Raoul Pal’s Bold 2030 Crypto Prediction: 4 Billion Users and $100T Market Cap — Too Good to Be True?

Wall Street's crypto oracle drops another bombshell projection that'll either make you rich or leave you laughing.

The Adoption Tsunami

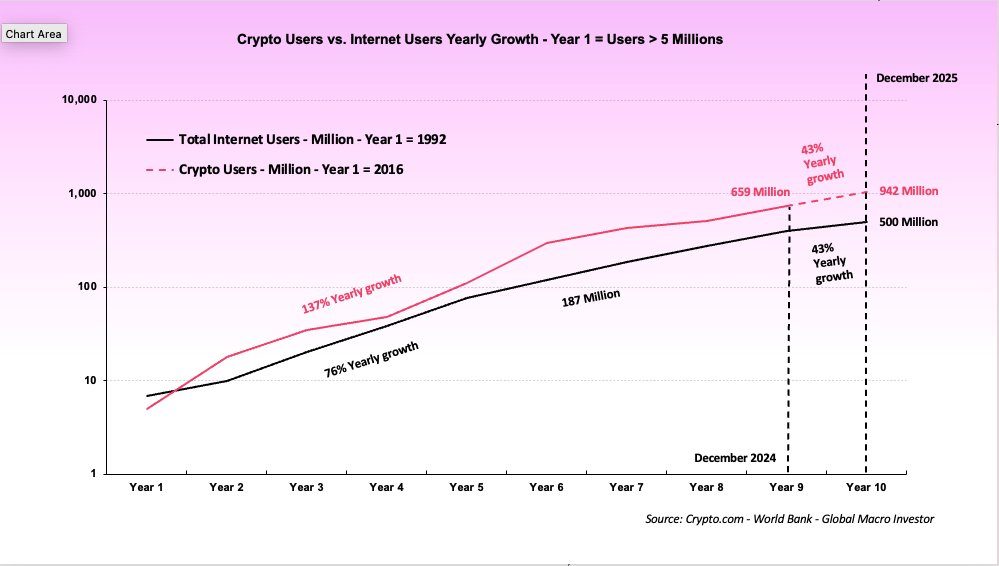

Raoul Pal's crystal ball shows 4 billion crypto users flooding the market by 2030—that's half the planet's population clutching digital wallets instead of leather ones. The former Goldman Sachs exec insists this isn't fantasy math but inevitable network effects meeting generational wealth transfer.

The $100 Trillion Gambit

That user tsunami supposedly catapults crypto's total market cap to $100 trillion. For context? That's more than today's global gold, stock, and real estate markets combined. Pal argues blockchain infrastructure will eat traditional finance—if regulators don't eat it first.

Reality Check

Sure, the numbers sound outrageous until you remember this is the same industry that turned dog meme tokens into retirement plans. Even if Pal's right about adoption curves, hitting those targets requires every central bank, pension fund, and your grandma to YOLO into crypto simultaneously.

One thing's certain: whether this prediction lands or crashes, someone's getting management fees.

Source: X/@RaoulGMI

Source: X/@RaoulGMI

The Numbers Behind Pal’s Bold Forecast

According to his framework, debasement explains 90% of crypto price action, while adoption drives outperformance against traditional inflation hedges, such as gold.

The prediction has triggered pushback from critics who question whether wallet proliferation genuinely represents unique users or creates misleading signals of adoption.

Pal’s analysis builds on current crypto adoption metrics, which show 820 million active wallets globally as of 2025, with software wallet downloads surpassing 520 million worldwide.

However, research by venture capital firm a16z reveals significant overcounting in these figures, suggesting only 30-60 million real monthly transacting users exist, representing just 14-27% of the 220 million monthly active addresses measured across blockchain networks.

Critics challenged Pal’s IP address comparison on social media, with user @thejustinfagan noting that “a typical home has 1 IP address” while crypto founders can easily create thousands of wallets to inflate community metrics.

To corroborate this claim, a recent study of 1,000 active crypto users in the US and UK also found that 62% manage more than two mobile wallets, primarily due to interoperability issues between blockchain networks.

Pal defended his methodology by pointing out that IP addresses also multiply through smartphones, laptops, VPNs, and different locations, making the wallet comparison “like for like” despite concerns about overcounting.

We all have numerous address for IP addresses to. Its like for like and matters not for trend.

— Raoul Pal (@RaoulGMI) August 31, 2025His macroeconomic thesis finds support in current monetary conditions, as the U.S. M2 money supply reached $22.12 trillion in July 2025, reflecting 4.8% year-over-year growth.

The U.S. national debt has climbed to $37 trillion, with annual interest payments exceeding $1 trillion for the first time, creating conditions that historically favor alternative stores of value.

Market Reality Check: Can Crypto Reach $100 Trillion?

Institutional adoption has accelerated with the introduction of Bitcoin spot ETFs, which have attracted over $54.75 billion in net inflows since their approval in January 2024.

Stablecoins have also emerged as a key driver of adoption, settling $6.3 trillion in payments over the 12 months to February 2025, representing 15% of global retail cross-border payments.

JPMorgan’s blockchain platform processes $2 billion daily through its JPM Coin system, while major banks, including Goldman Sachs and Deutsche Bank, explore stablecoin offerings.

Yet, reaching 4 billion users would require crypto to serve half the world’s population, a massive leap from current estimates, which range from 500 million to 659 million users.

For context, achieving $100 trillion market capitalization would approach the size of global equity markets, currently valued at approximately $110 trillion.

![]() Citi executive warns stablecoin interest payments could drain bank deposits like the 1980s crisis amid GENIUS Act loophole concerns.#Stablecoin #Bankshttps://t.co/aaHxz9bXHM

Citi executive warns stablecoin interest payments could drain bank deposits like the 1980s crisis amid GENIUS Act loophole concerns.#Stablecoin #Bankshttps://t.co/aaHxz9bXHM

Meanwhile, banking industry groups have warned that yield-bearing stablecoins could trigger deposit flight similar to the 1980s money market fund crisis, when money market funds grew from $4 billion to $235 billion in seven years.

Some experts have argued that user experience and privacy concerns are the primary factors preventing institutional participation, citing complex interfaces and seed phrase management as the main obstacles to mainstream adoption, with many calling for account abstraction solutions.

Privacy advocates, such as Petro Golovko, also warn that public blockchain transparency creates fundamental adoption barriers by exposing financial data that institutions and individuals prefer to keep private.

Moreover, regulatory developments have also contributed to this growth, with the EU’s MiCA regulation introducing comprehensive oversight, while the U.S. The GENIUS Act establishes a framework for the stablecoin industry’s growth.

Pal has advised followers to maintain long-term positions rather than worry about short-term volatility, stating that “it will all play out with or without your endless fretting.”