Michael Saylor’s Massive $60.2M Bitcoin Grab: MicroStrategy Now Holds 638,985 BTC

Another day, another massive Bitcoin purchase from the oracle of corporate crypto adoption.

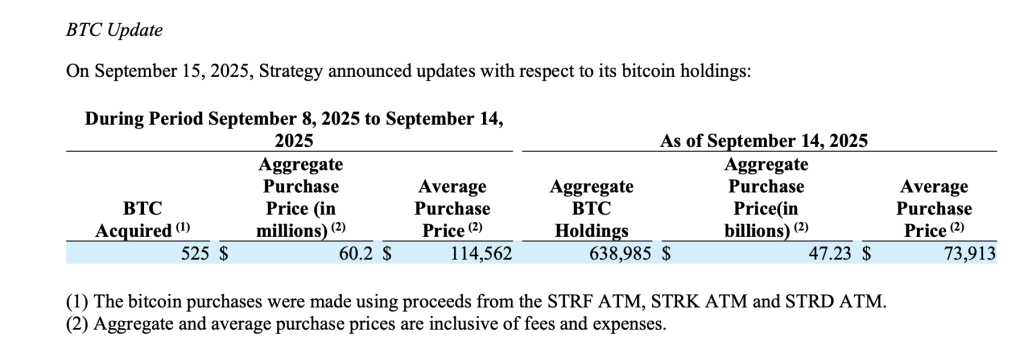

MicroStrategy's relentless accumulation strategy just added another 525 BTC to its treasury—pushing total holdings to a staggering 638,985 BTC. The $60.2 million purchase reinforces Saylor's unwavering conviction in Bitcoin as the ultimate corporate treasury asset.

While traditional finance executives fret over bond yields and stock buybacks, Saylor keeps stacking sats like there's no tomorrow. His moves make Wall Street's 'diversification' strategies look downright archaic.

This latest acquisition continues MicroStrategy's laser-focused Bitcoin accumulation play—ignoring short-term volatility while building what's essentially a publicly-traded Bitcoin proxy. Because why hold depreciating dollars when you can own digital gold?

Meanwhile, traditional CFOs still can't wrap their heads around putting company funds into 'that internet money.' Their loss—Saylor's already up billions while they chase fractional percentage gains in treasury bonds.

Massive Bitcoin Treasury

With this latest acquisition, Strategy now holds an astonishing 638,985 BTC, purchased at an aggregate cost of $47.23 billion. The company’s average purchase price per Bitcoin stands at $73,913, meaning its holdings remain strong in profit at current market valuations.

This monumental stash, accumulated steadily over several years, shows Saylor’s long-term strategy of treating Bitcoin as digital Gold and a hedge against inflation.

Funding Through Share Programs

The purchases were financed through proceeds from the company’s at-the-market (ATM) equity offering programs. Over the same reporting period, Strategy sold hundreds of thousands of preferred shares across different series, raising a total of $68.2 million in net proceeds.

The filing noted sales of STRF, STRK, and STRD shares, all part of the company’s broader strategy to tap equity markets and funnel the funds directly into Bitcoin acquisitions.

This structured financing model has allowed Strategy to consistently accumulate Bitcoin without over-leveraging its balance sheet. By maintaining a steady cadence of share issuance and crypto purchases, the company has managed to expand its digital asset position while retaining operational flexibility.

Strategic Outlook

Michael Saylor remains one of Bitcoin’s most outspoken advocates, frequently describing the asset as superior to traditional stores of value like gold. The company’s growing BTC stockpile represents not only a bold bet on digital assets but also a high-profile example of corporate treasury diversification in the modern era.

As institutional adoption of Bitcoin expands and ETFs drive market inflows, Strategy’s aggressive approach continues to set it apart. With nearly 639,000 BTC under management, the firm’s holdings are larger than the reserves of most countries, placing it in a unique position of influence within the global crypto economy.

Strategy’s unwavering accumulation of Bitcoin indicates that, for Saylor and his company, digital assets are not a speculative play—but a generational hedge and a cornerstone of corporate strategy.