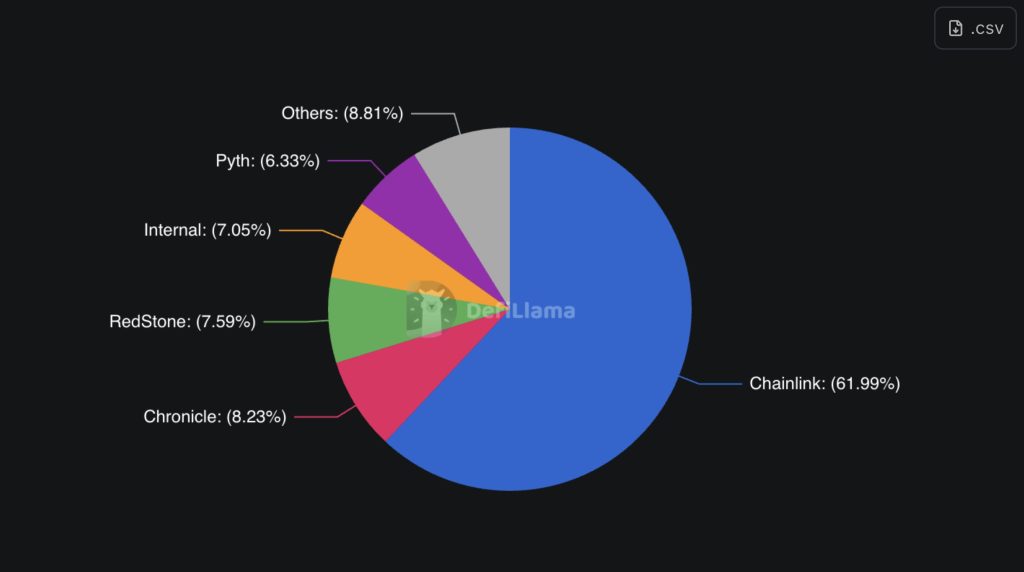

Chainlink Cements 62% Dominance After Inking Major Polymarket Deal to Supercharge Prediction Market Accuracy

Chainlink just locked down the oracle wars—and traditional finance is scrambling to keep up.

The Polymarket partnership cements Chainlink's stranglehold on decentralized data feeds, pushing its market dominance to a staggering 62%. No other oracle comes close.

Why it matters: Prediction markets live or die by data integrity. Chainlink's tamper-proof feeds eliminate the garbage-in-garbage-out problem that plagues legacy systems. Polymarket gets bulletproof accuracy; Chainlink gets another flagship client.

The mechanics: Real-world data flows through Chainlink's decentralized oracle network directly into Polymarket's contracts. No intermediaries, no manipulation, no excuses. It's automated truth—something Wall Street still can't quite figure out despite spending billions on 'AI-driven solutions'.

Market impact: This isn't just another integration. It's a statement. While traditional prediction markets drown in regulatory gray areas and outdated infrastructure, DeFi keeps building the future—one verifiable data point at a time.

Bottom line: Chainlink isn't playing for second place. And after this move, neither is anyone else.

Source: DefiLlama

Source: DefiLlama

Chainlink Data Streams Now Power Bitcoin and Ether Prediction Markets on Polymarket

According to the announcement, Polymarket has integrated Chainlink’s Data Streams and Automation services into its resolution process, with the system now live on the Polygon mainnet.

The collaboration allows near-instant settlement of prediction markets, beginning with asset-pricing markets on assets such as Bitcoin and Ether.

.@Polymarket, the leading onchain prediction markets platform, has officially partnered with chainlink to launch new 15-minute markets featuring near-instant settlement and industry-leading security.https://t.co/M5C1yRrBI5

Starting with asset pricing, the integration combines… pic.twitter.com/Dh7LQLmTdo

Chainlink’s decentralized networks deliver low-latency, timestamped data while eliminating single points of failure, ensuring that resolutions are both secure and verifiable.

Polymarket, which has grown rapidly since launching in 2020, has positioned itself as a global hub for real-time information.

