Ethereum’s September Showdown: $5K Breakout or $3K Collapse?

Ethereum teeters on the edge of a massive price movement as September volatility kicks in.

Bull vs Bear Battle Lines

Traders brace for either a historic rally toward the elusive $5,000 threshold or a brutal correction down to $3,000 support levels. The charts don't lie—this isn't for the faint of heart.

Market Mechanics at Play

Institutional money flows clash with retail sentiment while derivatives markets flash warning signs. The entire ecosystem holds its breath waiting for the next big move.

Traditional finance analysts watching from the sidelines—still trying to figure out how wallets work while missing the biggest wealth transfer of our generation.

ETH Price Battles for $4,000

Ethereum enters September after a historic rally that nearly pushed it past $5,000. But with the price now stuck between $3,800 and $4,200, the big question is whether ETH price can break through or if a deeper correction is coming.

,, ETH’s outlook will depend not just on price levels but also on broader market liquidity:

As ethereum enters September with an optimistic outlook, the market holds its breath to watch whether it can hold above the $4,000 level. If that turns out to be true, it could help set the stage for what could be the long-awaited altseason.

A drop below $3,800 could signal growing weakness in the market if overall liquidity starts to dry up. Zhao highlights this risk as worth watching:

The possibility of failure to sustain above $3,800 would mean caution, especially if broader liquidity conditions manage to tighten. The momentum for Ethereum right now lies in network activity instead of just price. Network activities like DeFi volumes, Layer-2 adoption, and renewed energy around its ecosystem projects are the ultimate fuels for a sustainable upside.

,, points to Ethereum’s position as the leading chain for institutional and tokenization-driven flows. While momentum remains strong, he notes the market may pause before the next move:

It’s pretty clear why it’s moving. It’s the go-to chain for serious money and the whole tokenization trend. It’s had a huge run-up, so honestly, I wouldn’t be surprised to see it cool off a bit or trade sideways for a while to catch its breath. The real battleground for September is the $4,000 mark. If it can break through and hold that level, the path to its old all-time high NEAR $4,800 looks wide open. If it gets rejected there, I’m watching the $3,550–$3,600 area as the first line of defense.

, is watching the same $4,000 level as a key turning point:

I like the setup but $4,000 is the make-or-break level. A strong weekly close above $4,000 that holds could open the door to $4,400–$4,600, with a shot at the prior highs if momentum broadens. If it stalls, I’d look for buyers around $3,620–$3,680, and worst case, closer to $3.420.

While ETH price has pulled back slightly, this rally was long anticipated by many in the market. Now the focus shifts to whether it can sustain momentum or if a deeper cooldown is ahead.

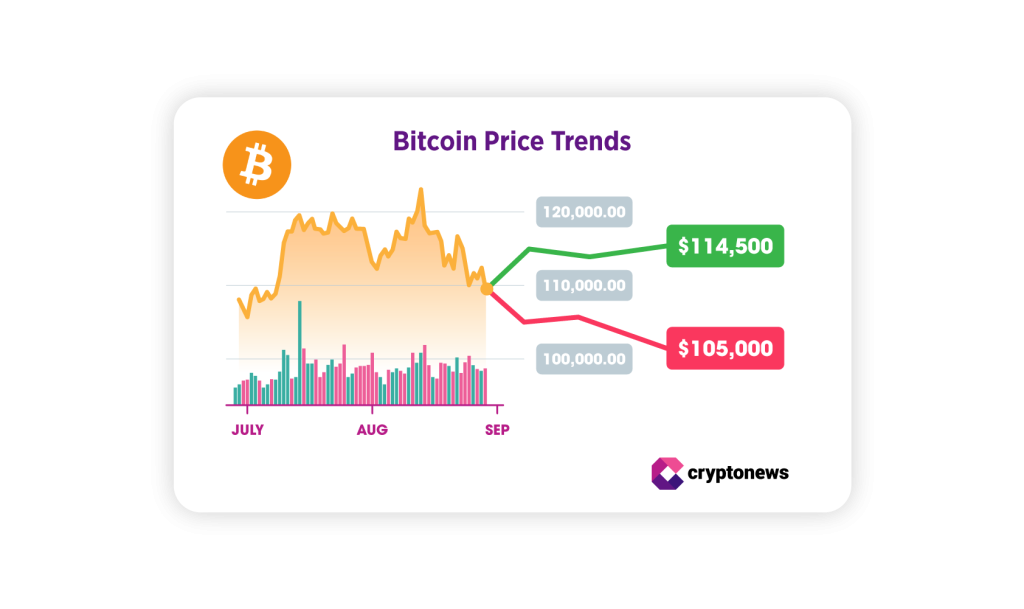

Bitcoin Holds the Line at $110,000

According to,, Bitcoin’s technical setup has turned fragile after a major sell-off:

Bitcoin has broken the support level of $114,500, which led to heavy selling. A significant spike occurred because a whale sold 24,000 BTC, causing the price to drop. The price needs to hold above the $110,000 level. Otherwise, we may see further declines in the market.

