Ethereum’s Dual Surge: Institutional Floodgates Open as On-Chain Activity Shatters Records

Ethereum isn't just climbing—it's rewriting the rulebook. Institutional capital pours in while the network's heartbeat accelerates to unprecedented rhythms. CryptoQuant's latest data reveals a perfect storm of Wall Street meets blockchain.

The Institutional Greenlight

Big money isn't just dipping toes—it's diving headfirst. Investment vehicles tracking Ethereum see inflows that would make traditional finance blush. Meanwhile, hedge funds allocate portions of their portfolios that suggest genuine belief, not just speculative plays.

On-Chain Frenzy

Transaction volumes hit levels that strain the very infrastructure meant to handle them. Smart contract deployments multiply, NFT markets buzz with renewed vigor, and DeFi protocols swell with locked value. The network doesn't just process transactions—it breathes fire.

This isn't mere growth—it's validation. While traditional banks still debate blockchain's merits, Ethereum builds the future right under their noses. Sometimes disruption doesn't ask for permission—it just outperforms. Guess which approach actually delivers returns?

Institutional Demand Accelerates

Institutional participation in ethereum has surged in recent months. Fund holdings have doubled since April 2025, now totaling 6.5 million ETH, while large whale wallets with balances between 10,000 and 100,000 ETH collectively hold more than 20 million ETH.

This shift demonstrates the deepening involvement of asset managers and sophisticated investors. However, the fact that so much “smart money” is already positioned could limit near-term upside unless fresh inflows sustain momentum.

Staking Confidence Hits New Highs

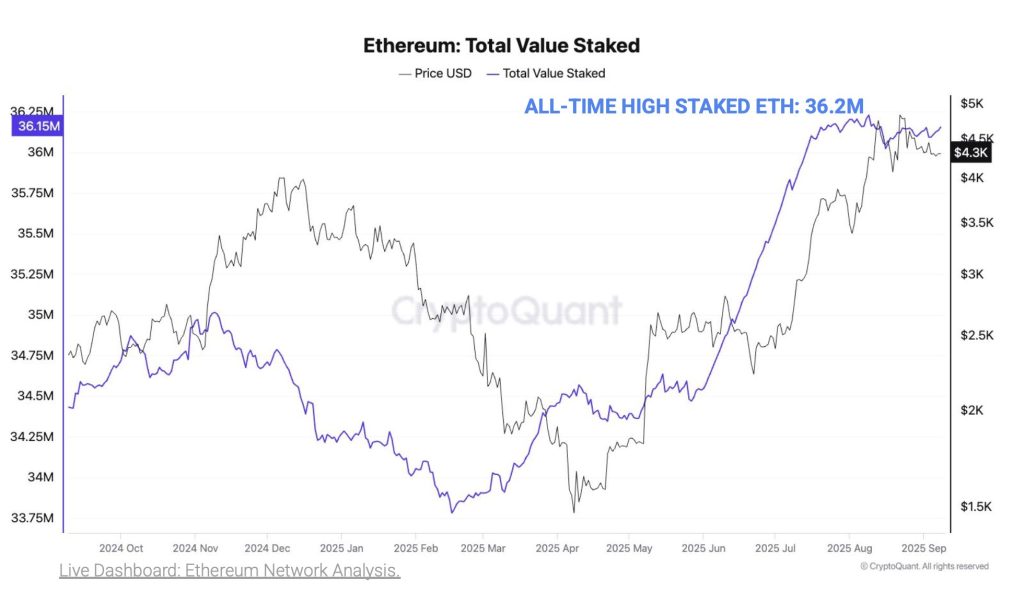

The total amount of ETH staked has climbed to an all-time high of 36.15 million, a milestone that reflects long-term confidence in Ethereum’s security and economic design.

Staking reduces circulating supply, creating natural bullish pressure as less ETH is available on the open market. At the same time, locking up this capital also means liquidity is constrained, which could slow the pace of new inflows if price momentum falters.

Overall, staking growth shows strong conviction among ETH holders but introduces a delicate balance between supply reduction and market flexibility.

Network Activity Expands Across Sectors

Ethereum’s utility as a programmable blockchain continues to expand. Both daily transactions and active addresses have hit record highs, showing its role in powering DeFi applications, stablecoin transfers, and tokenized assets, reports CryptoQuant.

Smart contract calls recently exceeded 12 million per day for the first time, reinforcing Ethereum’s position as the settlement LAYER of choice for decentralized activity. This wave of network usage provides fundamental support to ETH’s valuation and strengthens the case for long-term adoption.

Price Faces Historic Resistance

Despite these bullish fundamentals, market dynamics show signs of consolidation. Exchange inflows have slowed sharply since Ethereum peaked near $5,000, reducing selling pressure and supporting stability.

However, ETH’s rally stalled near the $5,200 realized price upper band, a historically strong resistance level. With ETH currently trading around $4,400, the market may be primed for sideways action or a modest correction unless it can decisively break through this resistance.

Analysts at Derive, a crypto options exchange, anticipate that Ethereum could climb to $6,000, driven by three major bullish factors, creating what could be the strongest crypto bull run in recent years.

![]() Analysts eye $140K Bitcoin and $6K Ethereum by year-end driven by Trump macro catalysts and Digital Asset Treasury accumulation.#Bitcoin #Ethereumhttps://t.co/x1Lqsfu35T

Analysts eye $140K Bitcoin and $6K Ethereum by year-end driven by Trump macro catalysts and Digital Asset Treasury accumulation.#Bitcoin #Ethereumhttps://t.co/x1Lqsfu35T

Ethereum’s dual momentum—institutional adoption on one side, record on-chain activity on the other—shows its unique role in the evolving digital asset environment. Whether this cycle delivers further price discovery depends on its ability to convert strong fundamentals into a sustained push beyond key resistance levels.