The platform recently acquired QCEX, a CFTC-licensed exchange and clearinghouse, in a $112 million deal to prepare for a return to the U.S. market. It has also partnered with X to integrate personalized market recommendations into the social platform.

![]() X and Polymarket have joined forces to bring live prediction odds to the social timeline, replacing the short-lived Kalshi link-up. Real-time widgets and AI summaries seek to turn trending topics into quick crowd forecasts. #crypto #PredictionMarke…https://t.co/HBustPGwCk

X and Polymarket have joined forces to bring live prediction odds to the social timeline, replacing the short-lived Kalshi link-up. Real-time widgets and AI summaries seek to turn trending topics into quick crowd forecasts. #crypto #PredictionMarke…https://t.co/HBustPGwCk

The latest MOVE with Chainlink further strengthens Polymarket’s infrastructure, reducing reliance on subjective voting systems and minimizing resolution risks in more complex market types.

Chainlink co-founder Sergey Nazarov described the deal as a “pivotal milestone,” adding that resolving markets with tamper-proof computation and high-quality data transforms prediction markets into reliable signs “the world can trust.”

The integration marks the beginning of a broader collaboration between the two companies, with plans to expand beyond asset-pricing into more subjective prediction categories.

The agreement comes at a time when Chainlink has accelerated its expansion into traditional finance and government-linked data services.

On August 11, the firm partnered with Intercontinental Exchange (ICE) to provide on-chain foreign exchange and precious metals rates through its Data Streams, using ICE’s Consolidated Feed sourced from over 300 marketplaces.

Two weeks later, Japanese financial giant SBI Group revealed a collaboration with Chainlink to develop crypto tools for banks and institutions in Japan and the Asia-Pacific region, with an initial focus on tokenized bonds and stablecoin reserves.

![]() U.S. Commerce Dept teams up with @Chainlink to bring official macroeconomic data onchain.#Crypto #Web3https://t.co/etmPClbKwI

U.S. Commerce Dept teams up with @Chainlink to bring official macroeconomic data onchain.#Crypto #Web3https://t.co/etmPClbKwI

On August 28, the U.S. Department of Commerce began publishing official economic data on-chain via Chainlink, including GDP and inflation indicators, marking the first time government statistics were made verifiable on blockchain networks.

With nearly $100 billion in total value locked in DeFi secured by its oracles and trillions of dollars in transaction value supported to date, Chainlink continues to assert itself as the backbone of decentralized data infrastructure.

Polymarket Cleared by U.S. Regulators as Platform Eyes Major Expansion

The U.S. Department of Justice (DOJ) and Commodity Futures Trading Commission (CFTC) in July closed their investigations into Polymarket without taking enforcement action.

The probes, launched in late 2022, examined whether the New York-based platform continued to allow U.S. users access after agreeing to block them under a prior settlement.

The regulatory closure marks a turning point for Polymarket, which has since secured clearance to re-enter the U.S. market.

On September 3, the CFTC granted a no-action letter covering event contracts through QCX LLC and QC Clearing LLC, entities Polymarket acquired earlier this year in a $112 million deal.

The relief provides a framework for offering compliant prediction contracts, shielding participants from enforcement tied to swap reporting and recordkeeping requirements.

Polymarket has rapidly scaled into the largest prediction market globally, processing more than $8 billion in wagers, including $2.5 billion during the 2024 U.S. election cycle. In the first half of 2025 alone, users placed around $6 billion in bets.

Currently, the total volume of prediction markets is $1.1 billion, with Polymarket accounting for more than 25 million positions and a user base of more than 1.2 million traders.

Calculated the stats from Polymarket (prediction markets):

> traders: 1,2M+

> positions: 23M+

> total volume of prediction markets: $1,1B

> total open interest: $279M

> top 1 trader: +$21.8M PnL

> top market by volume: F1 Drivers Champion

found this stats and was surprised how… pic.twitter.com/Oxz4oNe1Hr

The platform is also nearing a $200 million funding round led by Founders Fund that WOULD value it at $1 billion.

Meanwhile, Donald TRUMP Jr.’s 1789 Capital has joined as an investor and advisory partner, indicating growing institutional and political backing for the fast-expanding platform.