Bitcoin Under Pressure: OG Whales Dump BTC – Will ETF Demand Absorb the Shock?

Bitcoin faces its toughest test yet as original whales unleash massive sell pressure.

The Exodus Begins

Early adopters are cashing out at levels not seen since the last cycle peak. These aren't weak hands—they're veterans who've held through multiple crashes and rallies. Their movement signals a fundamental shift in market dynamics that could redefine Bitcoin's trajectory.

ETF Firewall

Institutional ETFs now stand as the primary buffer against this selling tsunami. BlackRock, Fidelity, and other giants must absorb millions in daily outflows without flinching. Their performance under pressure will determine whether Bitcoin holds key support levels or enters correction territory.

Market Mechanics Clash

Traditional finance meets crypto purity in this high-stakes showdown. The old guard exits just as Wall Street doubles down—creating the ultimate stress test for Bitcoin's new institutional framework. Because nothing says 'mature asset class' like billionaires dumping while ETFs promise stability.

Watch the flows, not the headlines. This battle between OGs and institutions will write Bitcoin's next chapter—whether it's a consolidation breakthrough or a reality check about who really controls the market.

ETF Demand Offsets Selling Pressure

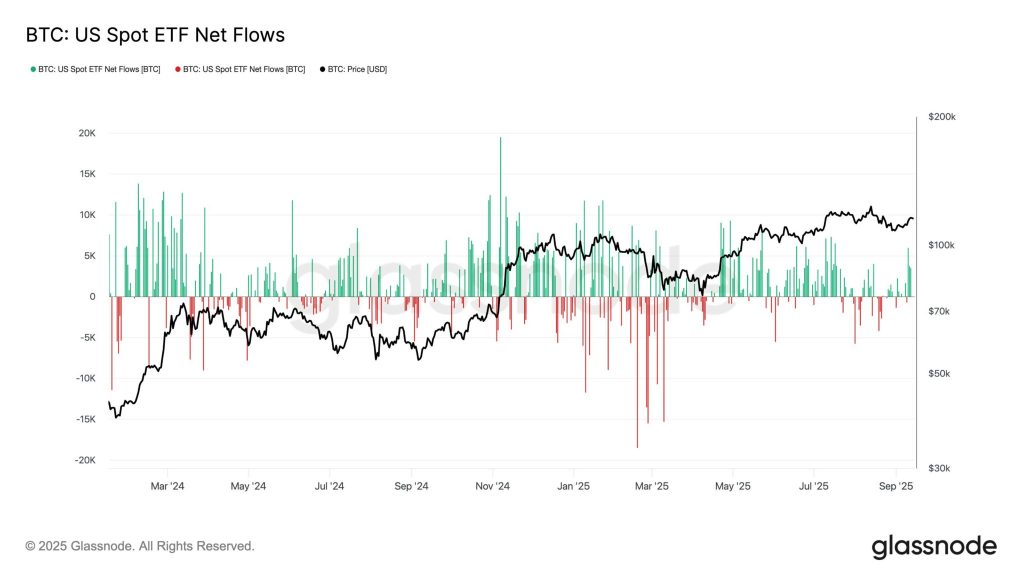

Despite renewed selling, demand from U.S. spot bitcoin ETFs has provided support. According to Glassnode, ETFs logged 5,900 BTC inflows on September 10 — the most significant single-day inflow since July.

That boost turned weekly ETF flows positive, underlining institutional appetite as Bitcoin holds above $114,000.

The flows highlight a tug-of-war: long-term holders are releasing supply, but regulated products are absorbing coins at scale.

For traders, the question is whether ETF inflows can keep pace with whale offloading as Bitcoin’s next MOVE looms.

Bitcoin (BTC/USD) Technical Outlook: $122K or $112K Next?

On the charts, Bitcoin is coiling inside a descending triangle, with price pressing resistance NEAR $116,750. The 50-day EMA at $114,360 underpins the bullish case, while the RSI at 57 signals momentum remains constructive but not overextended.

Recent spinning top candlesticks show hesitation, a typical pause before volatility expands.

If buyers force a breakout above $116,750–$119,500, BTC could quickly target $122,200, with a measured extension pointing to $124,500.

However, failure to hold above $114,000 risks a slide toward $112,000, and a deeper pullback to $108,250 remains possible.

Bitcoin (BTC/USD) Trade Setup

Think of Bitcoin as “testing the ceiling.” A confirmed breakout above $116,750 offers a long entry at $116,800 with stops under $114,000, targeting $119,500 and $122,200. Buyers may wait for dips at $112,000, where demand meets the trendline.

Whales are selling billions, and ETFs are buying. Bitcoin is at a crossroads. If demand wins, we could see a breakout to $122K+ and set up 2025 for a six-figure move.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana VIRTUAL Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $16.2 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012925—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale