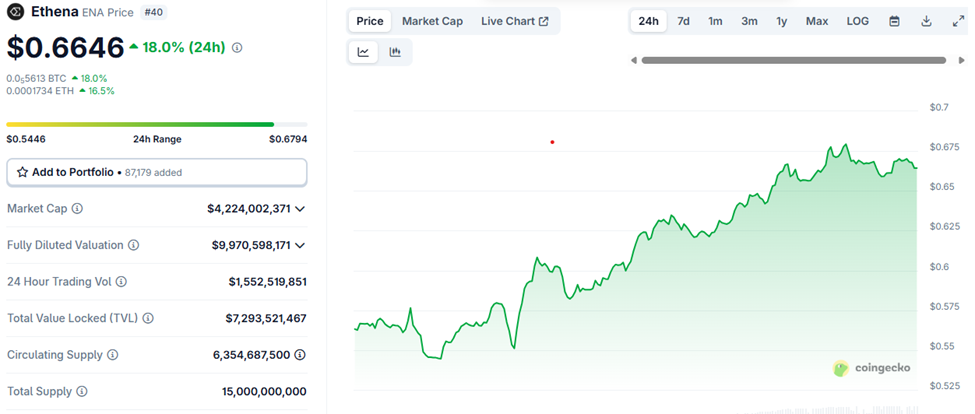

🚀 ENA Soars 18% as Arthur Hayes Drops Millions – Will Bulls Smash Through the $0.68 Barrier?

Crypto heavyweight Arthur Hayes just turbocharged ENA's rally—throwing gasoline on an already blazing fire. The token ripped 18% in hours, leaving traders scrambling. But now, all eyes are locked on that stubborn $0.68 resistance level.

Can the bulls break through—or is this another 'buy the rumor, sell the news' setup? (Spoiler: Wall Street interns could write the script at this point.)

Key levels to watch:

- $0.68: The make-or-break zone where profit-takers lurk

- $0.75: Next psychological target if momentum holds

One thing's certain: When Hayes moves, markets listen. Whether this pumps further or dumps harder depends on whether retail FOMO can outmuscle the usual whale games.

Source: CoinGecko

Source: CoinGecko

Ethena’s Anchorage Deal Paves Way for Historic U.S. Stablecoin Launch

The Ethena ecosystem uses a unique model that combines crypto assets and derivatives to issue a stable dollar-equivalent token, USDe. This system relies on a strategy known as “delta hedging” to manage the volatility of cryptocurrencies.

Recently, Ethena Labs introduced a new feature called “Liquid Leverage” in collaboration with Aave.

This feature allows users to borrow using a 50/50 mix of sUSDe and USDe, earning around 12% promotional rewards. The goal is to drive more user activity and boost TVL across both the Ethena and Aave ecosystems.

Despite the USDe setback in Germany, Ethena continues to forge impactful partnerships that strengthen its ecosystem. This is reflected in its Total Value Locked, having grown to an impressive $8.597 billion.

A key development is Ethena Labs’ partnership with Anchorage Digital, a federally chartered crypto bank, to bring its stablecoin, USDtb, onshore in the United States. This milestone not only ensures compliance with the new GENIUS Act but also marks USDtb’s debut in the U.S. market.

Evidence of this impact can be seen in the spike in accumulation patterns across Ethena’s ecosystem. Over the past week alone, large holders have acquired more than 79.25 million $ENA tokens. This whale activity coincides with trading volume exploding over 400% from $6 billion in June to $27 billion in July.

Whales have accumulated 79.25 million Ethena $ENA in the past week! pic.twitter.com/bD8NAthAwu

— Ali (@ali_charts) July 30, 2025The momentum from large players continues with participation from prominent investor Arthur Hayes, co-founder of BitMEX, who added 2.16 million $ENA to his portfolio, bringing his total to 7.76 million $ENA.

Adding to the bullish narrative, stablecoin-focused Ethena treasury, StablecoinX Inc., announced a $360 million capital raise to acquire $ENA tokens, backed by admission plans for its Class A stock (“USDE”) on NASDAQ.

But can $ENA’s rally hold above $0.68 with an aggressive bullish setup? The technical analysis has all the answers.

$ENA’s V-Shaped Recovery Cools Into Resistance as Derivatives Build

The V-shaped recovery on $ENA/USDT has stalled just beneath short-term resistance at $0.68 after a strong bounce from the $0.54 base.

The asset’s price momentum faded heading into July 31, with sellers stepping in aggressively NEAR the highs. The volume footprint chart confirms this inflection.

Although total volume ROSE beyond 99 million in the last session, the delta skewed heavily negative at –5.58 million, indicating strong market selling despite liquidity absorption.

Earlier blocks near $0.665 to $0.668 also indicate this selling dominance, with multiple candles posting negative delta between –2.0 and –2.6 million even as the price attempted to stabilize.

This combination of price pushing into resistance and selling pressure showing up in the footprint suggests that the latest push may be running out of steam and could reverse soon.

Regarding overall structure, the green ascending trendline off the $0.54 low is still intact, but momentum indicators are beginning to show a weakening stance.

The asset’s RSI sits around 61, just below the overbought threshold, and has started to slope downward, which is a classical MOVE that often precedes a pullback or a move sideways.

What adds to the concern here is the crowded long positioning within derivatives markets.

According to Coinglass, open interest has increased by 16.32% while volume has jumped 59.74%, both indicating a rise in speculative activity.

Over the past 24 hours, $3.94M in longs have been wiped compared to $2.87M in shorts, which, when compared to some other markets, is still a manageable figure given the total leverage deployed.

That said, this setup favors a pullback unless bulls can reclaim $0.68 with more market buys than sells and dislodge the passive sell wall showing up in the order book.

If the $0.645 area gives way, watch for a move down toward $0.615–$0.62 as the next logical support, followed by $0.585 if the correction deepens.