment with it.

The futures market is still running hot. Open interest rose to $45.6 billion, staying near the high end of its band. Long traders continued to dominate, pushing funding rates higher and reinforcing the presence of Leveraged longs. Selling pressure in perpetual contracts also eased, with the Perpetual CVD showing fewer aggressive sell-offs, which suggests the market is stabilizing, though cautiously.

The options market, however, is getting jittery. While open interest fell 2.2%, the volatility spread surged 77%, showing a dramatic rise in expected price swings. The 25 Delta Skew also turned slightly positive, reflecting fading demand for downside protection and more balanced sentiment among traders.

ETF activity in bitcoin has slowed dramatically. Net inflows dropped by 80% to $496 million, and total trade volume declined to $18.7 billion. Yet, ETF MVRV remains elevated at 2.4, suggesting plenty of unrealized profits remain in the system, even as buyers cool off.

Glassnode’s capital rotation indicators also confirm that speculative traders are more active right now. The STH/LTH ratio and Hot Capital Share are both slightly up, suggesting a small but noticeable rise in short-term risk appetite — one that’s increasingly pointed at Ethereum.

Profit-taking is also slowing down across both assets. Right now, 96.9% of all Ethereum in circulation is still in profit, based on realized price data. But Net Unrealized Profit/Loss (NUPL) and the Realized P/L Ratio have both dipped this week, showing that investors are holding back on locking in gains while momentum finds new direction.

KEY Difference Wire helps crypto brands break through and dominate headlines fast