BREAKING: Tether’s USDT Stablecoin Set to Launch on Bitcoin Blockchain - Game Changer for Crypto Liquidity

Tether just dropped a bombshell—USDT is coming to Bitcoin. This isn't just another blockchain integration; it's a seismic shift that could reshape crypto's entire liquidity landscape.

Why This Matters

Bitcoin's network gains stablecoin capabilities overnight. No more bridging assets across chains—traders get native dollar exposure on the world's most secure blockchain. Lightning Network integration could make instant, low-cost USDT transactions a reality.

The Domino Effect

Expect massive liquidity migration from alt-L1s. Why settle for riskier chains when you can have Bitcoin's security with stablecoin functionality? This move threatens Ethereum's DeFi dominance and makes Bitcoin's ecosystem suddenly competitive for everything from trading to lending.

Wall Street's Worst Nightmare

Traditional finance hates this—Bitcoin just became a one-stop-shop for both store-of-value and daily transactions. Banks watching stablecoin revenue streams evaporate while Bitcoin eats another slice of the financial pie. Because nothing says 'financial revolution' like making legacy institutions sweat over their shrinking profit margins.

Native, Private, and Scalable Payments

In a blog post Tether said with this launch, users will be able to hold and transfer USDT alongside their bitcoin in the same wallet. RGB’s architecture will allow USDT to run directly on Bitcoin’s infrastructure.

According to Tether this also opens the door for advanced features such as offline transactions, giving users greater flexibility and resilience in payment scenarios.

For billions of people globally, the combination of Bitcoin’s security and Tether’s stability is a step toward stable, everyday digital money.

A Freer Financial Future?

Paolo Ardoino, CEO of Tether, explains the importance of this move: “Bitcoin deserves a stablecoin that feels truly native, lightweight, private, and scalable. With RGB, USDT gains a powerful new pathway on Bitcoin, reinforcing our belief in Bitcoin as the foundation of a freer financial future.”

The launch shows Tether’s leadership in driving stablecoin innovation and expanding support across blockchain ecosystems. By making USDT native to Bitcoin through RGB, Tether is ensuring that the world’s first cryptocurrency continues to serve as the bedrock of a global, decentralized financial system.

Tether Takes Minority Stake in Bit2Me

Earlier this month, Tether made a new investment in Bit2Me, acquiring a minority stake in the Spanish crypto platform.

As part of the deal, Tether said it is also leading a €30 million ($35 million) funding round to support Bit2Me’s expansion across Europe and Latin America. The funding round is expected to close in the coming weeks.

Stablecoin Exchange Reserves Hit Record High

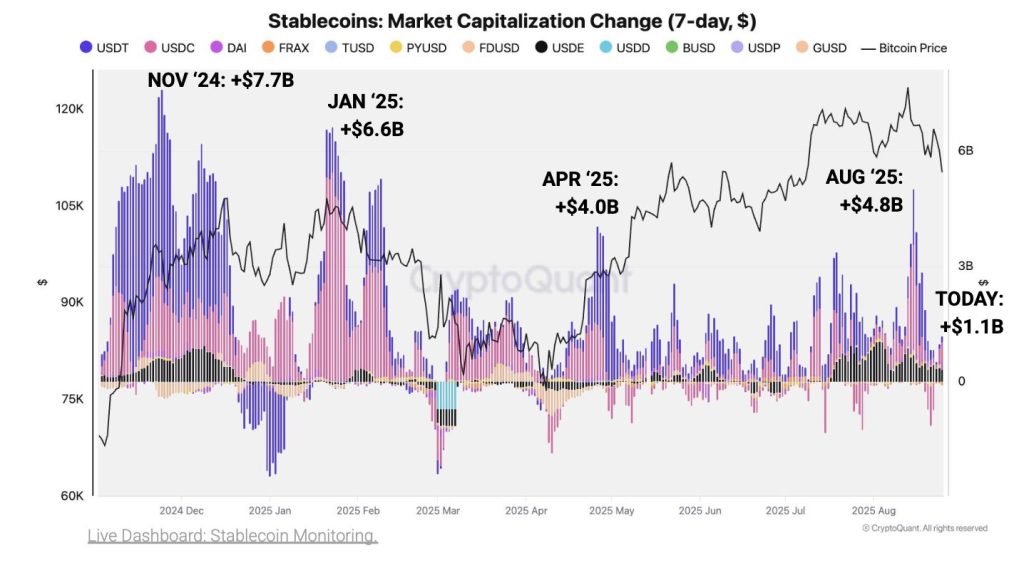

Latest data from CryptoQuant shows stablecoin liquidity continues to expand but the pace of growth has slowed considerably.

Weekly expansions in stablecoin market capitalization have dropped to around $1.1 billion. This is in stark contrast to the $4–8 billion weekly inflows observed in late 2024, which were instrumental in supporting Bitcoin’s sharp upward momentum.

Tether’s USDT, the dominant stablecoin, has also seen its 60-day growth moderate, holding at roughly $10 billion compared with peaks above $21 billion earlier in the cycle. While the figures remain in positive territory, they indicate a cooling trend in capital inflows.