Ethereum Developers Severely Underpaid Despite Running $500B Network: Explosive Report Reveals Compensation Crisis

Ethereum's core developers—the architects behind the world's second-largest blockchain—are earning salaries that would make traditional tech workers weep, according to a bombshell new report.

The Brain Drain Threat

While Wall Street bankers collect bonuses for moving decimal points, these engineers maintain a network securing over half a trillion dollars in value—yet their compensation sits dramatically below market rates. The report exposes a growing sustainability crisis that could jeopardize Ethereum's long-term development pipeline.

Market Reality Check

Top-tier blockchain developers command premium salaries in the private sector, while Ethereum's core team reportedly earns 40-60% below industry standards. This compensation gap creates an unsustainable model where the most critical infrastructure in decentralized finance relies on borderline charitable contributions from its brightest minds.

The report drops just as institutional adoption reaches fever pitch—proving once again that in crypto, the real value gets created by idealists while speculators reap the rewards.

Only 37% Of Contributors Receive Tokens Or Equity Grants

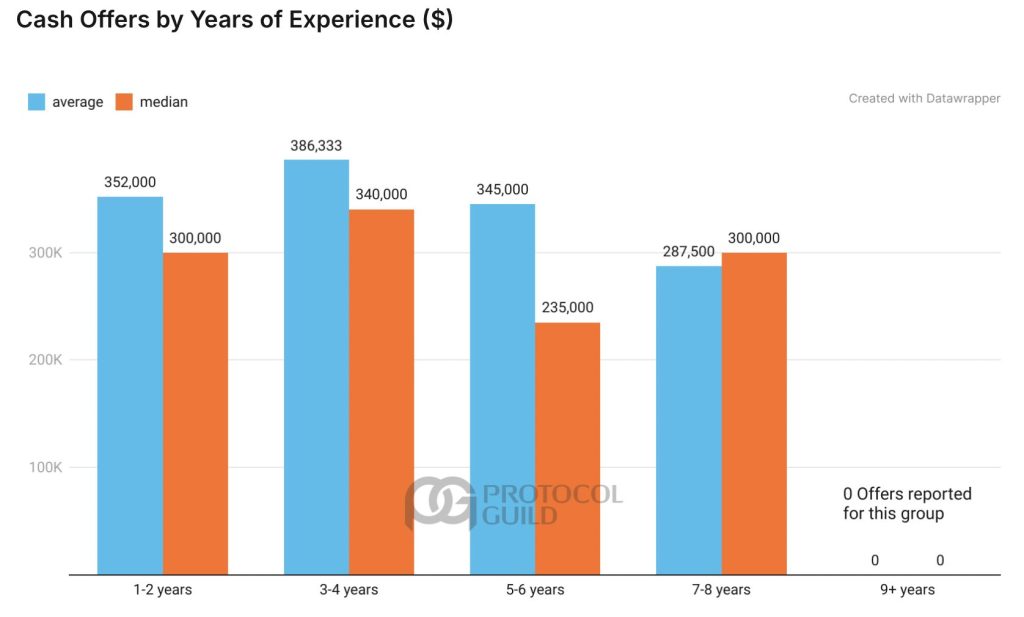

Median base pay landed at $140,000, while market offers hovered at $300,000 and averaged an eye-catching $359,000, laying bare the gulf in earnings.

1/ We are releasing the first-ever comp report for Ethereum core devs. Two striking takeaways:![]() they pass up at least 50% of their market value to maintain existential industry software

they pass up at least 50% of their market value to maintain existential industry software![]() PG funding helps reduce this gap & retain talent long term

PG funding helps reduce this gap & retain talent long term

↓ Report & thread ↓ pic.twitter.com/FDZ5qYOfHH

One developer even reported turning down a jaw-dropping $700,000 package, choosing instead to stick with Ethereum’s core work despite the steep pay cut.

The findings reflect a long-standing challenge. Unlike commercial crypto ventures that can issue tokens or equity, most client teams and research groups working on Ethereum core software cannot offer lucrative upside packages.

Only 37% of contributors surveyed received any FORM of equity or token grants from their employers. For the majority, the answer was zero.

Image Source: Protocol Guild

That absence of upside stands in sharp contrast to the broader industry, where engineers at start-ups or exchanges often receive significant equity stakes or token allocations.

Community Funding Offers Predictability Lacking In Traditional Employers

In Ethereum’s case, the entities employing core developers are usually non-profits, academic institutions or foundations, and they lack the structure or business model to offer such incentives.

Protocol Guild said it helps bridge part of the pay gap. Since its start in May 2022, it said it has distributed more than $33m, with much of the funding coming from projects that pledged 1% of their token supply, including EigenLayer, Ether.fi, Taiko and Puffer. The support vests onchain over four years, making the process visible and predictable.

In the past year, the median contributor received $67,121 through this channel, which brought overall median compensation to $207,121. While still below market, it has eased some of the pressure.

Client Developers And Coordinators Earn Well Below Research Roles

The survey also revealed differences across roles. Researchers reported the highest median cash compensation at $215,000, while client developers and coordinators earned around $130,000.

By experience, those with seven to eight years in the space had a median of $212,000, but the figure dropped to $150,000 for those with nine or more years.

This pay structure places Ethereum in a difficult position as competition for blockchain engineering talent intensifies. Almost 40% of respondents said they had received final job offers from external employers in the past year. Many came from rival LAYER 1 and Layer 2 networks that can afford higher packages.

Devs Keep Building Even As Pay Trails Market

The stakes are evident. Persistent underpayment could lead to higher churn, weaker institutional memory and slower progress on Ethereum’s upgrade roadmap. It could also make independent teams more vulnerable to acquisition or, in worst cases, undue external influence.

Despite these challenges, many contributors remain motivated by values rather than financial upside. Several respondents said they chose to continue because they believed in Ethereum’s mission of decentralization, censorship resistance and credible neutrality, even if it meant earning less.

Protocol Guild framed the report as a call to action. It said ecosystem funders should recognize undercompensation as a serious issue and work toward scalable solutions. Without stronger support, Ethereum risks losing the very people responsible for maintaining its infrastructure.