833K ETH Locked in Validator Queue Sparks Supply Crunch – Is $4,500 the Next Breakout?

Ethereum's validator queue hits capacity crisis as 833,000 ETH gets stuck in entry limbo—creating the perfect storm for supply shock.

The Bottleneck Effect

Network congestion reaches critical mass with nearly a million ETH sidelined from circulation. Validator activation delays stretch to weeks as the queue backs up—artificially constraining liquid supply while demand keeps climbing.

Price Pressure Builds

Traders spot the squeeze play: reduced selling pressure from new validators combined with institutional accumulation creates textbook bullish conditions. Options markets flash green as whales position for upside.

Breaking the Ceiling

Technical analysis suggests $4,500 isn't just possible—it's probable if the supply crunch persists. Resistance levels crumble while derivatives traders pile into long positions. The only thing growing faster than ETH's price? The waiting list to stake more.

Wall Street's watching from the sidelines again—still trying to explain how 'internet money' outperforms their precious bonds.

Validator Supply Shortage Prime ETH For $4,500 Breakout

Since Ethereum shifted from Proof of Work (PoW) to Proof of Stake (PoS), staking activity has grown rapidly.

However, the price impact wasn’t immediate because macro conditions (Fed hikes, risk-off markets) overshadowed fundamentals.

But since the Shanghai/Capella Upgrade (April 2023), staking surged as new validators joined. ETH ROSE from $1,800 in April to ~$2,100+ within weeks.

Historically, validator supply shortages always result in bullish momentum in ETH price, which this time around could trigger the $4,500 Ethereum breakout to new all-time highs.

For better context, in PoS networks like Ethereum, validators replace miners (who uphold the PoW like in Bitcoin), and they do so by staking ETH to secure the network, validate transactions, and propose new blocks.

In return, they earn staking rewards (in ETH), meaning if they act dishonestly, they risk losing part of their stake (slashing).

Data from Glassnode also shows that ETH supply on exchanges continues to reach record lows as institutions like BlackRock and Fidelity, and treasury companies like Bitmine and Sharplink Gaming are stacking billions of Ether.

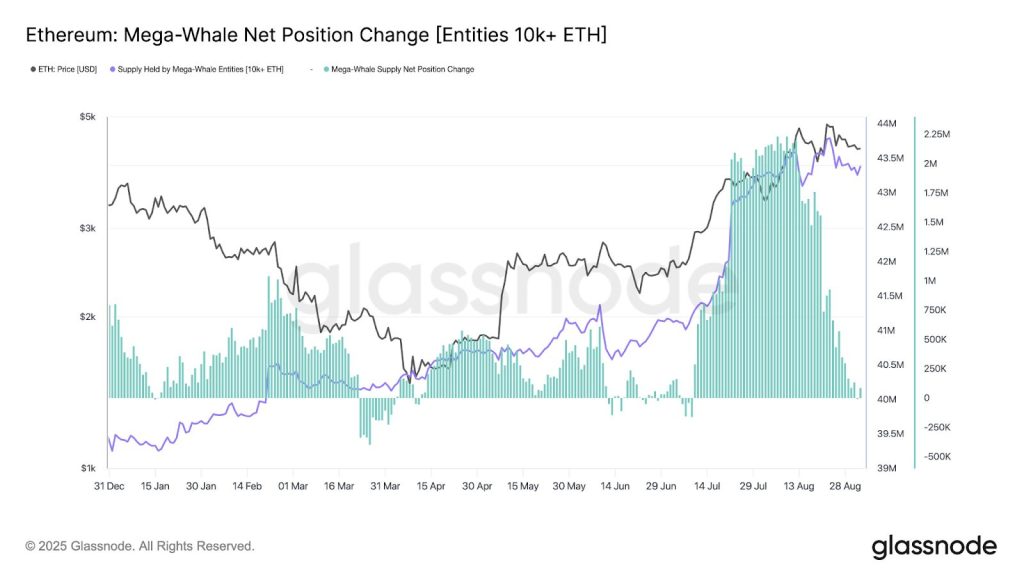

Particularly from mid-July through August, ETH saw the largest accumulation in history as mega whales (10k+ ETH) drove the rally with net inflows peaking at 2.2M ETH ($10 billion).

Moreover, Ethereum Cost Basis Distribution (CBD) shows a clear divergence in spot flows between spot activity and the derivative market.

Per the data, while there is spot demand in ETH, derivatives-led speculation has been moving price more than conviction-driven spot.

It all depends on what is driving price.

Even though there is spot demand in ETH, derivatives-led speculation has been moving price more than conviction-driven spot.

From @glassnode.https://t.co/kblr67ymdB

Fundstrat Analysis and Wyckoff Pattern Point to $9,000 ETH

Analysts at Altcoin Vector believe that what ETH needs to clear the $5,000 psychological resistance is renewed strong-hand accumulation from mega whales, as well as the derivative market to generate impulse.

Mike Zaccardi, financial analyst at Fundstrat Insights, also shared that ETH is cooling off in the last 10 days, but the overall consolidation looks constructive.

In a chart shared with Fundstrat CIO Tom Lee, Zaccardi revealed a resurfacing Wyckoff accumulation pattern that formed when Ethereum did a 54x out of its last base ($90 → $4,866).

Yes![]() https://t.co/GAiSfWGwTt

https://t.co/GAiSfWGwTt

According to him, the current ETH rally is about to get wild because “the bigger the base, the bigger the breakout.”

Similarly, Fundstrat Head of Technical Strategy Mark Newton sees $9k ETH by January 2026, according to his implied ETH fair value based on the ETH/BTC ratio.

Moreover, Bitmine Chairman Tom Lee argues that the tailwinds of tokenizing and AI should propel ETH/BTC to ATH and beyond.

In an X discussion with OpenAI’s Sam Altman, where the AI founder talked about how LLMs are making social interaction “dead,” Lee added that Altman is revealing the urgent need for a “proof of human” in an increasingly agentic world.

To me, seems like @sama telling us we need “proof of human” in an increasingly agentic world

PS: $ETH is at the center of that solution (among others) https://t.co/rFhyeoU01f

Lee asserts that ETH, being a decentralized blockchain network that can issue a unique identity for users, is at the center of the solution to the AI rot (among other possible solutions).

This aligns with what Ethereum co-founder Joe Lubin recently revealed in his thesis that ETH will 100x from current price levels with the potential to flip Bitcoin’s monetary base.

Can ETH Supply Shortage Push Price Above $4,680 Resistance?

On the technical front, the Ethereum 4H chart highlights a battle between a strong demand zone around $4,195–$4,277 and overhead resistance NEAR $4,680.

Price is currently testing the mid-range at $4,345, with the RSI sitting at 41, reflecting weak momentum but not yet oversold.

The structure suggests that as long as ETH holds the demand zone, buyers have a chance to drive a recovery.

A reclaim above $4,400 WOULD confirm strength and open the path toward $4,500 and ultimately the $4,680 resistance.

However, a clean break below $4,195 would weaken the setup and risk deeper downside.