Record-Breaking $1.15B Bullish IPO Fuels Solana Stablecoin Surge – Crypto’s Wall Street Takeover Accelerates

Forget traditional IPOs—crypto just rewrote the rulebook with a staggering $1.15 billion raise that's sending shockwaves through both Wall Street and the blockchain ecosystem.

The Solana Stablecoin Revolution

Solana-based stablecoins aren't just participating in this landmark offering—they're fundamentally transforming how institutional capital flows into digital assets. The network's blistering transaction speeds and negligible fees made this record-breaking raise possible while traditional finance still struggles with settlement times measured in days.

Wall Street's Awkward Embrace

Traditional investment banks—once crypto's loudest skeptics—now face the uncomfortable reality that blockchain infrastructure just outperformed their entire IPO machinery. While they were busy debating regulatory hurdles, decentralized networks built a more efficient capital formation system that actually works round-the-clock.

The $1.15 billion question isn't whether crypto is taking over—it's how much longer traditional finance can pretend this is just a speculative sideshow. After all, nothing says 'serious asset class' like moving nine figures without asking for permission or paying middlemen their usual vig.

Bullish Diversified Stablecoin IPO Validates Solana’s Role as the Go-To Settlement Layer

![]() @Bullish has priced its initial public offering at $37 per share, giving the cryptocurrency exchange a market capitalization of $5.4 billion. #Bullish #IPOhttps://t.co/69QK4cYx10

@Bullish has priced its initial public offering at $37 per share, giving the cryptocurrency exchange a market capitalization of $5.4 billion. #Bullish #IPOhttps://t.co/69QK4cYx10

The IPO leaned heavily on USD Coin (USDC) and Euro Coin (EURC), both custodied by Coinbase and increasingly anchored on the solana blockchain. Jefferies, acting as billing and delivery agent, coordinated minting, conversions, and transfers across several issuers spanning the U.S., Europe, and Asia.

The offering also drew contributions from a diverse range of stablecoins, showcasing how the cross-border infrastructure is now underpinning capital markets activity. Among the tokens received were USD CoinVertible (USDCV) and EUR CoinVertible (EURCV) from Société Générale-FORGE, Global Dollar (USDG) issued by Paxos, and PayPal USD (PYUSD), also issued by Paxos.

Additional settlements were made in Ripple USD (RLUSD), issued on the XRP Ledger by Ripple, USD1 from World Liberty Financial, Agora Dollar (AUSD) from Agora, and EURAU from AllUnity, reflecting the breadth of issuers and blockchains involved in what market observers describe as the most diversified stablecoin-based settlement ever executed in a public listing.

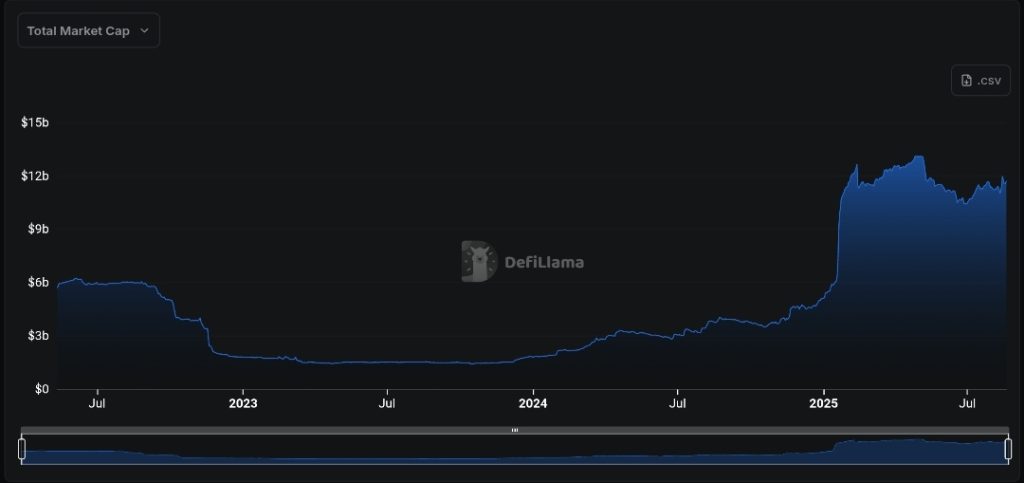

With the majority of the settlements made using stablecoins on Solana, the IPO serves as validation of Solana’s role. Recently, Solana’s stablecoin ecosystem has experienced notable growth, with the total market capitalization of stablecoins on the Solana network standing at $11.739 billion, marking a 5.04% increase over the past 7 days, according to DeFiLlama.

USDC and EURC now account for a strong portion of daily stablecoin volume on Solana, which has become the leading blockchain for these assets. According to recent data, Solana stablecoin transfers exceeded $300 billion in cumulative volume in 2025.

“We view stablecoins as one of the most transformative and widespread use cases for digital assets,” said David Bonanno, Bullish CFO. “Internally, we leverage them for rapid and secure global fund transfers, especially on the Solana network.”

The rise of stablecoins has been aided in part by the GENIUS Act, recently passed in the U.S., which established clearer guidelines for stablecoin issuance and oversight. By providing regulatory certainty and influencing frameworks abroad, the law has encouraged greater adoption of U.S.-backed digital assets both domestically and internationally.

A joint report from Keyrock and Bitso reveals that stablecoin volumes reached $6.3 billion in February 2025, with B2B transactions accounting for $2.7 billion and card payments surpassing $1 billion. At this growth rate, the sector is projected to approach $1 trillion in annual volumes by 2030.

USDC Still Dominates, but Paxos, PayPal, and New Entrants Push Stablecoins Into the Next Phase

While Circle’s USDC and EURC dominated the Bullish raise, other stablecoin projects are carving out market share and momentum.

![]() @Paxos has applied for a US national trust bank charter, aiming to manage digital assets for clients under federal oversight.#Stablecoin #Bankinghttps://t.co/bujGJtf1fW

@Paxos has applied for a US national trust bank charter, aiming to manage digital assets for clients under federal oversight.#Stablecoin #Bankinghttps://t.co/bujGJtf1fW

Paxos, for instance, deployed both Global Dollar (USDG) and PayPal USD (PYUSD) into the IPO settlement. The company also made headlines this month by applying for a national trust charter, which WOULD extend its authority beyond New York and put it under direct supervision of the U.S. Office of the Comptroller of the Currency (OCC).

If approved, Paxos would become one of the most heavily regulated blockchain firms globally, a MOVE expected to appeal to large financial institutions.

New entrants are also making noise. Stable, a network centered on Tether’s USDT, raised $28 million in seed funding from backers including Bitfinex, Hack VC, Franklin Templeton, and KuCoin Ventures. Plasma, which entered the market in January, secured $24 million, while Circle announced Arc, a blockchain designed for its own stablecoin ecosystem.

![]() Payment giant Stripe is building 'Tempo' blockchain with crypto VC Paradigm targeting Fortune 500 companies following $1.1B Bridge acquisition and Privy purchase.#Stripe #Blockchainhttps://t.co/GdVktNhRoy

Payment giant Stripe is building 'Tempo' blockchain with crypto VC Paradigm targeting Fortune 500 companies following $1.1B Bridge acquisition and Privy purchase.#Stripe #Blockchainhttps://t.co/GdVktNhRoy

Even Stripe joined the wave, with a reveal of its Tempo blockchain project, while tokenization specialists such as Securitize, ONDO Finance, and Dinari announced new blockchain initiatives to expand stablecoin and asset tokenization infrastructure.