Michael Saylor’s Bitcoin Bet: 850 BTC Purchase at $117K Pushes Holdings to 639K BTC

MicroStrategy's founder just doubled down on his Bitcoin conviction with another massive purchase.

The Billionaire's Latest Move

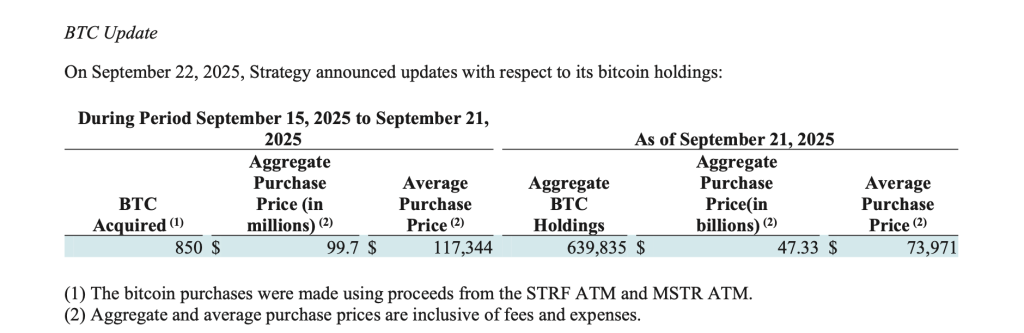

Michael Saylor scooped up 850 BTC at $117,000 per coin—timing the market like a surgeon while traditional finance executives still debate whether cryptocurrency is a 'real asset.' His total Bitcoin stash now stands at a staggering 639,000 BTC.

Market Impact

The purchase signals unwavering institutional confidence despite volatility concerns. Saylor keeps accumulating while Wall Street analysts scratch their heads about digital gold—proving sometimes the smartest money moves happen outside traditional banking channels.

Another quarter, another nine-figure Bitcoin buy from the CEO who treats treasury management like a crypto accumulation game. Meanwhile, hedge funds continue paying 2-and-20 fees for sub-inflation returns.

639,835 BTC Held as of September 21, 2025

Strategy’s aggregate bitcoin holdings now stand at 639,835 BTC. The company reports having acquired these holdings at a total purchase price of $47.33 billion, equating to an average cost of $73,971 per bitcoin.

As of September 21, 2025, Strategy’s BTC treasury makes it not only a dominant corporate player in the bitcoin market but also a bellwether for institutional adoption.

The company’s acquisition strategy continues to demonstrate a long-term conviction in bitcoin as both a reserve asset and a strategic hedge against macroeconomic volatility.

BTC Yield of 26.0% YTD 2025

Alongside its aggressive accumulation, Strategy highlighted a 26.0% year-to-date (YTD) bitcoin yield for 2025. The yield reflects the appreciation of bitcoin relative to the company’s aggregate acquisition costs, further validating its thesis that bitcoin represents a superior store of value in comparison to traditional assets.

This performance comes in the context of broader institutional adoption, with companies increasingly turning to bitcoin as an alternative treasury reserve strategy.

By continuing to capitalize on market opportunities, Strategy has demonstrated both the scale and discipline required to achieve strong returns in a volatile asset class.

ATM Programs Fuel Strategic Purchases

The company’s ability to fund its acquisitions has been supported by a series of at-the-market equity programs. Between September 15 and September 21, 2025, Strategy sold 173,834 STRF shares for net proceeds of $19.4 million, and 227,401 MSTR shares for $80.6 million, raising a total of $100 million.

These proceeds were funneled directly into bitcoin purchases, reinforcing Strategy’s model of converting capital market inflows into digital asset holdings. With billions still available under various ATM facilities, the company has ample firepower to continue expanding its bitcoin treasury in the months ahead.

Strategy’s latest acquisition shows unwavering conviction in bitcoin as a corporate treasury standard. With nearly 640,000 BTC under management and strong YTD returns, the company remains a central force in the institutional adoption of digital assets.