The pressure from large holders has increased short-term volatility. A sustained breakdown below $110,000 could trigger further panic, while stability above that mark may restore confidence heading into September.

believes Bitcoin’s behavior in early September will shape the altcoin outlook:

I’m cautiously optimistic about an altseason in September, but it’s not a given. If bitcoin cools off and dominance drifts lower, I think money rotates into the big alts, led by Ethereum. A hot macro print or another sharp Bitcoin leg up would likely delay that.

Altseason expectations remain closely tied to BTC dominance. As long as Bitcoin remains the main liquidity magnet, altcoins may struggle to take the lead.

Solana Joins Ethereum in the Spotlight

Historically, solana tends to rally after Ethereum. As ETH leads the charge, capital often rotates into faster, more volatile altcoins — and SOL has been a top beneficiary in past cycles. But this time, both coins have been rising side by side. In August, Solana repeatedly touched and briefly surpassed the $200 mark, signaling growing investor interest.

sees strength in the network’s fundamentals and believes $200 remains a key milestone:

I’m more outright constructive. The ecosystem has real traction, liquidity is improving, and developers are shipping. Clearing $200 and holding it WOULD be a clear risk-on signal for me, with $226–$232 next and then $255–$262. If the market wobbles, $172–$176 is first support; lose that and $152–$156 is where I’d expect dip-buyers.

points out that September is a pivotal month for Solana. While Ethereum has attracted most of the recent attention, SOL’s ability to hold key levels could determine if it joins the next wave of institutional inflows:

Solana, this cycle has become the stage for its standout performance. Come September, it would be the real test for Solana to see if it can maintain that leadership. The critical level to watch for Solana lies around $140. Surpassing it would keep the uptrend intact and invite more institutional flows, one that is into its DeFi and consumer app ecosystem.

However, Zhao notes that a drop below $120 could weaken confidence in the short term:

Should the price slip below $120, short-term sentiment could grow sullen. As Solana continues doing its best to attract developers and retail users alike, it has grown into becoming one of the best-positioned networks to benefit if there’s indeed a broader altcoin rotation.

According to, Solana may be gaining strength as it approaches a key price threshold:

Looking at the chart, SOL seems to be building up steam for its next leg up. The key number for September is $200. A clean break above that psychological level would be very bullish, and I’d be looking at $225 and then its all-time high around $260 as the next targets. On the flip side, it needs to hold support around $170. If that level breaks, we could see it dip back to the stronger support zone around $150.

Will ETH Price Lead the Market? September May Shape Q4 Trends

After a dramatic summer rally, the crypto market enters September at a crossroads. ETH price is battling to stay above $4,000, and its performance could determine whether altseason finally kicks off or gets delayed once again. Bitcoin is under pressure after breaking key support, with whale activity and macro data adding to the uncertainty. Solana continues to show strength, but its next move depends on holding above key psychological levels like $200.

If macro conditions remain steady and investor sentiment holds, September could open the door for renewed upside, especially in altcoins. However, concerns about liquidity, inflation, and insider-driven volatility remain in play.

Key Crypto Events to Watch in September 2025

- September 2 — Eurozone CPI & US Manufacturing PMI

Inflation data from the Eurozone and U.S. manufacturing activity could shape expectations for interest rate moves. - September 3 — ECB President Christine Lagarde Speech

Markets will look for signals on the European Central Bank’s next steps amid mixed macro conditions. - September 4 — U.S. Labor and Services Data

Initial jobless claims and Services PMI offer a snapshot of U.S. employment and consumer activity. - September 5 — U.S. Unemployment Rate (August)

A key indicator of labor market strength ahead of the Fed’s next decision. - September 10 — U.S. Producer Price Index (PPI)

Wholesale inflation data that may influence forecasts for upcoming CPI readings. - September 11 — ECB Interest Rate Decision

A pivotal moment for eurozone monetary policy that could affect global risk sentiment. - September 11 — U.S. CPI Inflation Release (August)

Monthly and annual CPI data — one of the most important macro events for crypto markets. - September 17 — U.S. Federal Reserve Rate Decision

No hike is expected, but Jerome Powell’s tone on inflation and future policy could move both crypto and traditional markets.

Disclaimer: crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.