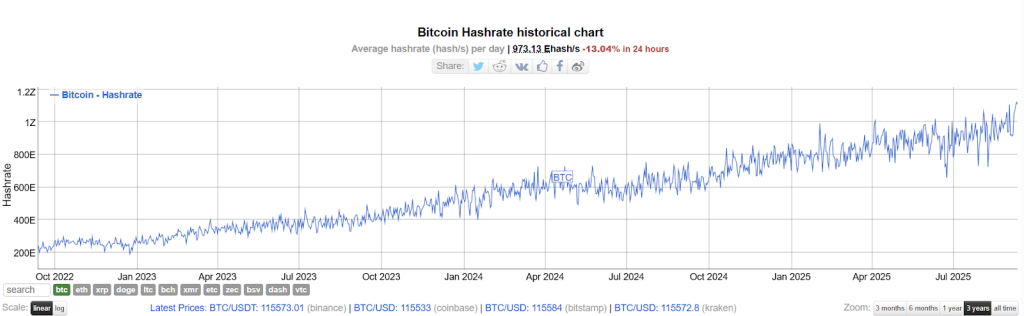

Bitcoin Hash Rate Shatters Records at 1.12B TH/s as Network Difficulty Skyrockets – Is $117K BTC Inevitable?

Bitcoin's backbone just flexed harder than ever—mining power hits unprecedented levels while the network tightens its security screws.

The Hash Rate Revolution

That staggering 1.12 billion terahashes per second isn't just a number—it's a statement. Miners worldwide are pouring unprecedented computational power into securing the network, making Bitcoin more resilient than ever against attacks.

Difficulty Spikes Signal Strength

As the network automatically adjusts to handle this massive influx of mining power, difficulty surges—proving that Bitcoin's self-regulating mechanism works flawlessly even under extreme conditions.

The Price Prophecy

Historically, hash rate peaks have preceded major price breakouts. With institutional adoption accelerating and traditional finance looking increasingly shaky—seriously, when's the last time your bank offered you real yield?—all signs point toward that $117K target being not just possible, but probable.

While the suits on Wall Street debate quarterly earnings, Bitcoin's network just quietly achieved what no centralized system ever could—perfect market-driven security scaling. The math doesn't lie, even if traditional finance does.

Record Bitcoin Hash Rate and Fed Rate Cut Could Trigger $117K Breakout

An increasing hash rate shows increased computational resources being allocated to bitcoin mining.

This typically reflects increased miner confidence, as they essentially bet that Bitcoin’s future valuation will warrant their hardware and energy costs, and it also rises proportionally with the hash rate

According to CoinWarz, the upcoming difficulty adjustment is projected for September 18, 2025, with current estimates indicating a 6.38% increase to 136.04T.

With the Federal Reserve’s highly anticipated rate decision scheduled for September 17 and risk-on markets anticipating a 25-basis-point reduction, investor sentiment on a Bitcoin $117k breakout now leans optimistic.

This perspective aligns with miner reserves climbing to a 50-day peak of 1.808 million BTC on September 9, according to CryptoQuant data, suggesting miners are maintaining their holdings rather than liquidating.

Similarly, crypto analyst Avocado Onchain identifies a fundamental shift in mining behavior and Bitcoin network resilience.

Examining the Miners’ Position Index (MPI), spikes have historically emerged under two conditions, which are pre-halving periods when miners tactically reduce holdings, and late bull market phases when they sell aggressively into fresh retail capital.

The present cycle shows a contrasting pattern, although some pre-halving distribution is obvious, as the intense late-cycle liquidations remain notably absent.

This shows that ETF inflows and Bitcoin’s adoption as a strategic treasury asset by major economies may be reshaping mining strategies. They seem to be transitioning from short-term liquidation toward long-term accumulation.

![]() U.S. spot Bitcoin ETFs Ignite with a $553M daily inflow, pushing a four-day streak to $1.7B. Ether ETFs also saw a resurgence with $113M in new funds. #Bitcoin #ETF #ETHhttps://t.co/zZiNqtKSEm

U.S. spot Bitcoin ETFs Ignite with a $553M daily inflow, pushing a four-day streak to $1.7B. Ether ETFs also saw a resurgence with $113M in new funds. #Bitcoin #ETF #ETHhttps://t.co/zZiNqtKSEm

The analyst further emphasizes that mining difficulty has achieved an all-time high, with its growth trajectory forming the characteristic “Banana Zone” of steep increases.

Bitcoin Technical Analysis: Bulls Challenge $117k Resistance Wall

Bitcoin analysts have identified $117,200 as the key resistance level for the price to overcome, which corresponds with a CME gap.

Should BTC decisively reclaim this threshold, pathways toward new all-time highs above $124k WOULD emerge.

In the event of rejection, BTC could retreat to monthly lows with liquidity concentrations around the $108K-$112K range.

The FOMC meeting approaches next week, with a 25-basis-point rate cut anticipated.

Market direction will hinge on Powell’s commentary and the Fed’s perspective on inflation and employment metrics.

If Powell emphasizes inflation concerns, BTC might decline to test the $112k liquidity zone.

From a technical perspective, the Bitcoin 4-hour chart displays price recovering within a trading range following several unsuccessful attempts to sustain levels above the $119,000 resistance area.

The wedge formation that previously supported the upward trend has now deteriorated, with repeated false breakouts confirming selling pressure at elevated levels.

The price currently trades around $115,400, which is NEAR the range’s upper limit, where resistance has historically prompted corrections.

With support established around $107,700, the chart indicates a probable rejection at current levels, favoring a decline toward the range’s lower boundary unless buyers achieve a convincing breakout above $119,000.