ECB’s Lagarde Demands Tighter Rules on Non-EU Stablecoin Issuers to Plug MiCA Loopholes

Europe's top banker just drew a line in the sand—non-EU stablecoins face a regulatory reckoning.

Christine Lagarde, President of the European Central Bank, is pushing for stricter oversight of foreign stablecoin issuers operating in EU markets. Her goal? Closing critical gaps in the Markets in Crypto-Assets (MiCA) framework that risk undermining financial stability.

Why It Matters Now

As global adoption of stablecoins accelerates, regulatory arbitrage has become a glaring weak spot. Offshore issuers—often outside MiCA’s reach—are gaining traction with minimal supervision. Lagarde’s move signals that the era of light-touch treatment is ending.

Lagarde isn’t mincing words. She called current rules “insufficient” and warned that loopholes could expose EU consumers and investors to undisclosed risks. Her proposal aims to level the playing field—forcing foreign issuers to meet the same standards as home-grown ones.

But Will It Work?

Skeptics argue more regulation might stifle innovation or push crypto activity further into the shadows. Others say it’s a necessary step toward legitimizing digital assets—especially if the ECB plans to launch a digital euro down the line.

One thing’s clear: Lagarde means business. And for crypto—a sector that’s part revolution, part Wild West—it’s another step toward growing up. Whether that’s good or bad depends on which side of the trade you’re on. After all, nothing says 'mature market' like a fresh batch of compliance paperwork.

Euro Stablecoins Struggle as Dollar Dominates Global Markets

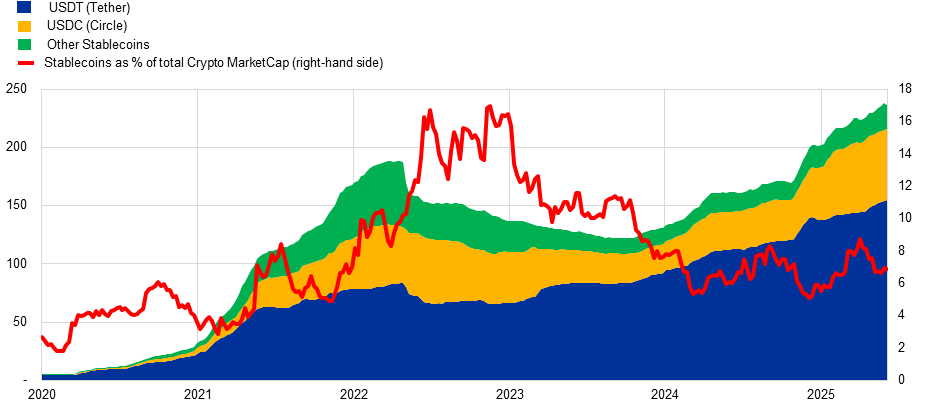

The warning comes as euro-backed stablecoins capture merely 0.15% of the $230 billion global market, with USD-pegged tokens accounting for 99% of stablecoin capitalization.

ECB advisor Jürgen Schaaf had previously cautioned that widespread adoption of dollar stablecoins could weaken European monetary control and financial sovereignty.

Lagarde identified critical vulnerabilities in the current MiCA implementation, where investors WOULD naturally prefer to redeem stablecoins in jurisdictions with the strongest safeguards during crisis periods.

EU-held reserves may prove insufficient to meet concentrated redemption demand, which creates systemic risks reminiscent of traditional banking liquidity mismatches.

The ECB chief demanded European legislation ensure multi-issuance schemes cannot operate without robust equivalence regimes in other jurisdictions and safeguards for asset transfers between EU and non-EU entities.

Her intervention follows mounting pressure to accelerate digital euro development after the United States’ comprehensive stablecoin legislation, the GENIUS Act.

![]() ECB advisor warns Europe risks losing monetary sovereignty as euro-denominated stablecoins capture just 0.15% of $230 billion global stablecoin market.#Europe #Stablecoinhttps://t.co/ztXdNdvv1C

ECB advisor warns Europe risks losing monetary sovereignty as euro-denominated stablecoins capture just 0.15% of $230 billion global stablecoin market.#Europe #Stablecoinhttps://t.co/ztXdNdvv1C

MiCA Loopholes Create “Path of Least Resistance” for Financial Risk

Lagarde used a submarine metaphor to emphasize how financial risks seek the easiest routes through regulatory gaps, regardless of technological innovation.

“,” she stated at the Frankfurt conference.

The specific vulnerability involves multi-issuance arrangements where EU-licensed entities and offshore partners jointly issue interchangeable stablecoins.

MiCA requirements apply only to European operations, resulting in asymmetric regulatory coverage within single-token systems.

During market stress, investors would logically concentrate redemption requests in EU jurisdictions where MiCA prohibits redemption fees and mandates par value redemptions.

However, Lagarde highlighted that reserve allocation may not match this redemption FLOW pattern, potentially triggering liquidity shortfalls.

Banking groups already face consolidated liquidity requirements that ensure reserve availability across all operational levels through net stable funding ratios and liquidity coverage standards.

Stablecoin multi-issuance schemes will replicate identical risks without equivalent regulatory oversight.

The European Commission previously clarified that companies could treat tokens as fungible across jurisdictions if EU-licensed entities participate.

However, the ECB warned that this approach risks undermining EU strategic autonomy by allowing non-EU redemption pressure to drain European reserves.

Lagarde emphasized that regulatory principles remain constant despite technological evolution.

“The categories of risk they create are not new. They are risks long familiar to supervisors and regulators,” she noted regarding stablecoin innovations.

Digital Euro Acceleration Targets US Stablecoin Dominance Challenge

European officials accelerated digital euro planning after TRUMP signed the GENIUS Act, establishing comprehensive dollar stablecoin regulations.

The swift US action unsettled EU policymakers who had pursued more cautious development approaches for their central bank digital currency project.

Current debates center on whether digital euros should operate on public blockchains, such as Ethereum, or private, ECB-controlled ledgers.

Public blockchain advocates argue for broader circulation possibilities, while critics cite concerns about privacy and transaction exposure risks.

![]() European officials are fast-tracking the digital euro, weighing ethereum or Solana, as pressure mounts to keep pace with US progress in digital currencies.#DigitalEuro #ethereum #Solana https://t.co/vMzIfEMIdu

European officials are fast-tracking the digital euro, weighing ethereum or Solana, as pressure mounts to keep pace with US progress in digital currencies.#DigitalEuro #ethereum #Solana https://t.co/vMzIfEMIdu

Some policymakers believe that open blockchain digital euros could strengthen the currency’s reach beyond European borders.

At the current speed of growth, dollar stablecoin integration into mainstream payment systems by Visa and Mastercard already threatens European financial control.

Major US retailers, including Walmart and Amazon, are exploring stablecoin adoption for high-volume transactions, which means some payment flows may occur outside traditional banking infrastructure.

Notably, Deutsche Bank, Galaxy Digital, and Flow Traders launched EURAU as Europe’s first MiCA-compliant euro stablecoin. However, its impact remains minimal given current market scale disparities.

Lagarde concluded that international cooperation remains indispensable for effective regulation while maintaining that traditional risk management principles can address emerging challenges through updated application methods.