Polkadot Caps DOT Supply at 2.1B — Shattering Inflation Forever

Polkadot just pulled off the ultimate monetary policy pivot—locking its total DOT supply at 2.1 billion tokens and axing inflation for good.

No more endless token printing. No more diluted holdings. The move positions DOT among the scarcest major assets in crypto—a direct challenge to traditional finance’s 'print now, ask later' addiction.

This isn’t a soft launch—it’s a hard cap. Validators and stakers now operate under a fixed-supply system, where rewards come solely from transaction fees rather than newly minted tokens. Talk about incentives alignment.

Sure, some Wall Street types might squirm—after all, how do you short scarcity? But in the world of decentralized networks, value isn’t manufactured. It’s earned.

Game on.

The Polkadot DAO has signaled support for a hard cap, by passing Referendum 1710 on the “Wish For Change” track, with 81% in favor.

Today

→ 1.6 Billion DOT exist

→ 120M DOT/year minted each year

→ No supply cap

What Ref. 1710… pic.twitter.com/OJMtDumAZC — Polkadot (@Polkadot) September 14, 2025

The measure was introduced on Polkadot’s “Wish for Change” track, a governance process designed to capture community sentiment on proposed updates. It received 81% approval, signaling broad consensus among participants.

Polkadot founder Gavin Wood earlier proposed shifting from the Nominated Proof-of-Stake system to a Proof-of-Personhood model.Among the notable changes in the approach was moving Polkadot toward store-of-value properties with a proposed 3.14 billion DOT supply cap.

Notably, this approval came on the backdrop of Polkadot broadening its institutional focus with the launch of Polkadot Capital Group on Aug. 19, a division created to LINK Wall Street firms with its blockchain infrastructure.

The initiative seeks to help traditional finance players explore opportunities in asset management, banking, venture capital, exchanges, and OTC trading while highlighting use cases such as DeFi, staking, and real-world asset tokenization.

Polkadot’s Current Cap at 1.6B DOT as it Shifts from Inflationary Model to Scarcity Framework

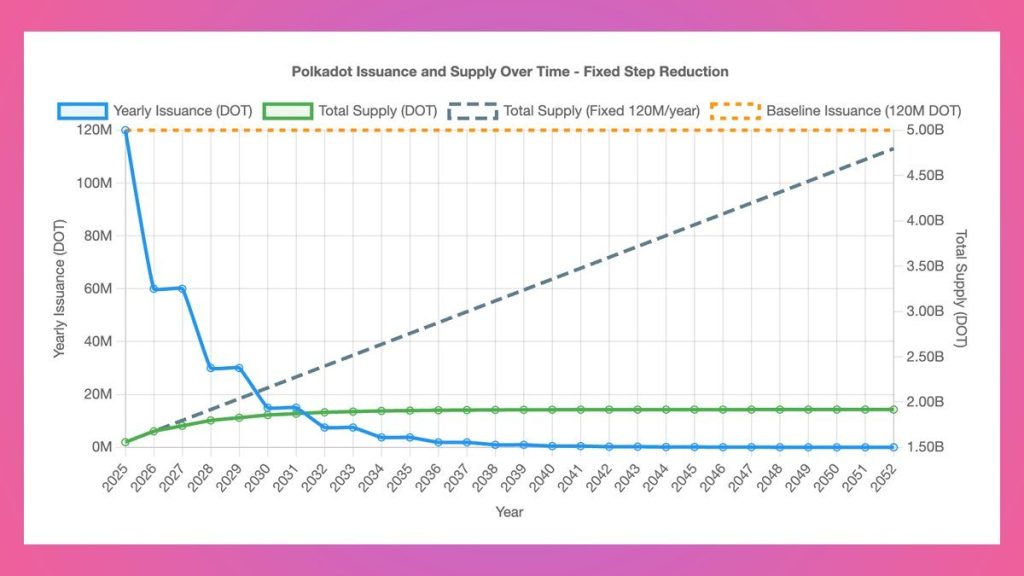

Currently, the total circulating supply of DOT stands at 1.6 billion. Until now, Polkadot minted 120 million DOT each year, with no maximum supply limit. This meant that if the issuance model continued, supply WOULD have grown to around 3.4 billion tokens by 2040 and over 5 billion by 2052.

This inflationary framework raised long-term concerns for holders and developers, as predictable scarcity is a key feature for many blockchain ecosystems. The newly adopted model introduces a strict limit of 2.1 billion DOT. Issuance will decline in fixed steps every two years on March 14, also known as Pi Day.

A chart released by Polkadot shows that annual issuance will drop from 120 million in 2025 to below 20 million by the early 2030s. By 2040, issuance will be minimal, and the total supply is projected to stabilize NEAR 1.91 billion tokens.

The fixed reduction mechanism prevents unchecked growth and aligns incentives between token holders and the network. Polkadot described the outcome as “scarcity, predictability, and long-term alignment.”

By implementing a hard cap, Polkadot joins a group of blockchain networks that restrict supply growth to strengthen economic sustainability. Bitcoin, for example, reduces issuance through programmed halving events, while Polkadot’s approach applies stepwise reductions on a set schedule.

The change may alter how DOT is perceived in the market. Investors and developers often weigh token supply structures when assessing the stability and potential value of a network. With predictable issuance and a capped supply, DOT now offers clearer monetary policy signals than before.

How Will Capped Supply Affect Polkadot?

As of this press time, DOT trades at $4.18, a 4.6% drop in the past day, reducing its rally in the past week to 3.9%. The technical pattern suggests the token bottomed at $3.02 in June before reaching a $4.5 high earlier this month.

Technical indicators such as the RSI and MACD signaled bullish divergences before DOT’s breakout, with both continuing to rise afterward. Chart analysis also reveals the token has been climbing along an ascending support line since its all-time low, forming an ascending triangle with resistance at $4.56, a pattern often linked to bullish momentum.

Source: TradingView

If this setup plays out, DOT could climb toward $6.30, the midpoint of its current range. How the price reacts at that level will be key in determining whether it has the strength to push higher toward the long-term resistance near $11.

Notably, analysts are particularly bullish on the token. In a post on X, a crypto analyst noted DOT holds strong at $3.60 support, bouncing for the fourth time in its multi-year range. A rebound could push it toward $13, a potential 230% upside. The analyst noted that $3.60 is the key level to watch for a potential upside. However, a trade below $3.40 will invalidate the setup.