Sonic Labs Shakes Up US Market With Revolutionary ETF Launch, PIPE Strategy, and Deflationary Tokenomics

Sonic Labs storms into US markets with a triple-threat approach that's turning heads across traditional finance and crypto circles.

ETF Innovation Meets Crypto

The firm launches its first US-listed ETF, offering institutional investors regulated exposure to cutting-edge digital asset strategies—finally giving Wall Street a proper gateway to crypto returns without the regulatory headaches.

Strategic PIPE Financing

Backed by private investment in public equity, Sonic Labs secures massive capital infusion while bypassing traditional fundraising bottlenecks. Because why wait for IPO paperwork when you can move at blockchain speed?

Deflationary Model Disruption

Implements token burn mechanics that actually create scarcity—something traditional central bankers still can't seem to grasp despite centuries of practice. The model systematically reduces supply while demand potentially skyrockets.

This isn't just another crypto project—it's a full-scale assault on traditional finance structures. Sonic Labs might finally give investors what they really want: all the gains of crypto with none of the regulatory theater. Just don't tell the suits this was built by degens who probably trade while wearing hoodies.

A Strategic Boost for S Token?

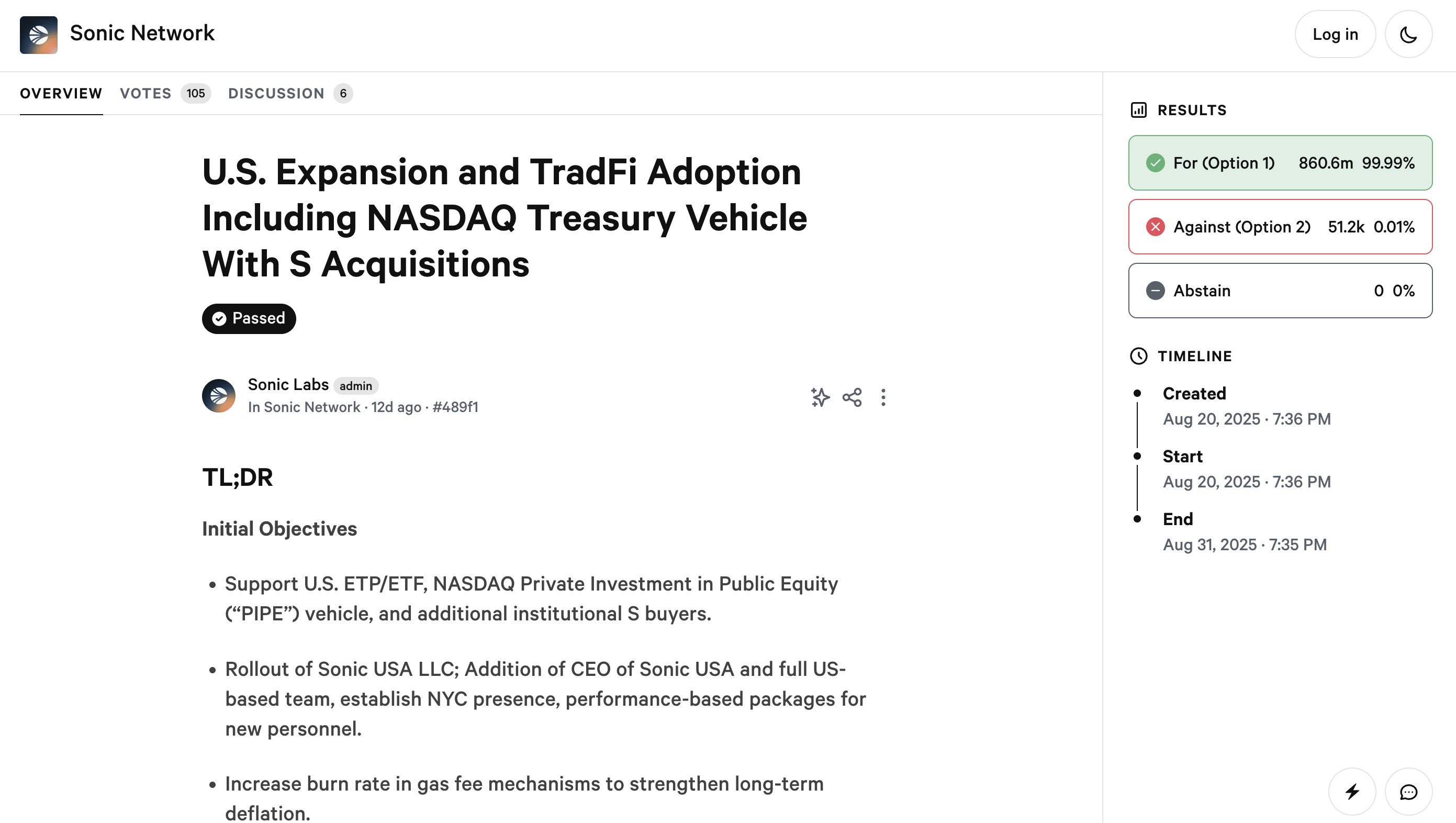

The Sonic Labs community voted in favor of the “US Market Expansion and TradFi Adoption Plan.” The proposal enables the project to establish a US legal entity named Sonic USA LLC, hire a CEO and a local team, and open a New York office. Additionally, it will apply a performance-based compensation scheme.

The proposal also outlines a long-term deflationary mechanism through gas fees to offset supply growth as the network activates its expansion plans.

A key technical highlight of the resolution package is the adjustment of network parameters to issue tokens for two potential options: First, a $50 million allocation for managed ETF/ETP structures, $100 million for a Nasdaq PIPE program, and $150 million S tokens (formerly FTM) designated to fund Sonic USA. Alternatively, rejecting all of the above adjustments.

On the institutional demand side, the ETF/ETP allocation could create a compliant access channel for traditional investors. Additionally, it WOULD standardize custody, enhance transparency of holdings, and streamline the creation/redemption process.

Meanwhile, the Nasdaq PIPE serves as a strategic “capital reserve,” allowing Sonic to interact with public markets more controlledly. This aligns with its long-term objective of positioning S closer to the standards of institutionally held assets.

On the supply side, the gas fee deflationary mechanism is crucial. If transaction activity grows alongside ecosystem expansion, burned fees could absorb part of the supply pressure from issuance. Additionally, locked fees would contribute to mitigating this pressure. Still, its effectiveness depends on the specific fee design, network activity, and treasury discipline across market cycles.

US Approval Still Remains as Risks

However, investors should remain cautious: new issuance to finance the ETF, PIPE, and Sonic USA represents immediate dilution. The net impact will depend on product rollout speed, compliance progress, and the ability to convert these channels into real cash flows for the ecosystem.

On the flip side, the main risks lie in the regulatory delays of US ETF/ETP approvals. Additionally, strict disclosure requirements for PIPEs and the operational costs of running a US entity could weigh heavily if the market contracts. Therefore, the key metric after this vote is not the immediate price action, but the execution milestones.