Bitcoin Mining 2025-2026: The Revolution Beyond the ASIC Arms Race

Mining's next evolution leaves hardware wars in the dust.

The End of Brute Force

For years, Bitcoin mining meant one thing: bigger, faster, hungrier ASICs. Operations competed on sheer computational power, driving energy consumption to staggering levels. That era's fading faster than a trader's confidence during a flash crash.

Efficiency Takes the Throne

New optimization algorithms now squeeze 30% more hashes from existing hardware. Smart cooling systems slash energy overhead by redirecting waste heat. The metric that matters shifts from terahashes to hashes per watt—and the leaders aren't who you'd expect.

Decentralization's Comeback

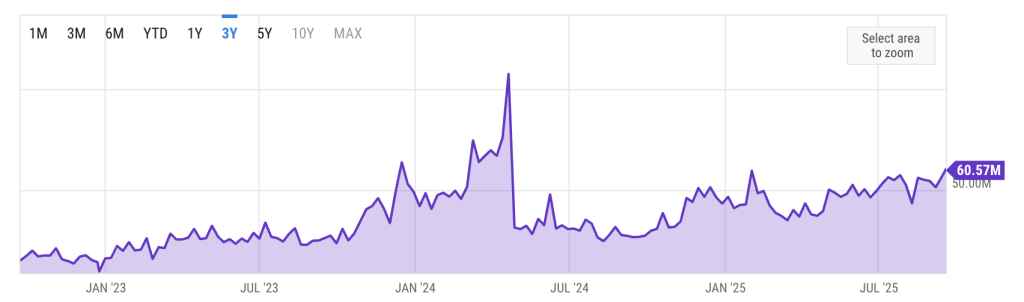

Small-scale miners finally compete again through pooled resource networks. Geographic distribution patterns reverse as miners chase stranded energy instead of subsidies. The network's hash rate becomes more resilient—and ironically more decentralized—than ever before.

Profitability Beyond the Block Reward

Forward-thinking operations now treat mining as a multi-revenue stream business. Demand response programs pay miners to power down during grid stress. Heat recycling turns mining farms into agricultural hubs. The halving's impact diminishes when mining revenue diversifies.

The new mining paradigm proves what crypto natives knew all along: innovation beats capital every time. Wall Street's still trying to short Bitcoin while miners are building the next financial infrastructure—some things never change.

Are Chips Not Enough Anymore?

For more than a decade, bitcoin mining has been defined by hardware leaps. Each new generation of ASICs (shrinking transistor size from 55nm to 3nm) brought dramatic efficiency gains, fueling explosive hashrate growth. But Moore’s Law slows, and chip size reduction hits physical and economic limits. Improvements in efficiency from silicon alone are hitting a plateau.

The 2024 halving cut miner revenues, leaving margins tighter than ever. To survive, miners must now find efficiency gains beyond silicon.

Every watt matters today — across the entire facility, not just the ASIC. Cooling, airflow, power distribution, software orchestration, and even real estate layouts now decide who stays profitable. The winners will be miners who squeeze maximum output from existing hardware, cut waste at every layer, and build infrastructure tough enough to last.

Watts Can Serve Both

Another economic challenge has come from a different front. AI and high-performance computing (HPC) companies are consuming more and more energy, and their competition with mining firms for grid access is intensifying. In the USA, AI/HPC players are expanding their domestic operations and securing large-scale power capacity (50 MW or more). Some simply acquire major mining companies and replace ASIC Bitcoin miners with AI-serving GPUs.

Is mining doomed to be pushed into places where energy is either wasted or underused? Not necessarily. In fact, competition with AI could end up working to miners’ advantage.

AI and HPC don’t have to eat mining; they can converge. Both industries share similar needs: they require massive power, advanced cooling systems, and real estate optimized for compute.

Some mining companies are already cashing in. They’re adapting their capacity for the AI demands, bringing back good ol’ GPUs alongside ASICs. CoreWeave expanded its partnership with Galaxy Digital, committing to an additional 260 MW for AI and HPC operations. Riot Platforms paused its planned 600 MW Bitcoin mining expansion in Texas and pivoted to the AI cloud business; its GPU-as-a-Service arm is already generating $25 million in annualized revenue. The trend is already pushing beyond U.S. borders and expanding into Canada.

AI’s appetite for compute far outstrips the supply, so this kind of restructuring opens the door to huge revenues. And sometimes it’s not just about making some extra cash — an AI pivot can literally save a struggling mining company.

We are likely to see a race for software that can flip workloads on the fly. Those who can jump between Bitcoin mining and AI/HPC in seconds, depending on real-time hash price and AI workload demand, will own the margins.

Why Will Wall Street Mine Bitcoin

Institutional investors have similar reasons to embrace Bitcoin mining.

Hedge funds and institutional investors are starting to realize that there’s more to mining than just Bitcoin rewards. It’s now a financial LAYER in the energy infrastructure, one that helps manage the grid, use waste assets, and open new income channels.

Mining offers programmable load that can be deployed like a tool. It soaks up Flare gas in oil fields, cuts off during peak grid stress, or switches on to stabilize prices in deregulated markets. When energy turns into money, miners become valuable partners for utilities, independent power producers, and even governments.

Also, mining proves to be a strategic asset for the adoption of renewable energy. Miners can absorb surplus solar at noon or excess wind at night, then scale back when the grid is tight. This load flexibility cuts waste and makes renewable systems more reliable.

All of these represent great opportunities for mining companies. Those who respond to the broader industry’s needs will gain a strong competitive edge.

You might also like As Bitcoin Mining Grows, 57 Million Ethiopians Remain in the DarkMining’s Next Race Begins

In 2025 and beyond, survival for mining firms means thinking beyond traditional profitability metrics. It implies optimizing the setup full-stack and adapting technology for broader use cases. Mining enterprises of the future will combine scalable systems, AI-ready infrastructure, and readiness to partner with institutional investors entering the field.

Bitcoin mining has become a foundation layer for energy and digital assets. The firms that win won’t just chase hashrate; they’ll master efficiency, pivot with AI, and work with institutions. The ASIC race is slowing, but the race to professionalize, monetize, and embed mining into global infrastructure has only just begun.

Disclaimer: The opinions in this article are the writer’s own and do not necessarily represent the views of Cryptonews.com. This article is meant to provide a broad perspective on its topic and should not be taken as professional advice.